- United States

- /

- Diversified Financial

- /

- OTCPK:FMCC

Freddie Mac (FMCC): A Fresh Look at Valuation After Quality Control Automation Upgrade and Industry Reform Proposals

Reviewed by Simply Wall St

Freddie Mac (FMCC) is rolling out Quality Control Advisor Plus, a new automation platform aimed at improving the quality control process for single-family loans. This initiative is designed to streamline loan reviews, lower repurchase risk, and improve overall efficiency.

See our latest analysis for Federal Home Loan Mortgage.

Focusing on operational upgrades and a stable mortgage market, Federal Home Loan Mortgage’s recent moves are getting attention. However, it is the stock’s 160.8% year-to-date share price return and a three-year total shareholder return of nearly 2,000% that truly underscore how much momentum has been building. While news like Bill Ackman’s reform proposals adds intrigue, investors have mostly responded to ongoing improvements in loan quality and efficiency, hinting at continued optimism about Freddie Mac’s growth outlook.

If you’re rethinking your portfolio strategy in light of these industry shakeups, it could be the right moment to broaden your search and discover fast growing stocks with high insider ownership

But with Freddie Mac’s share price more than doubling this year and trading nearly 44% below consensus analyst targets, the real question is whether the market still offers a buying opportunity or if it is already discounting future growth potential.

Price-to-Sales of 1.3x: Is it Justified?

Federal Home Loan Mortgage trades at a price-to-sales ratio of 1.3x, sitting well below peers and the broader industry. This suggests the market is currently pricing in lower expectations than comparable US diversified financial stocks.

The price-to-sales ratio reflects how much investors are willing to pay for each dollar of revenue generated. For a company like Federal Home Loan Mortgage, which is unprofitable yet maintains substantial revenues, this ratio is an important valuation lens, especially when profit-based multiples are not meaningful.

With a price-to-sales ratio of 1.3x, Federal Home Loan Mortgage stands apart from both its industry average of 2.3x and a peer average of 3.8x. Compared to an estimated fair price-to-sales ratio of 5.6x, the current multiple implies the market could be underpricing the company's revenue potential if conditions improve or efficiency gains persist.

Explore the SWS fair ratio for Federal Home Loan Mortgage

Result: Price-to-Sales of 1.3x (UNDERVALUED)

However, weak revenue growth and persistent net losses remain key risks. These factors could dampen investor enthusiasm if operational improvements do not materialize as expected.

Find out about the key risks to this Federal Home Loan Mortgage narrative.

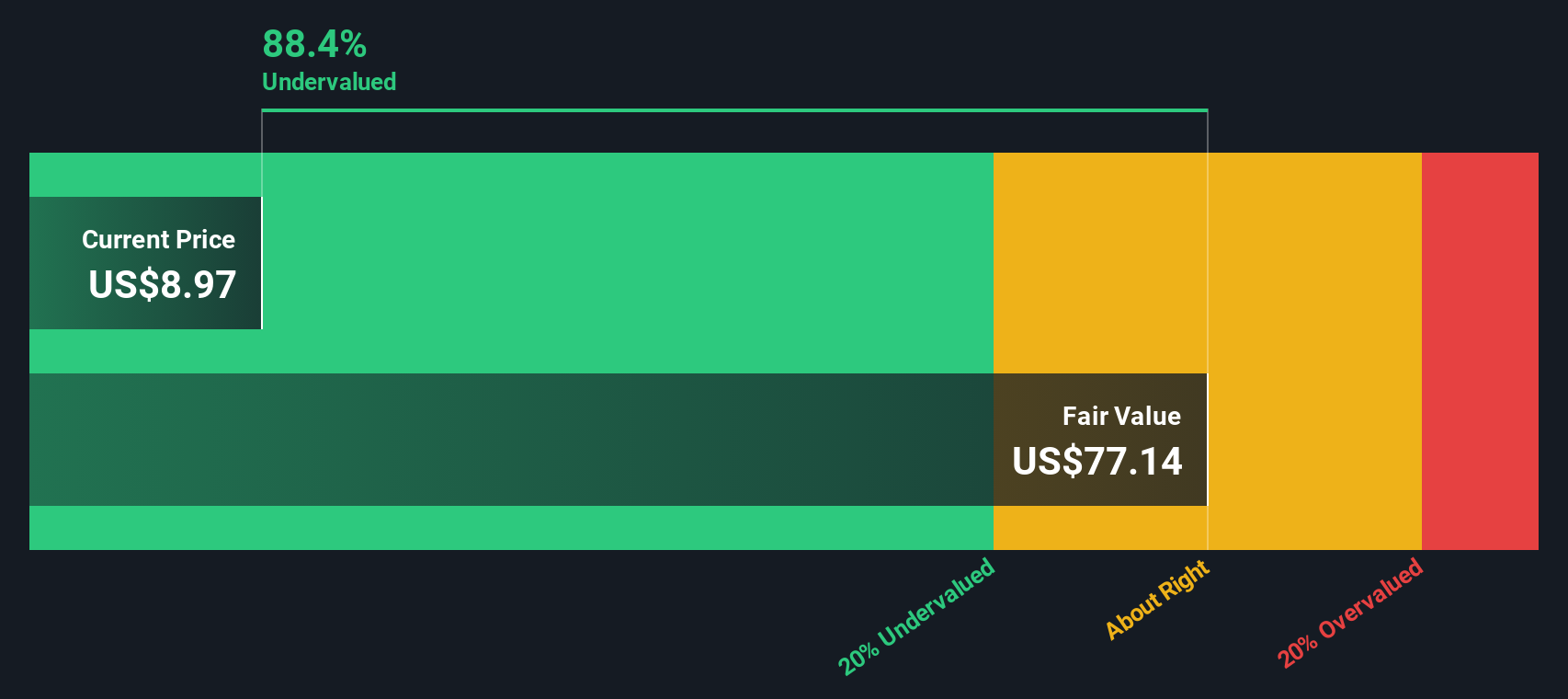

Another View: SWS DCF Model Suggests Even Deeper Undervaluation

While the price-to-sales ratio hints that Federal Home Loan Mortgage could be undervalued, our SWS DCF model presents an even stronger case. According to this calculation, shares are trading well below their estimated intrinsic value, highlighting a significant discount. Does this reflect hidden opportunity or is the market simply factoring in real risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Federal Home Loan Mortgage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Federal Home Loan Mortgage Narrative

If you see things differently, or want to dig into the numbers on your own terms, you can craft a personalized take in just a few minutes. Do it your way

A great starting point for your Federal Home Loan Mortgage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for Your Next Smart Move?

Don’t let opportunity pass you by. The right tools can help you find outstanding stocks beyond the obvious choices. Let these screens power up your search today.

- Tap into the future of medicine and technology by evaluating these 30 healthcare AI stocks, which is at the forefront of life-changing AI healthcare breakthroughs.

- Accelerate your returns by reviewing these 927 undervalued stocks based on cash flows, featuring opportunities that the wider market has yet to fully appreciate and currently offer compelling value.

- Boost your income strategy with these 16 dividend stocks with yields > 3%, known for delivering steady yields that can help grow your portfolio every year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FMCC

Federal Home Loan Mortgage

Operates in the secondary mortgage market in the United States.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives