- United States

- /

- Oil and Gas

- /

- NasdaqGS:APA

The Bull Case For APA (APA) Could Change Following William Blair's Outperform Coverage and Operational Focus

Reviewed by Sasha Jovanovic

- In late November 2025, William Blair initiated coverage on APA Corporation with an Outperform rating, emphasizing the company's substantial energy assets in the Permian Basin, Egypt, and Suriname.

- This analyst coverage spotlighted APA’s advances in operational efficiency, considerable cost reductions, and prospects for increased free cash flow, drawing significant investor attention.

- We'll look at how William Blair’s coverage and the focus on operational improvements could influence APA's current investment outlook.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

APA Investment Narrative Recap

To be a shareholder in APA today, you need to believe that the company’s broad international asset base, especially in the Permian, Egypt, and Suriname, can offset commodity and geopolitical volatility through improved efficiency and disciplined spending. The recent wave of analyst coverage, including William Blair’s Outperform rating and heightened price targets, provides a spotlight but does not substantially shift the most important near-term catalyst: the pace of operational execution in Egypt. The major risk, APA’s growing exposure to Egyptian regulatory and political dynamics, remains unchanged as a potential source of disruption. Of recent announcements, the Q4 production guidance raise to 123,000 barrels per day of U.S. oil stands out, reinforcing near-term operating momentum and feeding directly into free cash flow generation, one of the key drivers highlighted by analysts. This is highly relevant in light of the renewed interest from William Blair and others, but it doesn’t eliminate the challenges posed by the company’s refocused international strategy. In contrast, the risk of regulatory change in Egypt is something investors should be keenly aware of given...

Read the full narrative on APA (it's free!)

APA's outlook anticipates $8.1 billion in revenue and $1.6 billion in earnings by 2028. This projection assumes a 6.1% annual revenue decline and a $0.5 billion increase in earnings from the current $1.1 billion level.

Uncover how APA's forecasts yield a $25.37 fair value, in line with its current price.

Exploring Other Perspectives

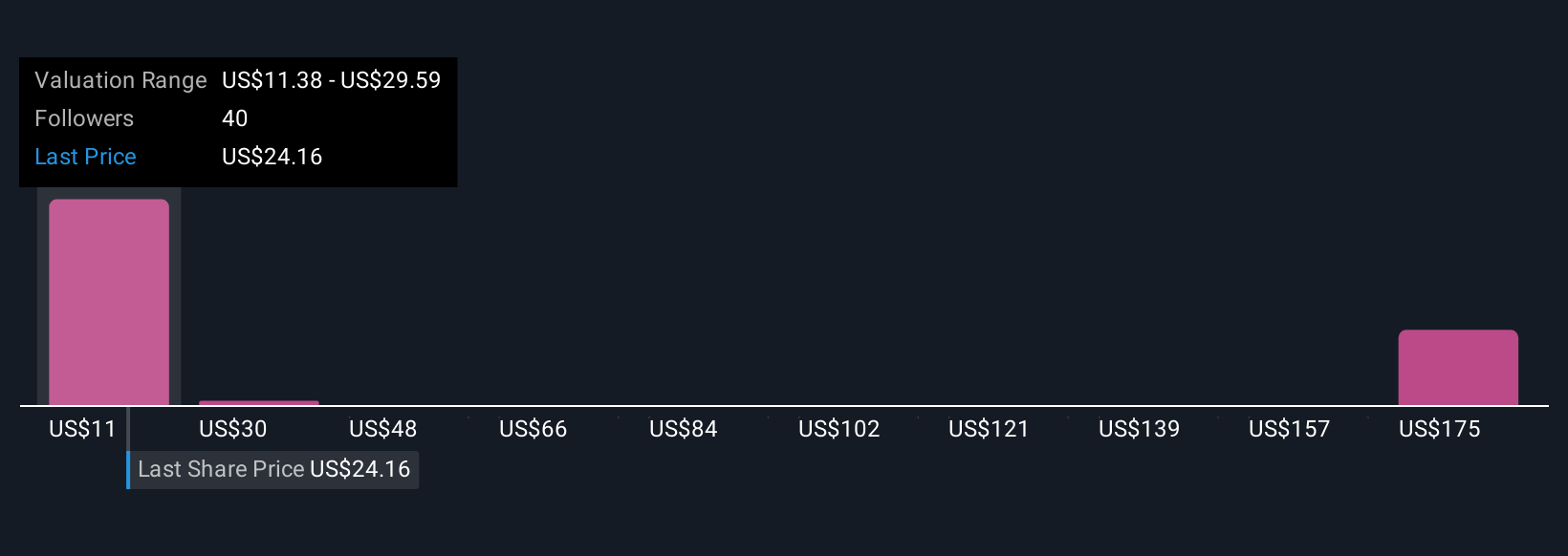

From the Simply Wall St Community, 11 individual fair value estimates for APA range widely from US$11.38 to US$168.56 per share. With Egypt now a larger part of APA’s operations, heightened exposure to regional risks could play a significant role in shaping future shareholder returns, see what others are projecting and consider how their expectations might compare to yours.

Explore 11 other fair value estimates on APA - why the stock might be worth less than half the current price!

Build Your Own APA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your APA research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free APA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate APA's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APA

APA

An independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026