- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

Does Square’s New Grubhub Partnership Reveal a Broader Fintech Strategy for Block (SQ)?

Reviewed by Sasha Jovanovic

- Block, Inc. recently announced a new partnership with Grubhub, integrating Square’s point-of-sale system and adding Cash App Pay as a payment option for restaurant customers, while Blackbird Bakery shared its successful migration to Square’s integrated ecosystem across all London locations.

- These collaborations highlight Block’s focus on operational integration and payment flexibility, helping restaurants streamline processes while broadening consumer access and engagement.

- We’ll explore how the Grubhub integration, which brings Cash App Pay to more diners and restaurants, could influence Block’s investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Block Investment Narrative Recap

To be a Block shareholder, you need conviction in the company’s ability to drive network effects across commerce, payments, and banking by deepening its ecosystem integration and broadening consumer reach, especially through innovations like Cash App. The Grubhub integration and Blackbird Bakery’s Square deployment showcase operational momentum, but neither appear likely to materially shift the near-term focus on user engagement and revenue per user, nor do they directly impact Block’s exposure to growing competition and fee compression in core payments.

Among Block’s recent announcements, the expanded partnership with Grubhub stands out. By making Cash App Pay available as a checkout option for millions of diners and streamlining order management for restaurants, Block both addresses immediate customer pain points and reinforces its push to grow payment volumes and deposit flows, key elements for maintaining user engagement and catalyzing sustained top-line growth in the face of rapid industry change.

Yet while this expansion brings new users into Block’s platform, investors should be aware that mounting competition and the risk of payment commoditization remain substantial...

Read the full narrative on Block (it's free!)

Block's outlook anticipates revenues of $32.8 billion and earnings of $2.4 billion by 2028. This scenario assumes an annual revenue growth rate of 11.3% and a $0.6 billion decrease in earnings from the current $3.0 billion.

Uncover how Block's forecasts yield a $88.40 fair value, a 11% upside to its current price.

Exploring Other Perspectives

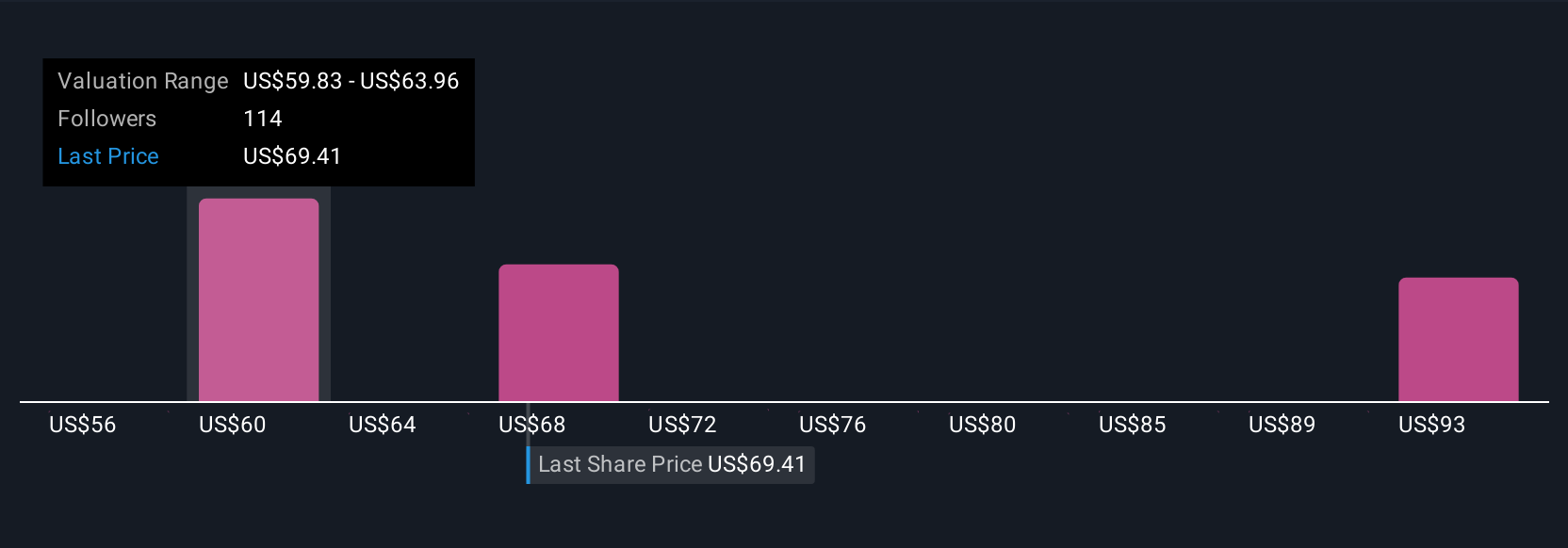

Seventeen fair value estimates from the Simply Wall St Community span US$60.37 to US$104 per share. Forecasts for slower user growth and fee pressure remind us that opinions vary and it pays to consider a range of outlooks.

Explore 17 other fair value estimates on Block - why the stock might be worth as much as 31% more than the current price!

Build Your Own Block Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Block research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Block research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Block's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives