- United States

- /

- Diversified Financial

- /

- OTCPK:FMCC

Assessing Fannie Mae (FMCC) Valuation After a 27% Share Price Surge

Reviewed by Kshitija Bhandaru

Federal Home Loan Mortgage (FMCC) has been drawing increased attention lately, as investors look for insights into how its performance fits within the broader landscape of U.S. financial stocks. With shares recently gaining more than 27% over the past month, questions about valuation are surfacing again.

See our latest analysis for Federal Home Loan Mortgage.

After a standout 27% surge this past month, Federal Home Loan Mortgage’s momentum is adding to a longer stretch of growth, with a 1-year total shareholder return just under 10% and three-year returns north of 20%. Investors seem to be reappraising both its growth outlook and risk profile as sentiment improves.

If shifting sentiment in financials sparks your curiosity, now is a perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

But after such impressive gains in a short period, the big question remains: is Federal Home Loan Mortgage still undervalued, or is the market already anticipating future upside? Could there be more room to run, or is the growth fully priced in?

Price-to-Sales Ratio of 1.7x: Is it Justified?

Federal Home Loan Mortgage's current price-to-sales ratio sits at 1.7x, markedly below both peer and industry averages. This signals a potential undervaluation based on sales fundamentals at the last close of $12.39.

The price-to-sales ratio compares a company’s market capitalization to its total sales, offering investors a sense of how much they are paying for each dollar of revenue. For Federal Home Loan Mortgage, which is currently unprofitable, sales-based metrics matter more than profit-based multiples.

This low price-to-sales ratio suggests the market could be underestimating the company’s revenue potential or future prospects, especially when compared to peer firms trading at much higher valuations.

- Compared to its peers, which average a price-to-sales ratio of 4.1x, Federal Home Loan Mortgage appears significantly undervalued on this metric.

- Against the wider US Diversified Financial industry average of 2.9x, FMCC also trades at a substantial discount.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 1.7x (UNDERVALUED)

However, weak profitability and the fact that Federal Home Loan Mortgage is currently trading well above analyst price targets may limit further upside in the near term.

Find out about the key risks to this Federal Home Loan Mortgage narrative.

Another View: Discounted Cash Flow Analysis

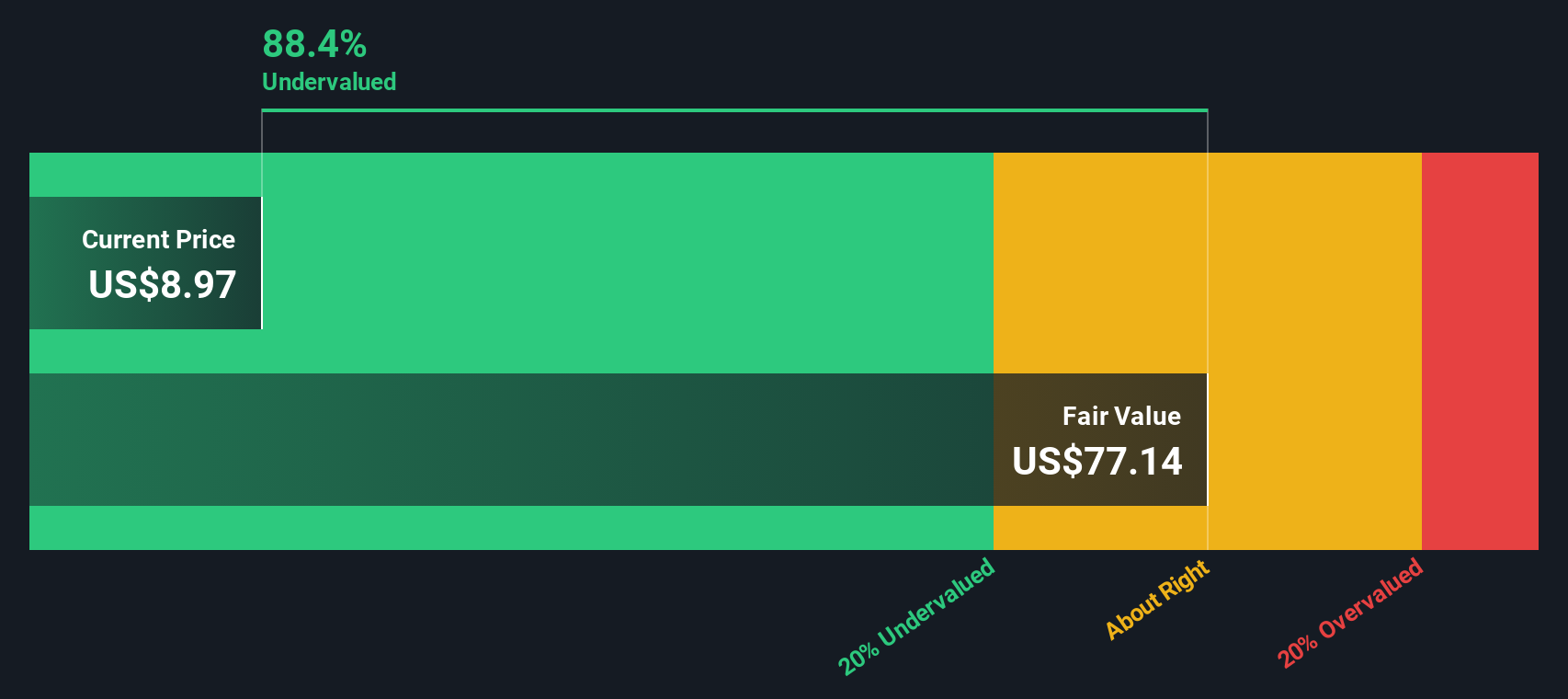

While sales-based ratios make Federal Home Loan Mortgage look undervalued, our DCF model offers a strikingly different perspective. The SWS DCF model estimates the company’s fair value to be $77.14, which is far above the current price. This suggests the market may be overlooking substantial intrinsic value. However, can this optimistic figure be trusted, given recent unprofitability?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Federal Home Loan Mortgage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Federal Home Loan Mortgage Narrative

If you’d rather draw your own conclusions or question the outlook presented here, you can dig into the numbers and build your perspective in under three minutes using Do it your way.

A great starting point for your Federal Home Loan Mortgage research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Set your portfolio apart by acting on today’s real opportunities. Tap into unique markets and enhance your strategy before the crowd spots these trends.

- Unlock potential in up-and-coming companies by scanning these 3569 penny stocks with strong financials with strong financial foundations and long-term growth promise.

- Capture the future of healthcare by targeting breakthroughs within these 31 healthcare AI stocks that are shaping diagnostics, drug discovery, and patient care.

- Amplify your passive income by zeroing in on these 19 dividend stocks with yields > 3% that offer superior yields above 3% and resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FMCC

Federal Home Loan Mortgage

Operates in the secondary mortgage market in the United States.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives