- United States

- /

- Diversified Financial

- /

- NYSE:WU

Western Union (WU) Profit Margins Rise, Challenging Bearish Views Despite Weak Earnings Outlook

Reviewed by Simply Wall St

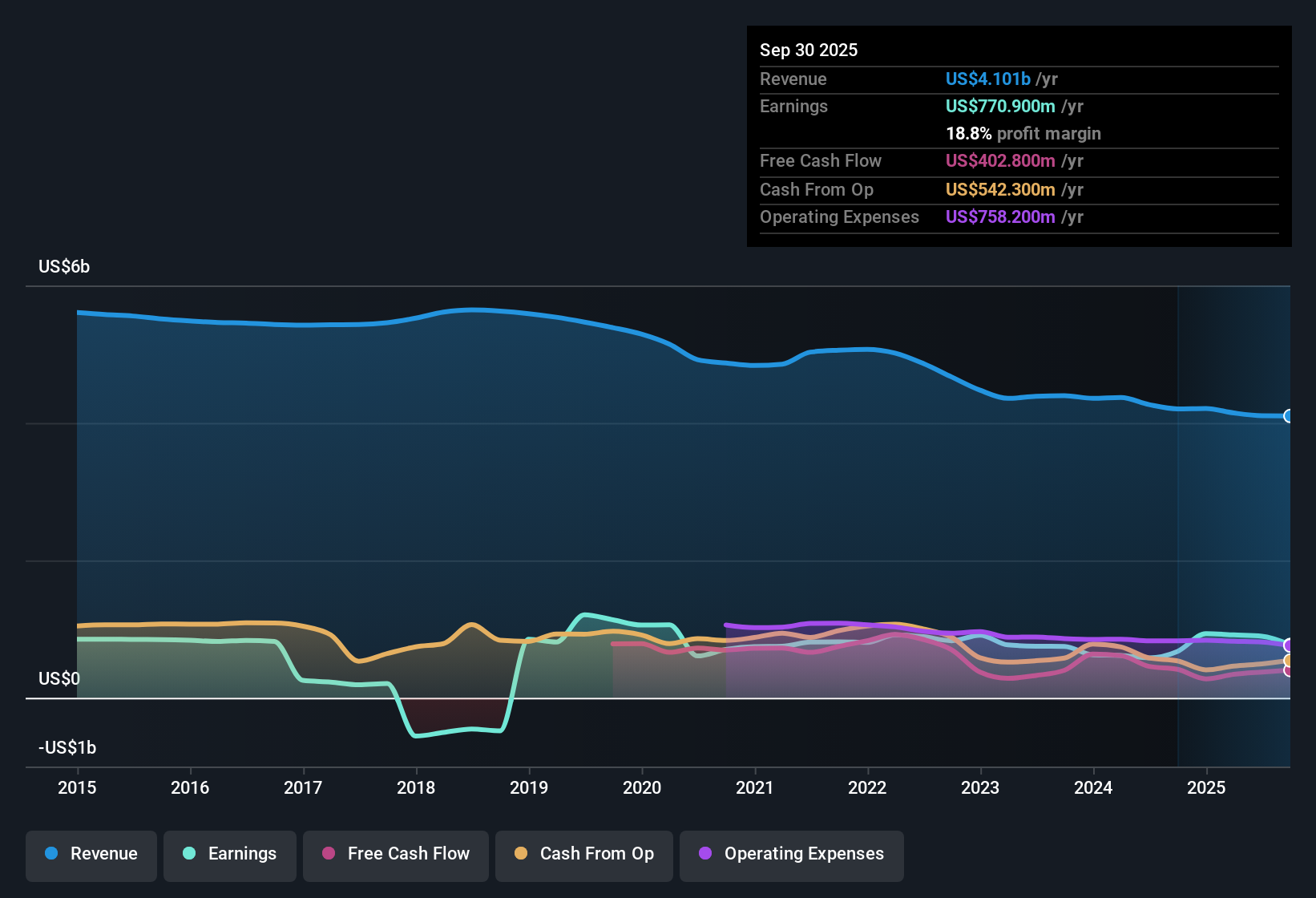

Western Union (WU) posted net profit margins of 18.8% in its latest results, up from 16.1% a year ago, while earnings grew 14.1% over the same period, well ahead of its essentially flat five-year trend. Despite the uptick in profits, revenue is only expected to inch up by 1.1% per year, and analysts anticipate earnings to decline by 8.8% annually for the next three years. Investors now face a classic valuation-versus-growth tradeoff: compelling profitability and below-average price-to-earnings valuations on one side, but muted revenue prospects and looming earnings pressures on the other.

See our full analysis for Western Union.The real test is how these numbers stack up against the prevailing market narratives. Some views will get reinforced, while others may be challenged in light of the latest earnings release.

See what the community is saying about Western Union

Profit Margins Projected to Shrink by Nine Points

- Analysts expect Western Union's profit margins to drop from 21.8% today to 12.7% by 2028, a decline of 9.1 percentage points over three years.

- According to analysts' consensus view, the margin compression is expected to outweigh modest growth catalysts, raising questions about the company's ability to offset cost pressures with digital and technology investments.

- While integration of AI and early adoption of blockchain are positioned as margin-boosting strategies, the rapid expansion of fintech competitors could erode market share and limit how much these moves actually protect long-term profitability.

- Persistent regulatory and compliance burdens, especially in critical corridors like U.S.-to-Mexico, are seen as structural challenges that may prevent Western Union from sustaining higher operating margins.

- Bulls and bears both grapple with whether digital efficiency gains can keep pace with rising competitive and regulatory risks, given this expected margin contraction.

- Consensus narrative highlights these pressures, making ongoing margin management a central tension for investors.

Consensus narrative highlights how this margin squeeze keeps the bull-bear debate alive. Get the full market perspective in the detailed Consensus Narrative. 📊 Read the full Western Union Consensus Narrative.

Share Count Shrinking, Future EPS Still Under Pressure

- Western Union's number of shares outstanding is projected to decline by 4.39% per year over the next three years, but despite this buyback-driven reduction, analysts expect absolute earnings to fall from $896 million today to $543 million by 2028.

- The consensus narrative underscores that the anticipated drop in overall earnings dominates any per-share boost from buybacks, so investors will need to see significant business transformation for a true EPS lift.

- Even with annual share repurchases, shrinking transaction volumes and the risk of losing ground to digital-first disruptors outpace the positives from reducing the share count.

- Bulls hoping for EPS stability will need to weigh these fundamental headwinds carefully against any operational upside.

Valuation Discount Remains Wide Versus Industry

- Western Union trades at a Price-To-Earnings ratio of 3.7x, well below the US diversified financial industry average of 16.5x and consensus analyst target of 6.4x. The company is also trading at a discount to the DCF fair value estimate of $29.50 with a current share price of $8.97.

- The analysts' consensus view raises a provocative question: will the low valuation eventually outweigh declining growth, or does the share price reflect deeper skepticism about future profitability?

- Despite a 9.6% upside to the official analyst target price of $9.25 (relative to $8.97), the market is pricing in a steep discount compared to both peer valuations and intrinsic value.

- The sizable gap between Western Union's current price and both its sector average and DCF fair value suggests that investors remain unconvinced that the business can deliver on even modest growth expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Western Union on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from another angle? Share your own take and shape a narrative in just a few minutes. Do it your way

A great starting point for your Western Union research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite Western Union’s appealing valuation, analysts see persistent pressures on profit margins and earnings growth as a result of regulatory hurdles and tougher digital competition.

If you want more stability and less earnings uncertainty, use stable growth stocks screener (2098 results) to focus on companies with consistent revenue and profit expansion even when conditions change.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Union might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WU

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives