- United States

- /

- Diversified Financial

- /

- NYSE:WU

Western Union (WU): Assessing Valuation After Earnings Miss, Outlook Cut, and CEO Insider Buy

Reviewed by Simply Wall St

If you have been weighing your options with Western Union, now is a moment worth watching. The company just released second-quarter earnings that fell short of expectations and cut its full-year revenue and earnings targets. At the same time, Western Union is rolling out a new digital service in Peru, waiving transfer fees to capture remittance flows. Its CEO also recently joined a wave of insider buying, which suggests leadership still sees untapped value.

This combination of mixed signals is showing up in the share price. Despite the company’s challenges, particularly in certain segments and the overall guidance, Western Union managed a 1.9% gain while the broader market dipped. That increase comes after a tough year, with shares down 22% over the last twelve months and momentum still lagging compared to three years ago. In summary, the market appears torn between caution and optimism, and the next significant move could depend on how these digital ambitions and internal confidence develop.

The question remains: Is Western Union now undervalued in light of its new growth strategy and insider support, or is the market already factoring in all the upside it can see?

Most Popular Narrative: 7% Undervalued

According to community narrative, Western Union is currently seen as undervalued. Analysts cite both structural shifts and future potential in digital transformation as the main catalysts for upside.

“The ongoing digital transformation, including expanded digital wallet offerings, card-based retail transactions, and value-added services, positions the company to capture a growing share of the large, underpenetrated market of financially included and mobile-first consumers. This supports improved revenue growth and higher long-term net margins due to better cost efficiency.”

Curious about why so many analysts are calling this a turnaround story? The community’s valuation playbook is built around bold digital bets and profit assumptions that defy recent trends. Wondering exactly which future financial numbers power this narrative's price target? Find out how the expected trajectory of revenues and margins could tip the scales in Western Union’s favor.

Result: Fair Value of $9.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory challenges or a failure to outpace digital-first competitors could undermine Western Union’s turnaround narrative and keep pressure on future earnings.

Find out about the key risks to this Western Union narrative.Another View: Discounted Cash Flow Model

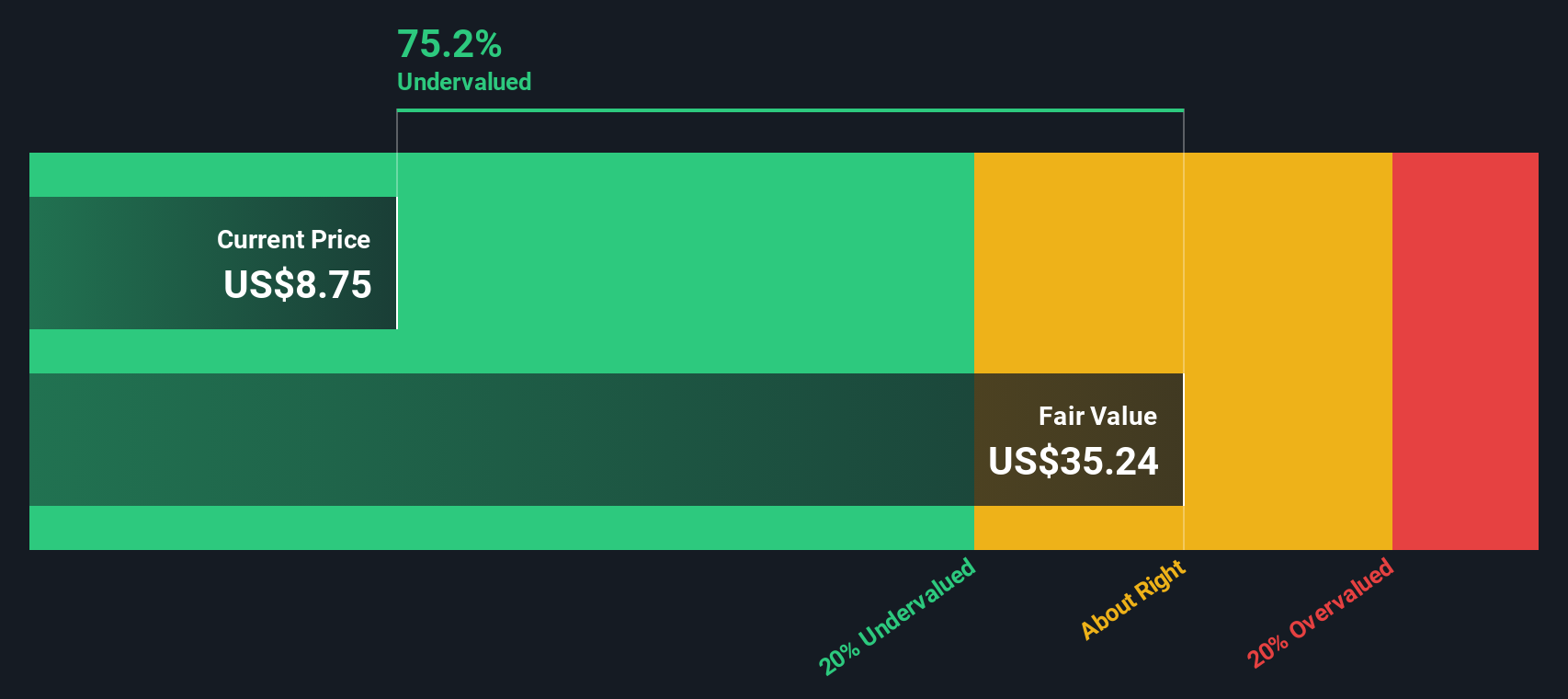

Looking at Western Union through the lens of our DCF model adds a different perspective. This method also signals undervaluation; however, the assumptions behind future cash flows and long-term growth are hotly debated. Could these divergent calculations suggest investors are still missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Western Union for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Western Union Narrative

If you want to draw your own conclusions or dig deeper into the numbers behind Western Union, it only takes a few minutes to assemble your own perspective. Do it your way.

A great starting point for your Western Union research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

There are always fresh ways to put your capital to work, especially if you know where to look. Don’t let great ideas slip by. See what’s shaking up the investment world and get ahead of the curve with these hand-picked screens designed to highlight real potential:

- Tap into surging tech trends by spotting the next wave of artificial intelligence breakthroughs through our AI penny stocks.

- Harness powerful income streams and find reliable yields exceeding 3% using the smart approach in our dividend stocks with yields > 3%.

- Seize unique value opportunities by uncovering companies trading below their intrinsic worth thanks to our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Union might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:WU

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives