- United States

- /

- Oil and Gas

- /

- NasdaqGS:APA

Why APA (APA) Is Up 5.8% After U.S. Sanctions Hit Russian Oil Giants Rosneft and Lukoil

Reviewed by Sasha Jovanovic

- Earlier this week, the U.S. government imposed sanctions on Russia's largest oil producers, Rosneft and Lukoil, causing a sharp rally in energy markets as expectations rose for tighter global oil supplies.

- The move sparked increased investor interest in U.S. energy companies like APA, highlighting the industry's sensitivity to sudden shifts in geopolitical risk and commodity prices.

- We'll now discuss how these new supply constraints and the supportive backdrop for U.S. energy firms may influence APA's investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

APA Investment Narrative Recap

APA’s investment thesis centers on the belief that demand for U.S. oil and gas will remain robust, enabling the company to benefit from price volatility and operational efficiencies. This week’s sanctions on Russian oil producers have boosted energy prices and sentiment for U.S. firms like APA, but the resulting tailwind may prove temporary. The company’s biggest risk remains its exposure to energy transition policies and regulatory developments, especially in Egypt, which could challenge revenue stability regardless of commodity spikes.

Of the recent corporate actions, APA’s ongoing U.S. production curtailments due to weak natural gas prices stand out. These cuts highlight the sensitivity of near-term results to commodity markets and serve as a timely reminder that even geopolitical tailwinds cannot fully insulate APA from fundamental supply and demand risks.

Yet, with new risks gathering, investors should be mindful that unlike sudden market rallies, the long-term challenge of decarbonization and policy shifts could...

Read the full narrative on APA (it's free!)

APA's outlook anticipates $8.1 billion in revenue and $1.6 billion in earnings by 2028. This scenario assumes a 6.1% annual decline in revenue and an increase in earnings of $0.5 billion from current earnings of $1.1 billion.

Uncover how APA's forecasts yield a $24.93 fair value, a 5% upside to its current price.

Exploring Other Perspectives

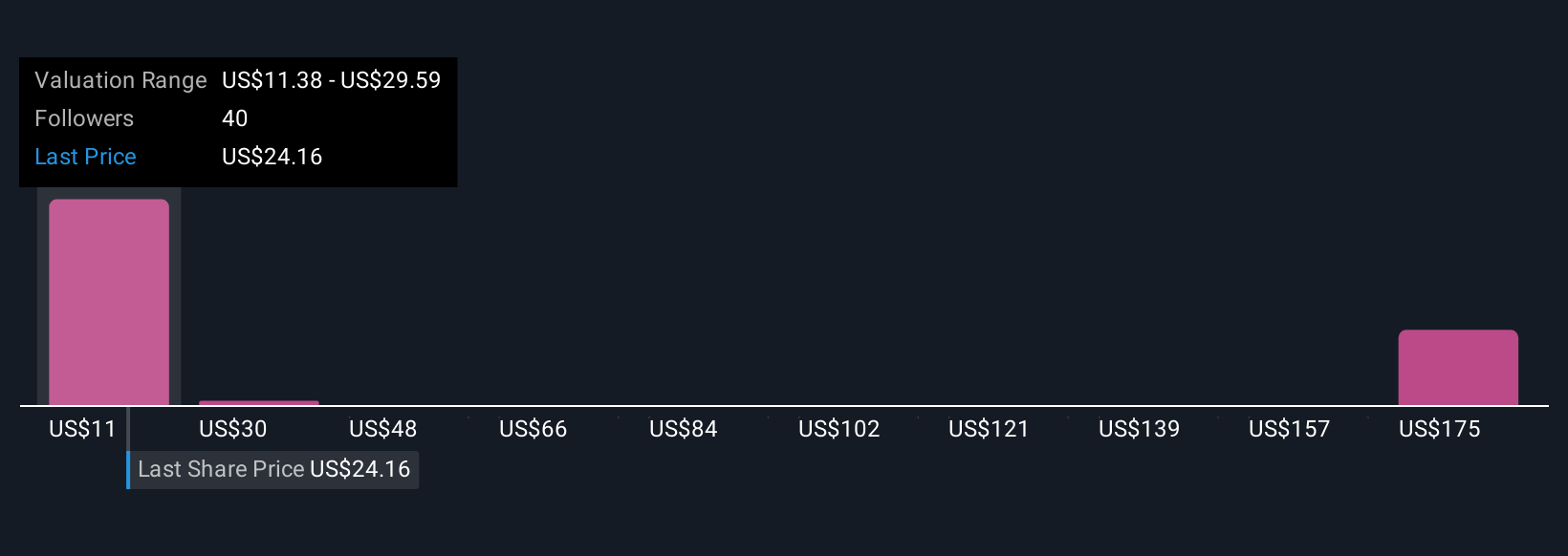

Ten members of the Simply Wall St Community estimated APA’s fair value between US$11.38 and US$114.40, suggesting wide-ranging opinions. In contrast, global supply disruptions have recently taken center stage, with potential to reshape short-term performance, take a look at what others expect next.

Explore 10 other fair value estimates on APA - why the stock might be worth less than half the current price!

Build Your Own APA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your APA research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free APA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate APA's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APA

APA

An independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives