- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

Block (SQ): Exploring Valuation After Fresh Analyst Ratings and Strategic Partnerships Boost Ecosystem Momentum

Reviewed by Simply Wall St

Block’s ecosystem has been getting fresh attention after a wave of new ratings from analysts. This interest follows energetic moves such as partnerships with Grubhub and South London’s Blackbird Bakery, both leveraging Block’s integrated solutions.

See our latest analysis for Block.

Block has seen its share price rebound in recent weeks, climbing almost 9% over the past month as momentum builds on the back of its new platform integrations and collaborations. Despite a negative year-to-date share price return, long-term holders have fared better with a 1-year total shareholder return of 9% and a strong 36% gain over the past three years.

If Block’s partnerships and tech upgrades have you rethinking what’s possible in fintech, now is a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

With analyst targets now suggesting further upside and the company’s ecosystem seeing real-world traction, is Block’s share price still an opportunity for savvy investors, or is the market already factoring in the company’s next phase of growth?

Most Popular Narrative: 9% Undervalued

Block’s widely followed narrative puts fair value roughly $8 above the latest closing price, reflecting strong hopes for product-led expansion and stickiness. This places fresh focus on whether recent gains are just the beginning.

The rapid acceleration in new product launches, especially around peer-to-peer features (like Cash App Pools) and integration of AI into product development, is heightening Cash App's network effects and virality. This is likely driving improved user acquisition and engagement, which supports recurring revenue expansion in future quarters.

Want the full playbook behind this bullish outlook? The narrative’s bold valuation stands on eye-popping projections for revenue, margins, and user base growth. Don’t miss the financial drivers that set this price target apart from the market’s expectations. Find out what’s fueling analyst confidence in the complete breakdown.

Result: Fair Value of $88.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering concerns about credit risks and volatile crypto revenues could quickly undercut analyst optimism if consumer behavior or market conditions suddenly shift.

Find out about the key risks to this Block narrative.

Another View: What Does Our DCF Model Say?

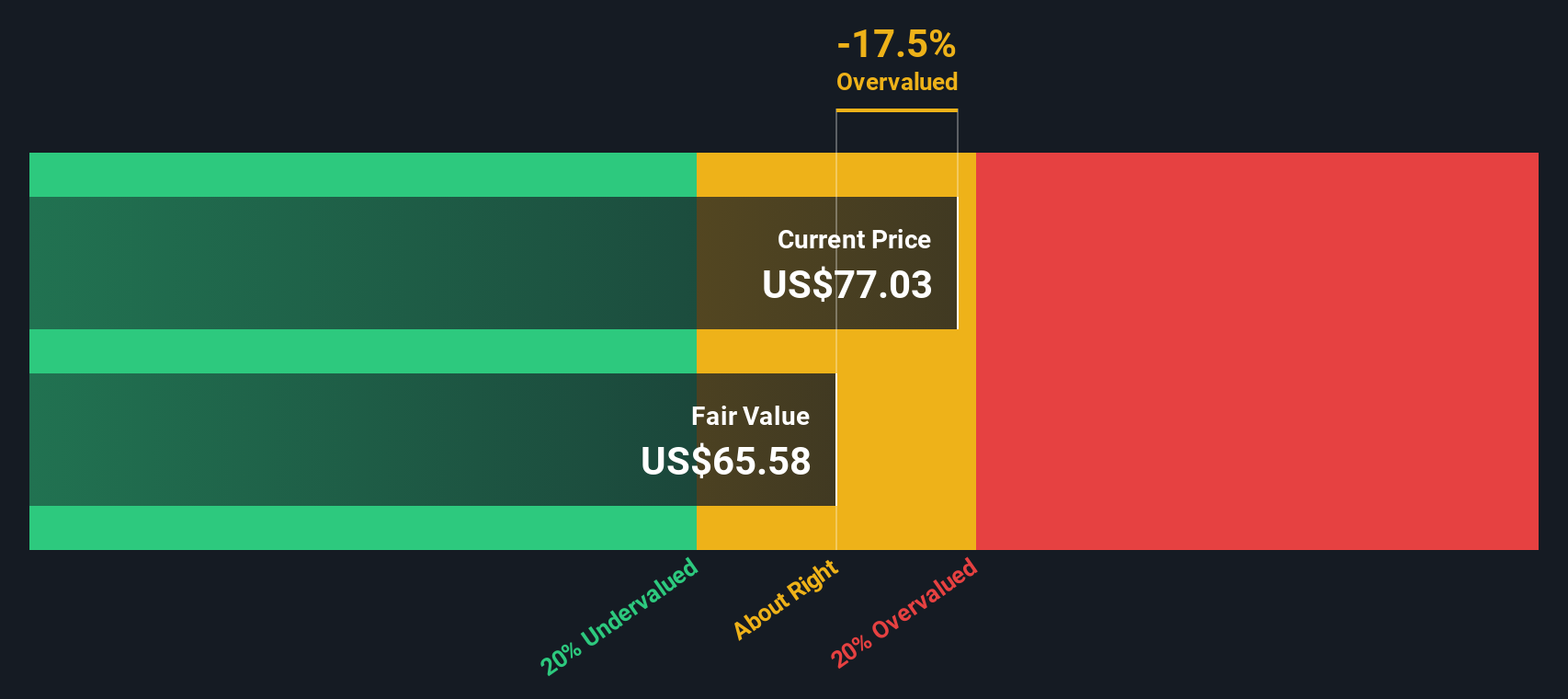

While analysts see Block as undervalued based on consensus price targets, the SWS DCF model paints a different picture. It finds Block’s current price is above its estimated fair value, suggesting a more cautious outlook. Could short-term optimism be missing some longer-range risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Block for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Block Narrative

If our analysis sparks your curiosity or you’d rather dive into the numbers on your own terms, you can shape your personal view on Block in just minutes with Do it your way

A great starting point for your Block research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Winning Ideas?

Don’t wait for opportunity to knock twice. On Simply Wall Street, you can target fast-moving sectors, income plays, or emerging tech leaders that fit your style.

- Boost your portfolio with consistent income by tapping into market standouts yielding over 3% with these 19 dividend stocks with yields > 3%.

- Take advantage of powerful technology trends and check out these 27 AI penny stocks, which uncovers the most promising AI-driven businesses today.

- Find tomorrow’s success stories trading below their true value, and see what sets apart these 870 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives