- United States

- /

- Oil and Gas

- /

- NasdaqGM:AMTX

While Aemetis (NASDAQ:AMTX) shareholders have made 658% in 5 years, increasing losses might now be front of mind as stock sheds 10% this week

The last three months have been tough on Aemetis, Inc. (NASDAQ:AMTX) shareholders, who have seen the share price decline a rather worrying 36%. But over five years returns have been remarkably great. In that time, the share price has soared some 658% higher! Arguably, the recent fall is to be expected after such a strong rise. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 60% decline over the last twelve months. Anyone who held for that rewarding ride would probably be keen to talk about it.

Although Aemetis has shed US$16m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Aemetis

Given that Aemetis didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Aemetis saw its revenue grow at 7.4% per year. That's a pretty good long term growth rate. However, the share price gain of 50% during the period is considerably stronger. We usually like strong growth stocks but it does seem the market already appreciates this one quite well!

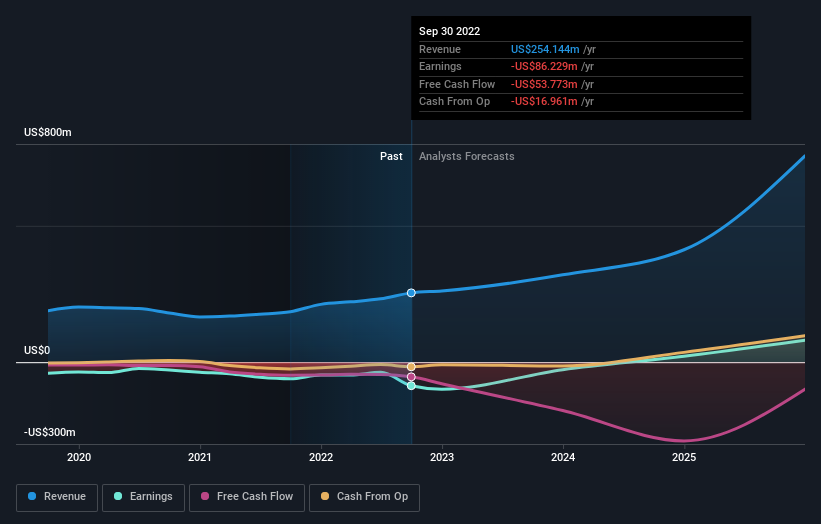

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Aemetis' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 8.4% in the twelve months, Aemetis shareholders did even worse, losing 60%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 50% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Aemetis has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AMTX

High growth potential slight.