- United States

- /

- Diversified Financial

- /

- OTCPK:FNMA

Fannie Mae (FNMA): Evaluating Value After Bill Ackman’s Push for a Measured IPO Approach

Reviewed by Simply Wall St

Prominent investor Bill Ackman has put a spotlight on Federal National Mortgage Association (FNMA) this week, urging the Trump administration to hold off on any hasty plans for a public offering. His detailed reform plan is drawing new scrutiny to Fannie Mae's future and prospects for existing shareholders.

See our latest analysis for Federal National Mortgage Association.

Fannie Mae’s shares have ridden a volatile wave this year, highlighted by a remarkable year-to-date price return of nearly 180% and an even more striking 204.75% total shareholder return for the past twelve months. Despite recent headlines and a swift pullback, with shares down over 15% in a day following Ackman’s comments, the long-term story still suggests considerable momentum, underpinned by thousands of percent in cumulative returns over three years.

If this market attention makes you curious about what else is capturing investors’ imaginations, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

After such dramatic returns and renewed policy debate, investors are left to wonder if FNMA is still undervalued relative to its long-term prospects or if the recent rally has already priced in all the future growth.

Price-to-Sales of 1.9x: Is it justified?

FNMA trades at a price-to-sales ratio of 1.9x, which is below both peers and the industry average. This signals the market may be discounting the company’s prospects relative to rivals at its last close of $9.63.

The price-to-sales ratio measures a company's stock price relative to its revenue per share. For financial businesses like FNMA, this multiple is especially watched when earnings are volatile or negative, as is the case here.

Given FNMA’s persistent unprofitability, this low price-to-sales multiple reflects caution from investors. It suggests shareholders are not willing to pay more for each dollar of revenue until there is a clear path to sustainable profits or the regulatory environment shifts in their favor.

Compared to the US Diversified Financials industry average of 2.3x and peer average of 3.6x, FNMA appears attractively priced. The estimated fair price-to-sales ratio is 7.2x, which would imply significant upside if the market’s sentiment changes.

Explore the SWS fair ratio for Federal National Mortgage Association

Result: Price-to-Sales of 1.9x (UNDERVALUED)

However, persistent unprofitability and ongoing regulatory uncertainty could quickly undermine confidence in FNMA’s discounted valuation story.

Find out about the key risks to this Federal National Mortgage Association narrative.

Another View: Discounted Cash Flow Paints a Different Picture

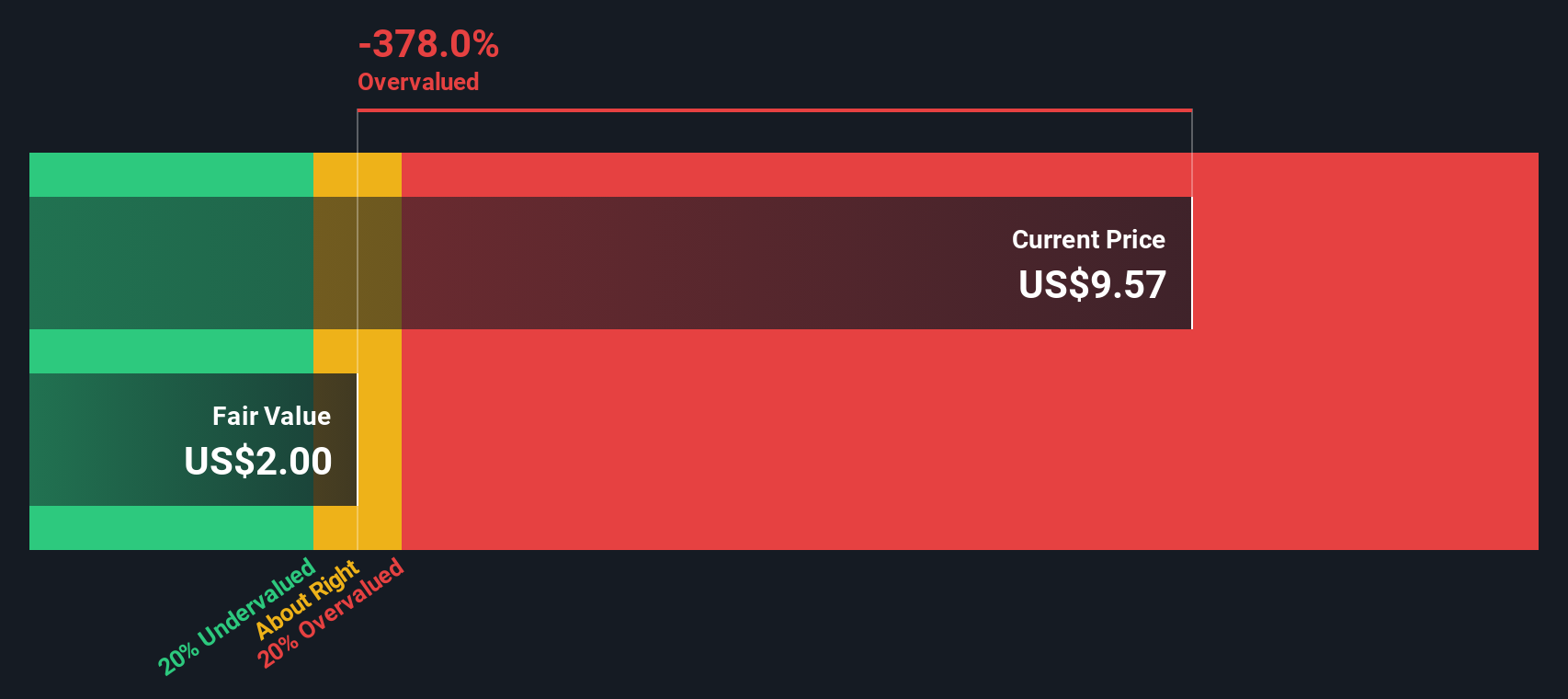

While FNMA appears undervalued when measured against peers and industry averages using the price-to-sales ratio, our SWS DCF model tells a different story. It estimates a fair value closer to $2 per share, which suggests shares may actually be overvalued at recent prices. So which approach should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Federal National Mortgage Association for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Federal National Mortgage Association Narrative

If you see things differently or enjoy digging into the numbers yourself, you can shape your own view of FNMA in just a few minutes, so Do it your way

A great starting point for your Federal National Mortgage Association research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors move quickly when new trends emerge. Seize opportunities others might overlook by exploring unique stock picks with the powerful Simply Wall Street Screener.

- Spot companies breaking ground in artificial intelligence when you review these 25 AI penny stocks. This helps you tap into tomorrow’s disruptive leaders.

- Capture hidden value by checking out these 919 undervalued stocks based on cash flows, which are poised for gains based on robust cash flow fundamentals.

- Boost potential portfolio income and stability by examining these 16 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FNMA

Federal National Mortgage Association

Provides financing solutions for residential mortgages in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives