- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

How Investors Are Reacting To Block (XYZ) Expanding Square's Venue Reach And Capital Flexibility

- Square has launched its new Square Handheld device and unified Point of Sale app in the UK, alongside industry-specific features for restaurants, and expanded its exclusive partnership with Live Nation Canada, making Square the point-of-sale provider at all major venues and festivals, including Toronto's new Rogers Stadium.

- Block's $5.09 billion shelf registration offers future flexibility for capital raising or employee stock programs, supporting ongoing expansion initiatives and product rollouts.

- We'll examine how Square's expanded presence at major UK and Canadian venues impacts Block's growth trajectory and ecosystem strategy.

Block Investment Narrative Recap

To invest in Block, you need to believe in its ability to expand its payments ecosystem globally and deepen engagement with sellers and consumers. Square’s launches in the UK and expanded Live Nation Canada partnership reinforce Block’s market presence, but neither event is likely to materially shift the company's most important short-term catalyst: delivering consistent gross profit growth, especially as Cash App expansion faces delays. The main risk remains unpredictable cash flows if the benefits from transaction cost initiatives or Cash App Borrow expansion do not materialize this year.

The rollout of the new Square Handheld device and unified Point of Sale app in the UK stands out among recent announcements. By simplifying operations and increasing efficiency for food and beverage sellers, these innovations could help drive sales volume, which supports Block’s focus on boosting revenue through product enhancements, critical for offsetting delays in other areas like lending expansion.

But while these commercial wins highlight Block’s strengths, investors should also be aware of the potential for regulatory changes that could add compliance costs or impact margins if...

Read the full narrative on Block (it's free!)

Block's narrative projects $32.6 billion in revenue and $2.5 billion in earnings by 2028. This requires an 11.0% yearly revenue growth and a 127.3% earnings increase from $1.1 billion.

Uncover how Block's forecasts yield a $96.99 fair value, a 46% upside to its current price.

Exploring Other Perspectives

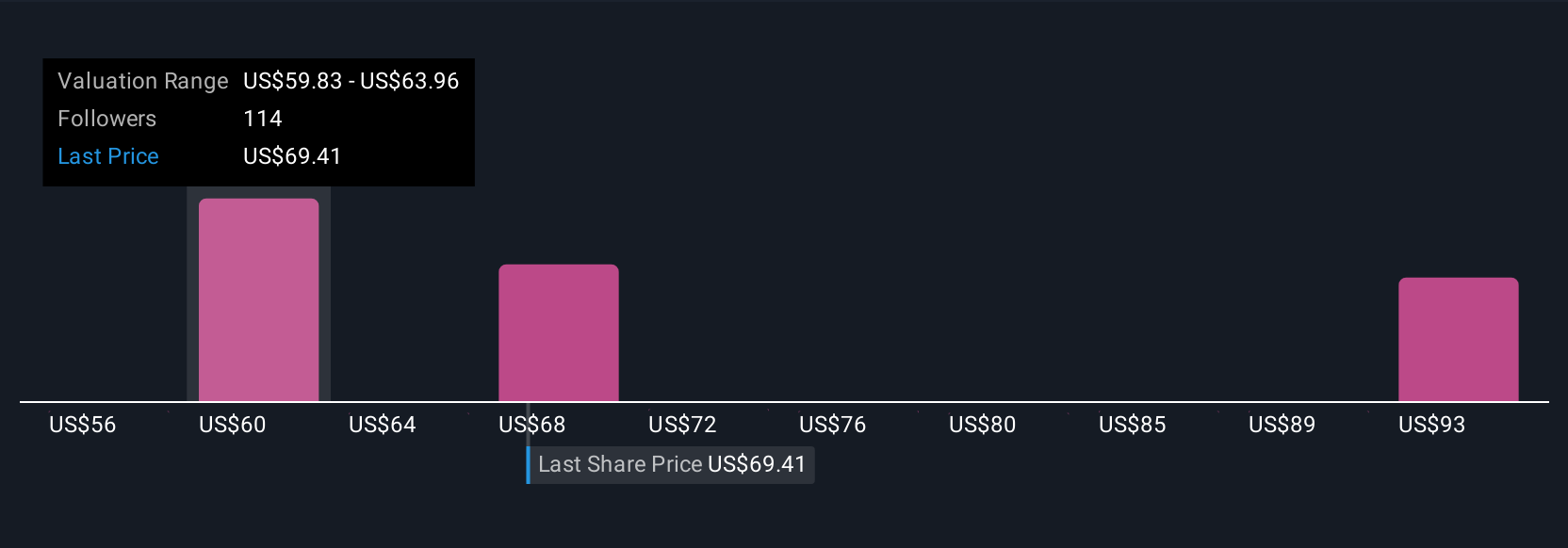

Simply Wall St Community members contributed 13 fair value estimates for Block from US$55.70 to US$96.99, showing broad disagreement on the company’s outlook. With regulatory clarity still a key risk affecting fintech products, now is a good time to compare the range of opinions and examine what could influence future performance.

Build Your Own Block Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Block research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Block research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Block's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 24 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives