- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

The Bull Case For Baker Hughes (BKR) Could Change Following Major Saudi Drilling Contract Expansion Announcement

Reviewed by Sasha Jovanovic

- Baker Hughes announced that Aramco has awarded a multi-year contract to significantly expand integrated coiled tubing drilling operations in Saudi Arabia, with work set to begin in 2026.

- This agreement enhances Baker Hughes’ position in the region by growing its underbalanced drilling fleet from four to ten units, highlighting ongoing demand for advanced drilling solutions in established and new natural gas fields.

- To assess the impact of this expansion, we'll look at how the Aramco contract shapes Baker Hughes' investment narrative and outlook.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Baker Hughes Investment Narrative Recap

To own Baker Hughes, I believe you need to see global energy demand and service contracts as anchors for long-term growth, while understanding that any meaningful acceleration or slowdown in upstream and LNG activity could influence its earnings trajectory. The new Aramco contract strengthens near-term revenue visibility in the Middle East, but it does not materially change the biggest catalyst, high-margin backlog growth tied to global LNG and gas projects, or address the main risk: ongoing pricing pressure and margin compression as cost inflation and customer demands intensify.

Among recent announcements, the third-quarter earnings release is most relevant, as it showed modest revenue growth but declining earnings year-over-year. That context highlights why expanding service agreements like the Aramco award are viewed as important for offsetting short term margin and revenue headwinds stemming from ebbing upstream spending cycles.

However, investors should not overlook the persistent cost inflation and supply chain pressures that threaten ...

Read the full narrative on Baker Hughes (it's free!)

Baker Hughes' outlook anticipates $29.1 billion in revenue and $2.9 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 1.8% and reflects a $0.1 billion decrease in earnings from the current $3.0 billion.

Uncover how Baker Hughes' forecasts yield a $52.43 fair value, a 8% upside to its current price.

Exploring Other Perspectives

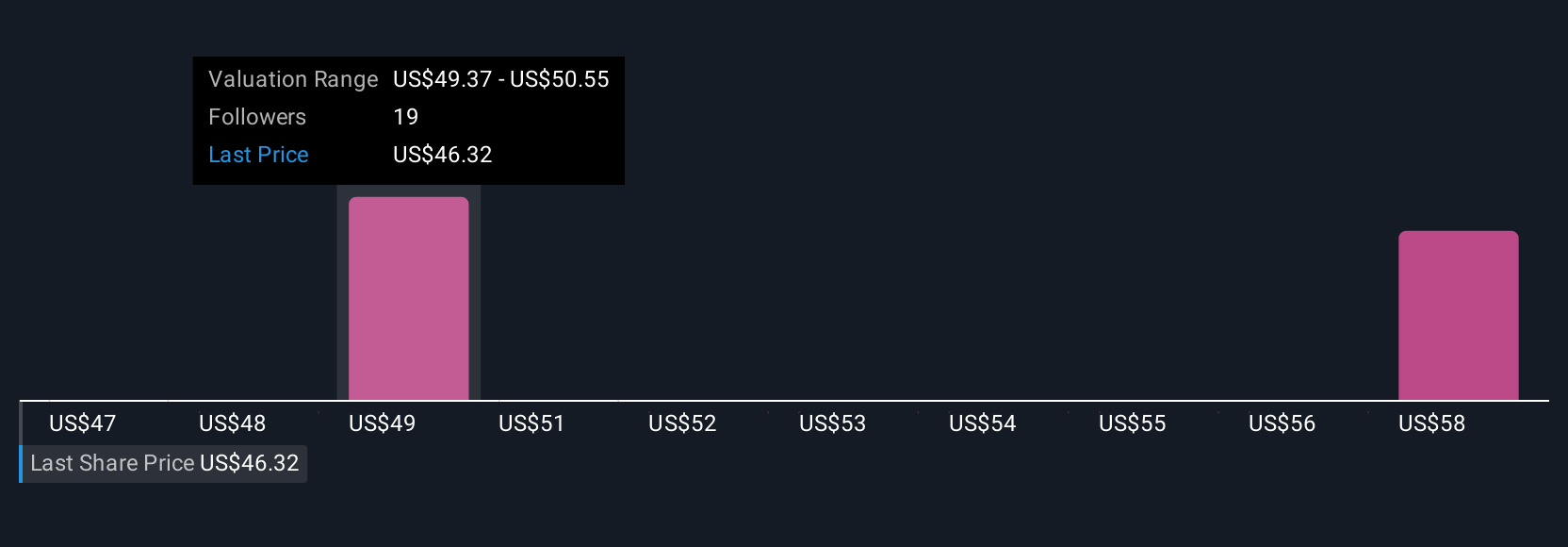

Simply Wall St Community members provided four fair value estimates for Baker Hughes, ranging from US$50.00 to US$58.34. While forecasts differ, many highlight the importance of sustained backlog growth as a key driver for long-term returns.

Explore 4 other fair value estimates on Baker Hughes - why the stock might be worth just $50.00!

Build Your Own Baker Hughes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baker Hughes research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Baker Hughes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baker Hughes' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives