- United States

- /

- Diversified Financial

- /

- NYSE:WU

Should Executive Insider Buying Ahead of Earnings Require Action From Western Union (WU) Investors?

Reviewed by Sasha Jovanovic

- Western Union is scheduled to announce its quarterly earnings after market close on Thursday, with analysts expecting a 1.2% year-on-year revenue decline to US$1.02 billion, marking an improvement from last year's 5.6% decrease in the same period.

- Recent insider share purchases by Western Union's CEO and CFO, along with significant changes in institutional holdings, have fueled increased market attention ahead of the upcoming earnings report.

- We'll examine how the recent executive insider buying could influence Western Union's investment narrative and near-term outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Western Union Investment Narrative Recap

To own Western Union shares today, you’d need confidence in its ability to revitalize growth through digital transformation and cost controls, while managing competition and regulatory changes. The recent insider share purchases by the CEO and CFO have brought short-term market attention, but they don’t fundamentally change the key driver for the stock: whether digital business growth can offset ongoing declines in core retail money transfers. Near-term, the biggest risk remains persistent weakness in high-volume corridors amid regulatory pressures.

Among recent announcements, the strategic partnership with dLocal to expand digital payments in Latin America stands out. This move directly addresses the shift toward digital channels, which is vital if Western Union is to counter competitive threats from digital-first and fintech players and capitalize on the catalyst of broader digital adoption.

But in contrast to this digital push, investors should also be aware of the persistent headwinds in Western Union’s core US-to-Mexico corridor if...

Read the full narrative on Western Union (it's free!)

Western Union's outlook projects $4.3 billion in revenue and $543.0 million in earnings by 2028. This reflects a 1.3% annual revenue growth and a $353.1 million decrease in earnings from the current $896.1 million.

Uncover how Western Union's forecasts yield a $9.32 fair value, a 15% upside to its current price.

Exploring Other Perspectives

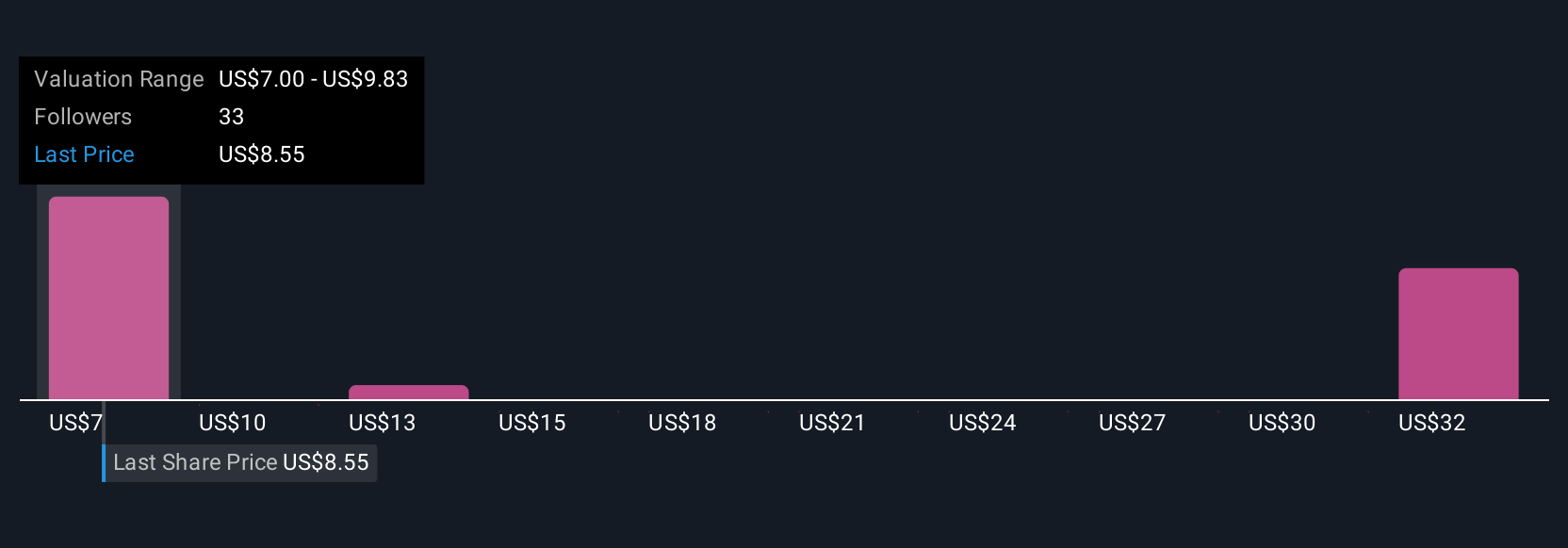

Fair value estimates for Western Union from nine Simply Wall St Community members range from US$7 to a high of US$36.62. While opinions vary, regulatory risks impacting major remittance corridors remain a central concern with wide implications for profitability and growth.

Explore 9 other fair value estimates on Western Union - why the stock might be worth 14% less than the current price!

Build Your Own Western Union Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Union research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Western Union research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Union's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Union might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WU

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives