- United States

- /

- Diversified Financial

- /

- OTCPK:FNMA

Will Fannie Mae’s (FNMA) Executive Shakeup Alter Management Stability or Strategic Direction?

Reviewed by Sasha Jovanovic

- Fannie Mae recently underwent significant leadership changes, appointing Peter Akwaboah as Acting CEO and promoting John Roscoe and Brandon Hamara to Co-Presidents, alongside other senior executive promotions.

- This leadership transition takes place just ahead of Fannie Mae's upcoming quarterly earnings announcement, highlighting a key period of change and heightened focus on operational continuity for the company.

- We'll consider how these new executive appointments may influence Fannie Mae’s investment narrative and management stability moving forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Federal National Mortgage Association's Investment Narrative?

To be a shareholder in Fannie Mae right now, you’d need to believe in the company’s crucial role in the US housing market and how it stands to benefit from movements toward privatization or housing market stabilization, even as profitability remains elusive. The recent wave of executive changes, an entirely new CEO, two Co-Presidents, and seasoned veterans stepping into key roles, introduces real uncertainty but also continuity, as most promotions were internal. This could offer some reassurance about operational stability in the lead up to quarterly results. Still, near-term risks have shifted with this leadership turnover: while it may not fundamentally alter the key catalysts like privatization policy or macro housing trends, the limited tenure at the top and board independence issues come into sharper focus. If confidence in management’s ability to steer through earnings pressures and regulatory uncertainty wavers, that could influence perceptions even if the long-term thesis is unchanged. Recent price volatility hints that the market is weighing these factors closely.

But the impact of management turnover on regulatory negotiations is something every investor should watch closely.

Exploring Other Perspectives

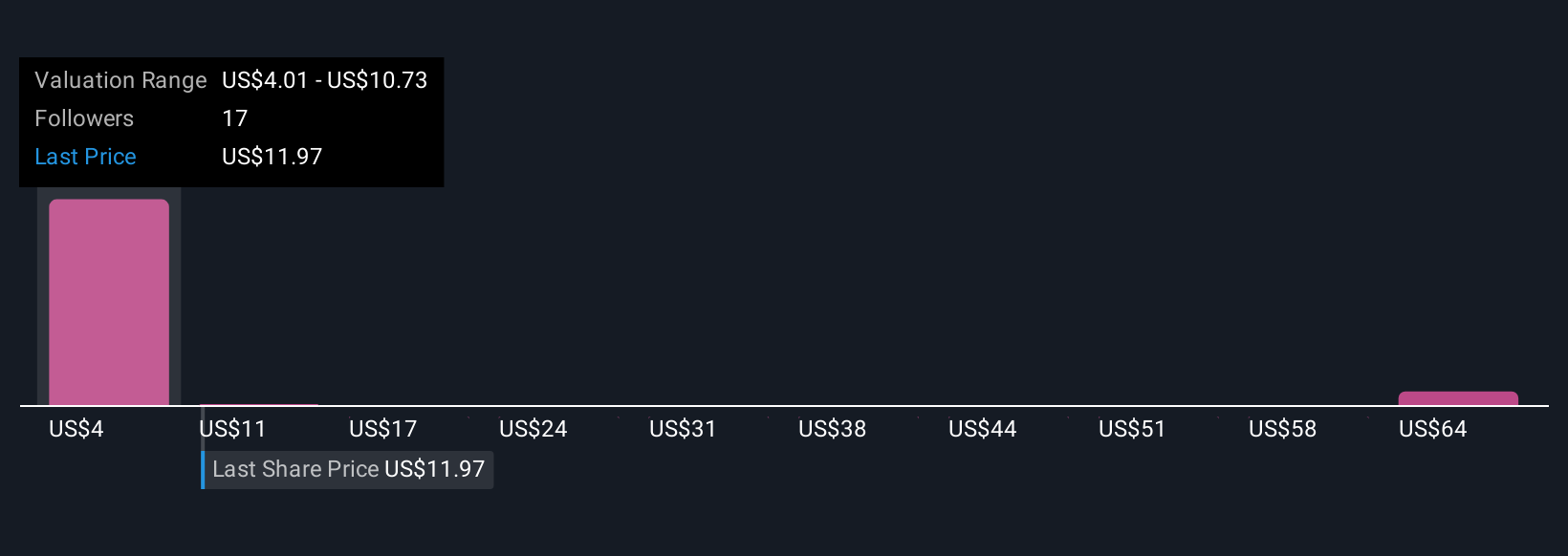

Explore 10 other fair value estimates on Federal National Mortgage Association - why the stock might be worth less than half the current price!

Build Your Own Federal National Mortgage Association Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federal National Mortgage Association research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Federal National Mortgage Association research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federal National Mortgage Association's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FNMA

Federal National Mortgage Association

Provides financing solutions for residential mortgages in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives