- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Is Baker Hughes Still a Bargain After 17.6% Rally and Analyst Upgrades?

Reviewed by Bailey Pemberton

- Ever wondered whether Baker Hughes is genuinely good value right now or if its price is getting ahead of itself? Let’s dive into what’s really going on beneath the surface before you make your next move.

- The stock price has climbed 17.6% year to date and is up 12.8% over the past year, suggesting investor optimism and possibly some shifting views on its risk or growth story.

- Enthusiasm for energy stocks has surged as the sector attracts renewed attention from both policymakers and major investors. At the same time, Baker Hughes was recently featured in several analyst upgrades and headlines noting increased demand for its innovative drilling technologies, helping fuel its momentum.

- Baker Hughes scores a 3 out of 6 on our valuation checks, meaning it appears undervalued in half of the ways we measure value. Next, we will break down what that score really means using a few widely recognized valuation models, but stick around for an even smarter way to judge if the stock is worth your attention.

Approach 1: Baker Hughes Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is truly worth by projecting its future cash flows and then discounting those amounts back to today’s value. This method relies on assumptions about growth and risk, helping investors look past short-term price swings to focus on long-term potential.

Baker Hughes currently generates $2.06 billion in annual Free Cash Flow, with analyst projections showing steady growth over the coming years. By 2028, forecasts suggest Free Cash Flow could reach $2.85 billion. Beyond that, Simply Wall St extrapolates continued increases, with Free Cash Flow potentially climbing above $3.7 billion by 2035. These projections account for both analyst insights up to 2028 as well as longer-term industry trends.

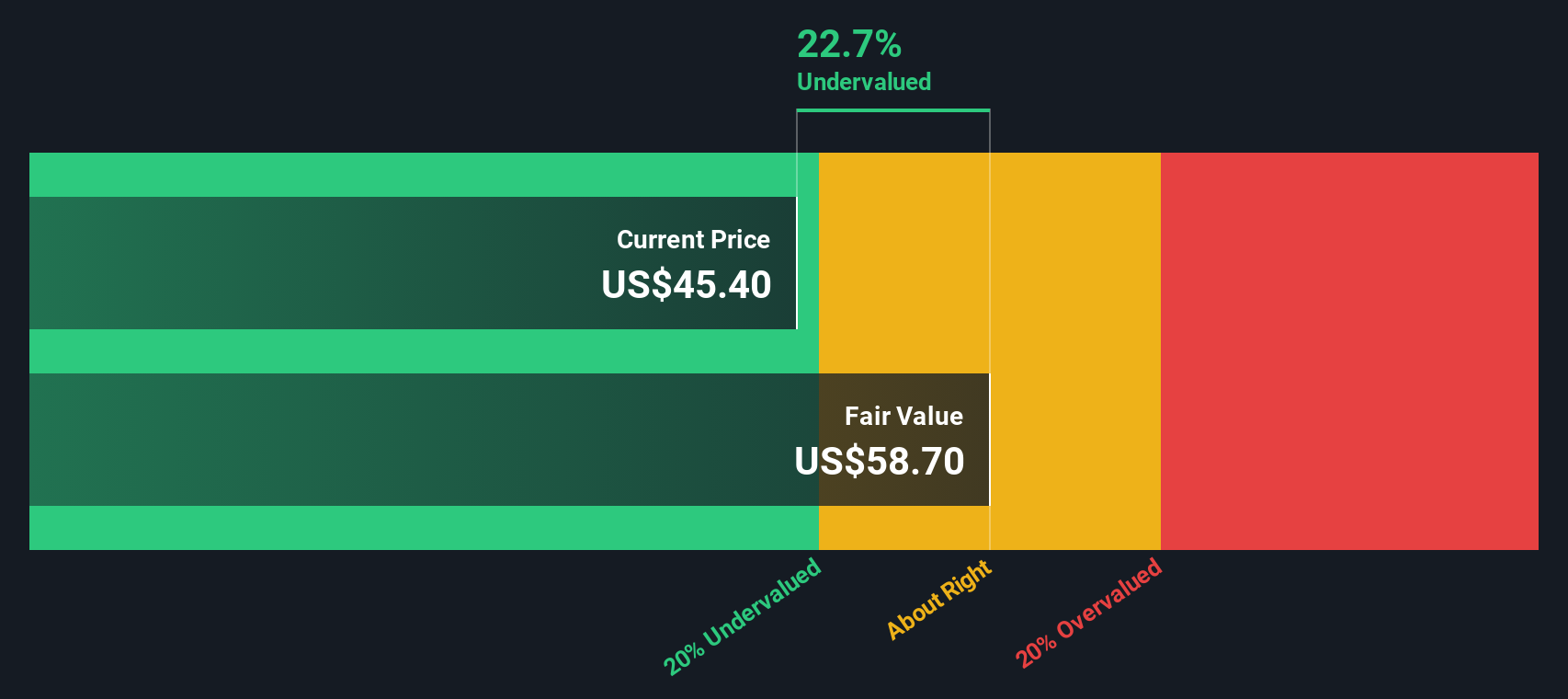

After crunching these numbers, the DCF model calculates an intrinsic value of $71.61 per share for Baker Hughes. At recent market prices, this represents a 31.7% discount. According to this model, the stock appears significantly undervalued based on expectations for future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Baker Hughes is undervalued by 31.7%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Baker Hughes Price vs Earnings (PE Ratio)

The price-to-earnings (PE) ratio is a widely used valuation metric for profitable companies like Baker Hughes because it relates a company’s share price to its per-share earnings. For investors, the PE ratio provides a straightforward way to gauge what the market is willing to pay for each dollar of company profits.

The "normal" or "fair" PE ratio for a stock is shaped by expectations for future earnings growth and the perceived risk of the business. Companies expected to grow faster or that are considered safer typically warrant higher PE ratios, while slower-growing or riskier firms see lower multiples.

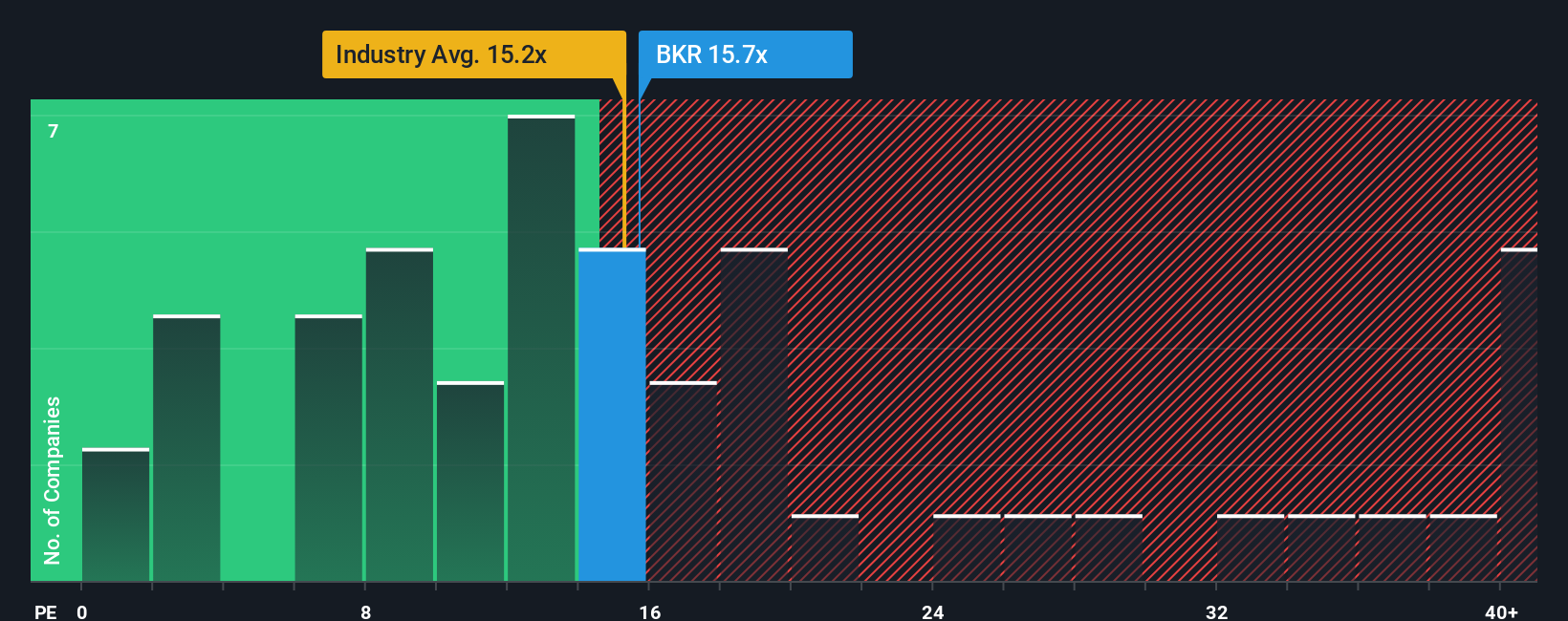

Baker Hughes currently trades at a PE ratio of 16.7x. This lines up closely with the Energy Services industry average of 16.6x and is almost on par with its peer group average of 16.0x. These benchmarks suggest that the market is treating Baker Hughes similarly to other companies in its space.

However, Simply Wall St’s proprietary Fair Ratio takes this analysis further by factoring in company-specific drivers like earnings growth, profit margin, market cap, and risk profile. This custom Fair Ratio offers a more holistic perspective because comparisons with peers or industry averages can miss important nuances like faster growth or greater resilience to industry shifts.

For Baker Hughes, the Fair Ratio is calculated to be 17.7x. This is nearly identical to the company’s current PE ratio of 16.7x, suggesting the stock is trading at about the level one would expect based on its financial profile and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1432 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Baker Hughes Narrative

Earlier, we mentioned there is an even smarter way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story about Baker Hughes; it is how you connect everything you know about the company, such as industry changes, leadership strategy, and potential risks, with your own forecasts of future revenue, earnings, and profit margins to set a fair value. Narratives link a company’s story to financial projections and a valuation, letting you make investment decisions that fit your perspective rather than simply following the crowd.

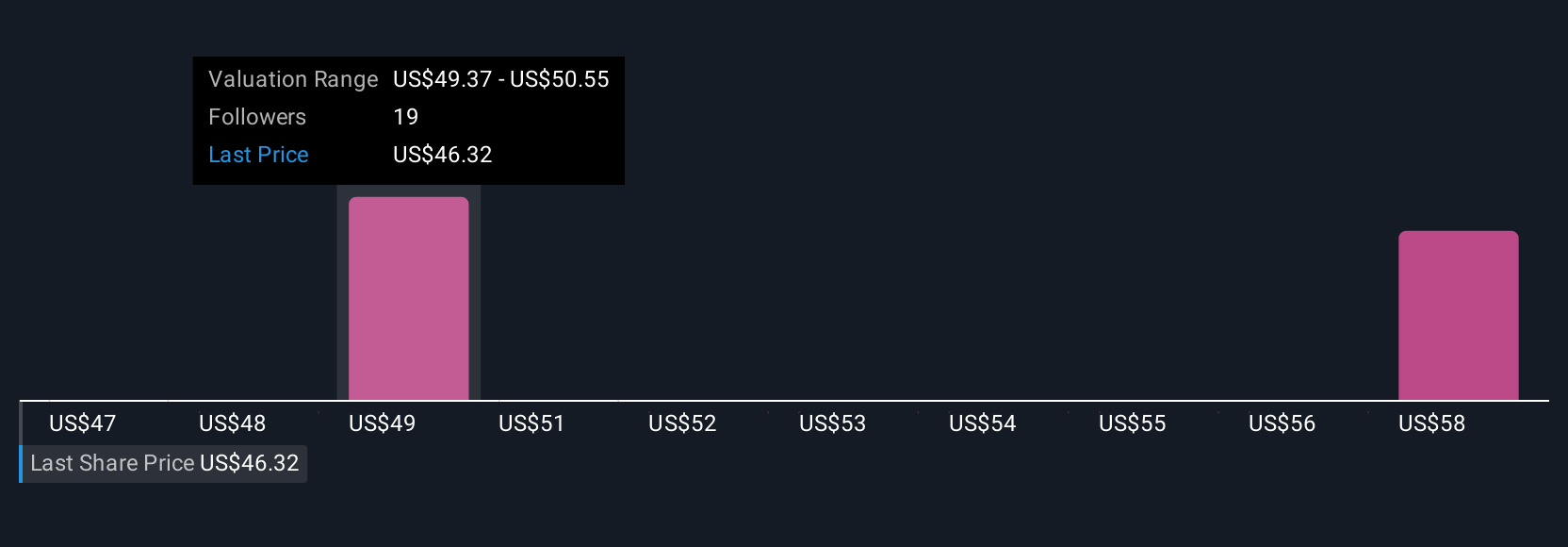

With Narratives on Simply Wall St’s Community page, used by millions of investors, you can quickly visualize how your expectations stack up, adjust assumptions in real time, and immediately see how your estimated Fair Value compares to today’s share price. Because Narratives update automatically whenever major news, earnings, or financial data comes in, you are always basing your view on the latest information. For example, one investor might see Baker Hughes’s push into digital and energy transition markets and set a bullish price target of $60.00, convinced by momentum and growth potential; another might focus on risks like volatile oil and gas reliance and assign just $37.00, targeting value in a tougher environment. Your Narrative, your decision, your edge.

Do you think there's more to the story for Baker Hughes? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives