- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Is Baker Hughes a Hidden Opportunity After 5% Price Dip and New Tech Partnerships?

Reviewed by Bailey Pemberton

- Wondering if Baker Hughes is a hidden value gem or just keeping up with the broader market? You are not alone, and looking closer could reveal some intriguing insights.

- Over the last year, the stock has climbed an impressive 21.7%, and it is up 10.6% year-to-date. However, there has been a recent dip of 5.2% in the past month.

- Recent analyst coverage and industry headlines have brought renewed attention to Baker Hughes, particularly as global energy demand expectations shift and the company's technology partnerships deepen. These developments have fueled a fresh round of investor interest and debate about the stock's long-term positioning.

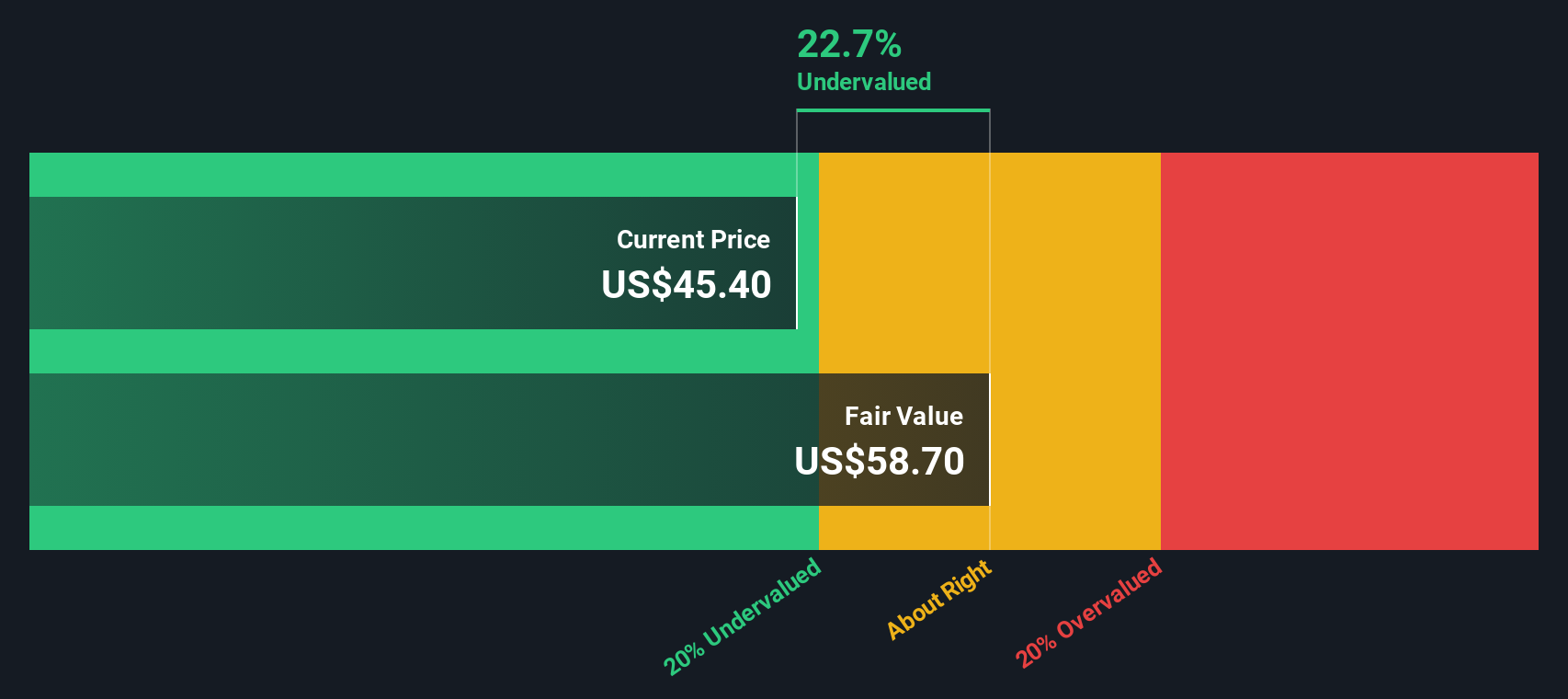

- When it comes to valuation, Baker Hughes currently scores 5 out of 6 on our value checks, suggesting it is undervalued by most traditional standards. Let us break down how that score stacks up, and why there might be an even smarter way to gauge value before you make your next move.

Approach 1: Baker Hughes Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach aims to determine what Baker Hughes is worth based on the cash it is expected to generate over time.

Currently, Baker Hughes reports Free Cash Flow (FCF) of approximately $2.06 billion. Analyst estimates predict that annual FCF will grow steadily in the coming years, reaching about $2.99 billion by the end of 2029. Analyst forecasts cover the first five years. Projections beyond that point use extended growth assumptions from Simply Wall St.

With these inputs, the DCF model calculates an intrinsic value of $66.66 per share. This is a 31.0% discount compared to the current market price, suggesting Baker Hughes may be significantly undervalued at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Baker Hughes is undervalued by 31.0%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Baker Hughes Price vs Earnings (PE Ratio)

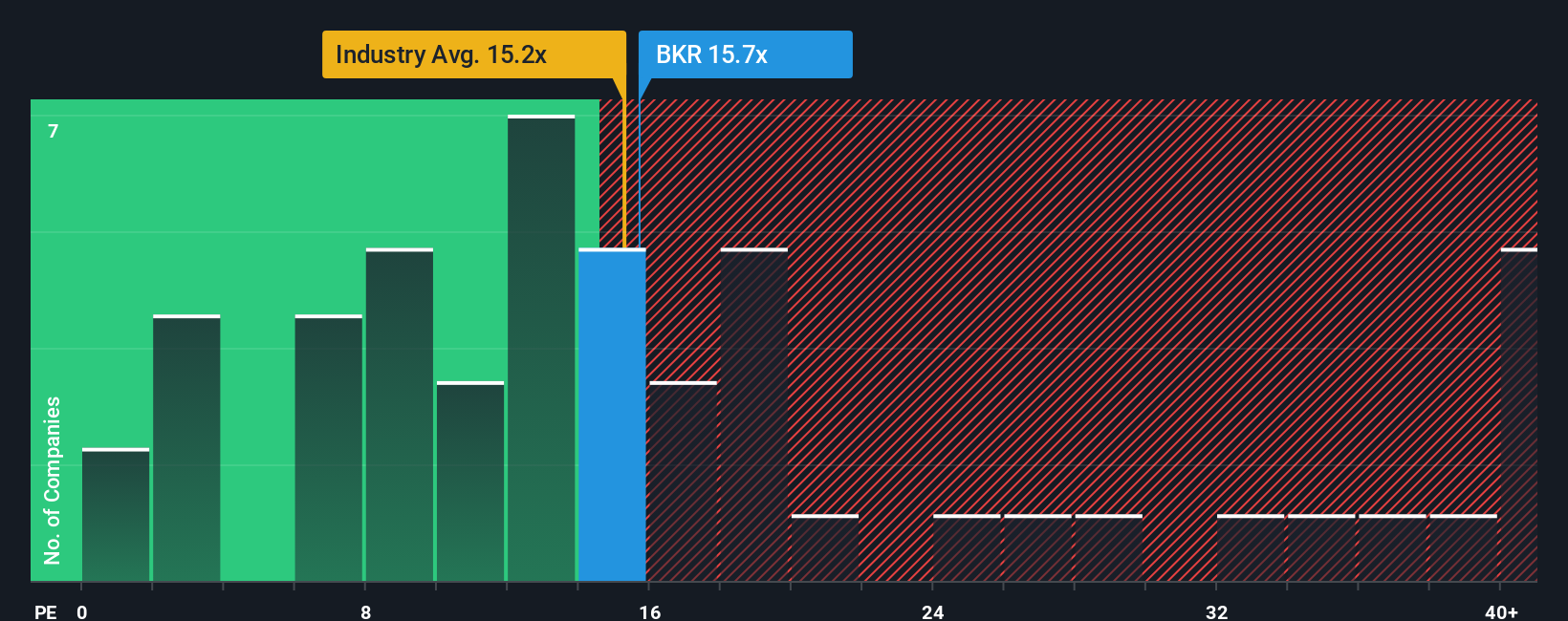

The Price-to-Earnings (PE) ratio is a widely used measure to value profitable companies like Baker Hughes, as it compares current share price to per-share earnings. For businesses generating steady profits, the PE ratio is a practical way to gauge investor expectations and assess how the market values each dollar of earnings.

A "normal" or "fair" PE ratio depends on factors such as earnings growth rates and risk profiles. Companies expected to post higher growth or with steadier profits typically trade at higher PE ratios, while those with more risk or slow growth command lower multiples.

Baker Hughes currently trades at a PE ratio of 15.7x. For context, this is just under the Energy Services industry average of 16.1x and close to its peer group average of 15.9x. On the surface, this suggests Baker Hughes is roughly in line with its sector and direct competitors.

Simply Wall St's proprietary “Fair Ratio” for Baker Hughes is 17.4x. This Fair Ratio goes further than simple peer or industry comparisons. It holistically incorporates Baker Hughes' unique growth prospects, profit margins, risk, market capitalization, and its industry landscape to determine what a justified PE multiple should be for this specific business. As such, it provides a more tailored and insightful measure than just looking at the broad sector or a handful of peers.

Comparing the Fair Ratio of 17.4x to Baker Hughes’ current PE multiple of 15.7x suggests the stock is undervalued by this metric, as it is trading below its calculated fair valuation benchmark.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Baker Hughes Narrative

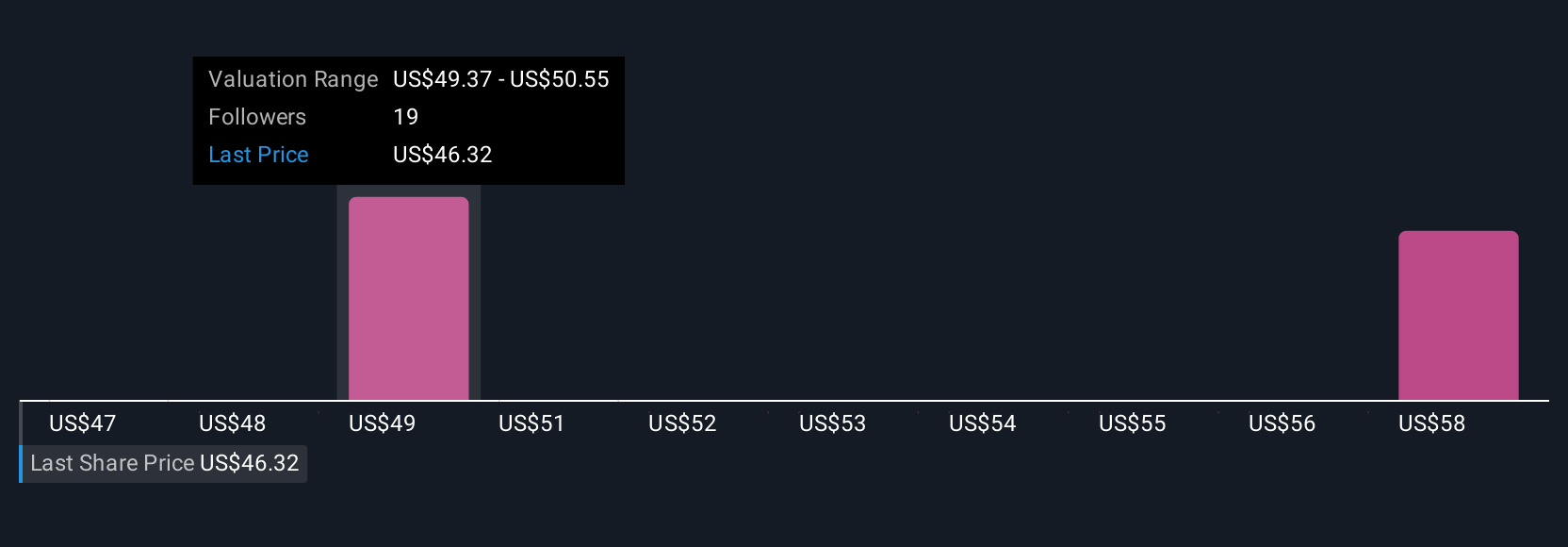

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story, the perspective you bring, about Baker Hughes’ future, bringing together your expectations for revenue, earnings, and margins to justify a fair value. Narratives go beyond the numbers, letting you link what is happening at the company (or in the world) to a clear financial forecast and, ultimately, to an actionable view of what the stock is really worth.

On Simply Wall St’s Community page, millions of investors can easily create and update their own Narratives for Baker Hughes, using intuitive tools to adjust assumptions and see the impact in real time. This helps you decide if, based on your view, Baker Hughes’ current price is above or below fair value, and whether to buy, sell, or hold.

Because Narratives automatically reflect breaking news, new earnings, or major strategy shifts, your valuation always stays relevant. For example, one investor may see digital infrastructure expansion and margin growth and set a high Narrative value (like $60 per share), while another may worry about oil price risk and prefer a much lower target (like $37); both reflect different stories behind the numbers, giving you control to invest your way.

Do you think there's more to the story for Baker Hughes? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives