- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Baker Hughes (BKR): Assessing Valuation After Strategic Saudi Expansion and New LNG Equipment Deal

Reviewed by Simply Wall St

Baker Hughes, the US-based energy technology company, has just inked a new strategic Memorandum of Understanding with NMDC Energy to expand its product localization in Saudi Arabia. The collaboration specifically targets offshore energy opportunities across the MENATI region.

See our latest analysis for Baker Hughes.

Baker Hughes continues to turn heads thanks to key announcements like its Saudi Arabia collaboration and new LNG equipment deal with Bechtel Energy. Both developments signal ongoing momentum in core growth markets. With a 16.65% share price return so far this year and an impressive 80.5% total shareholder return over the past three years, the stock has been building solid long-term momentum. Recent events have only increased interest, reflecting an improving growth narrative.

If the pace of Baker Hughes' contract wins has you curious, it might be the perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With the stock trading just below analyst targets and coming off stellar multi-year returns, investors are left to wonder if Baker Hughes is still undervalued or if the market has already priced in future growth.

Most Popular Narrative: 7.7% Undervalued

Baker Hughes' most widely followed narrative puts its fair value at $52.52 per share, just above the last close of $48.48. This signals cautious optimism about future earnings, even as market skepticism persists.

The company's strong momentum in securing large-scale service contracts, framework agreements, and technology-driven orders (such as for data centers, LNG, CCS, and recurring gas tech services) is driving an all-time high IET backlog. This is building strong visibility into future revenue and supporting sustained earnings durability.

Curious what forward projections support this elevated value? The most popular narrative leans heavily on a few specific, aggressive performance estimates and financial targets. What underpins these growth hopes? Dig in to discover the assumptions behind this bullish price tag.

Result: Fair Value of $52.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including volatile oil prices and supply chain pressures. Either of these factors could quickly change the growth scenario for Baker Hughes.

Find out about the key risks to this Baker Hughes narrative.

Another View: What Do Earnings Ratios Suggest?

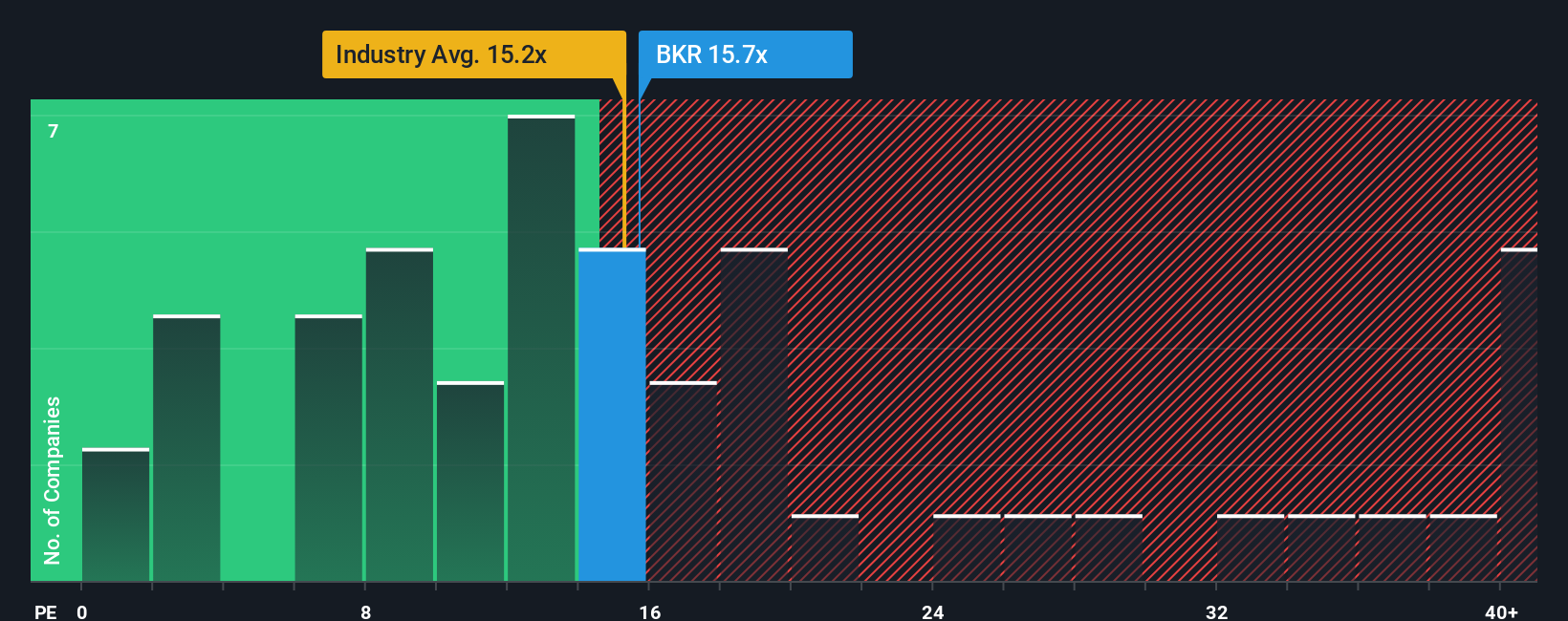

Looking at Baker Hughes through the lens of its price-to-earnings ratio paints a more cautious picture. The company's ratio stands at 16.5x, which is slightly higher compared to both the US Energy Services industry average of 16.4x and its peers at 16.1x. However, it remains below the fair ratio of 17.6x, indicating that the market could still move in either direction. Does this small gap mean there is limited room for upside, or could sentiment improve and close the value gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Baker Hughes Narrative

If you see things differently or want to dig into the numbers on your own terms, it only takes a few minutes to shape your own perspective. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Baker Hughes.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. With so many dynamic sectors transforming the market, now is the time to find tomorrow’s leaders and hidden gems using these highly targeted tools:

- Uncover income potential by jumping on these 15 dividend stocks with yields > 3% with solid yields exceeding 3%, putting steady returns at your fingertips.

- Tap into breakthrough medical innovation and secure your spot among the first to track these 30 healthcare AI stocks which is reshaping the future of healthcare.

- Capitalize on undervalued gems and unlock a selection of these 897 undervalued stocks based on cash flows that smart investors are adding to their radar right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives