- United States

- /

- Diversified Financial

- /

- NYSE:WU

Is Western Union’s Recent 12% Rally Signaling a Shift in Market Sentiment for 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Western Union stock right now? You’re not alone. After all, there’s something about a financial company with a long history and a cheap-looking share price that makes investors wonder if it just might be ready to turn the page. Over the past month, Western Union has posted a strong double-digit climb of 12.1%, with a 10.0% bump just in the past week. That kind of momentum stands out, especially considering the stock is still off 14.7% year-to-date and down even more over longer timeframes.

What’s been moving the needle? For starters, recent updates around international payments innovation and partnerships have reminded investors of Western Union’s reach and potential to adapt. While these headlines might not sound as dramatic as a major acquisition, they help reinforce the narrative that Western Union isn’t content to just watch competitors eat its lunch. Instead, the company is rolling up its sleeves and trying to stay relevant in a shifting financial services world.

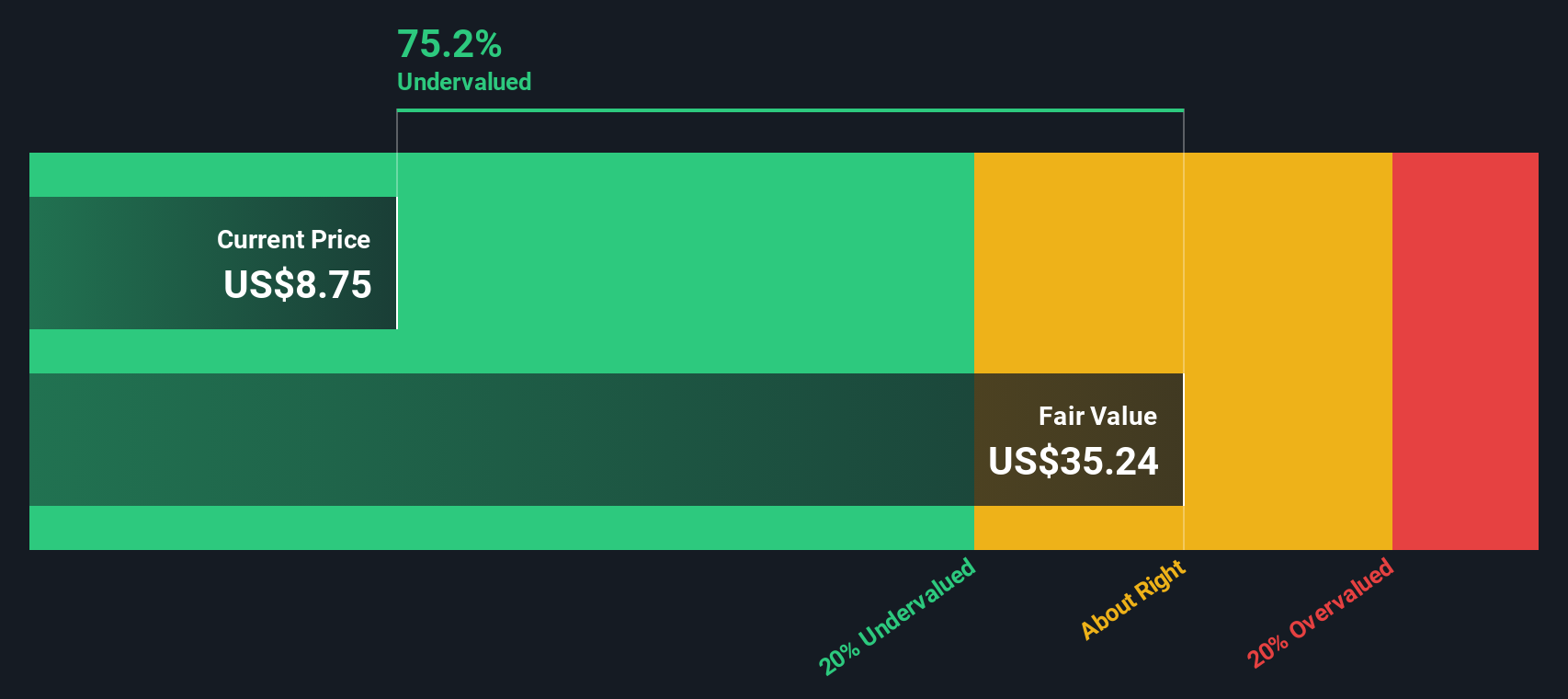

When it comes to undervaluation, Western Union looks intriguing: based on our valuation model, it passes 5 out of 6 key undervaluation checks and has a strong value score of 5. On paper, that suggests a bargain, but as always, not all valuation methods tell the whole story.

Let’s break down how these valuation approaches fit together and why there may be an even clearer way to understand what Western Union’s price is really telling us.

Why Western Union is lagging behind its peers

Approach 1: Western Union Excess Returns Analysis

The Excess Returns valuation model offers a clear snapshot of a company’s ability to generate returns over and above the required cost of equity. This method focuses on how effectively Western Union puts its capital to work, taking into account both consistent profitability and what shareholders expect as a reward for their investment risk.

For Western Union, the key numbers stand out:

- Book Value: $2.91 per share

- Stable EPS: $1.96 per share (source: Weighted future Return on Equity estimates from 6 analysts)

- Cost of Equity: $0.31 per share

- Excess Return: $1.65 per share

- Average Return on Equity: 48.52%

- Stable Book Value: $4.04 per share (source: Weighted future Book Value estimates from 4 analysts)

Using these figures, the Excess Returns model estimates an intrinsic value of $39.70 per share. With Western Union’s current share price trading at a 77.6% discount to this fair value, the model delivers a striking conclusion: the stock appears deeply undervalued based on its ability to reliably generate excess profits for shareholders.

Result: UNDERVALUED

Our Excess Returns analysis suggests Western Union is undervalued by 77.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Western Union Price vs Earnings

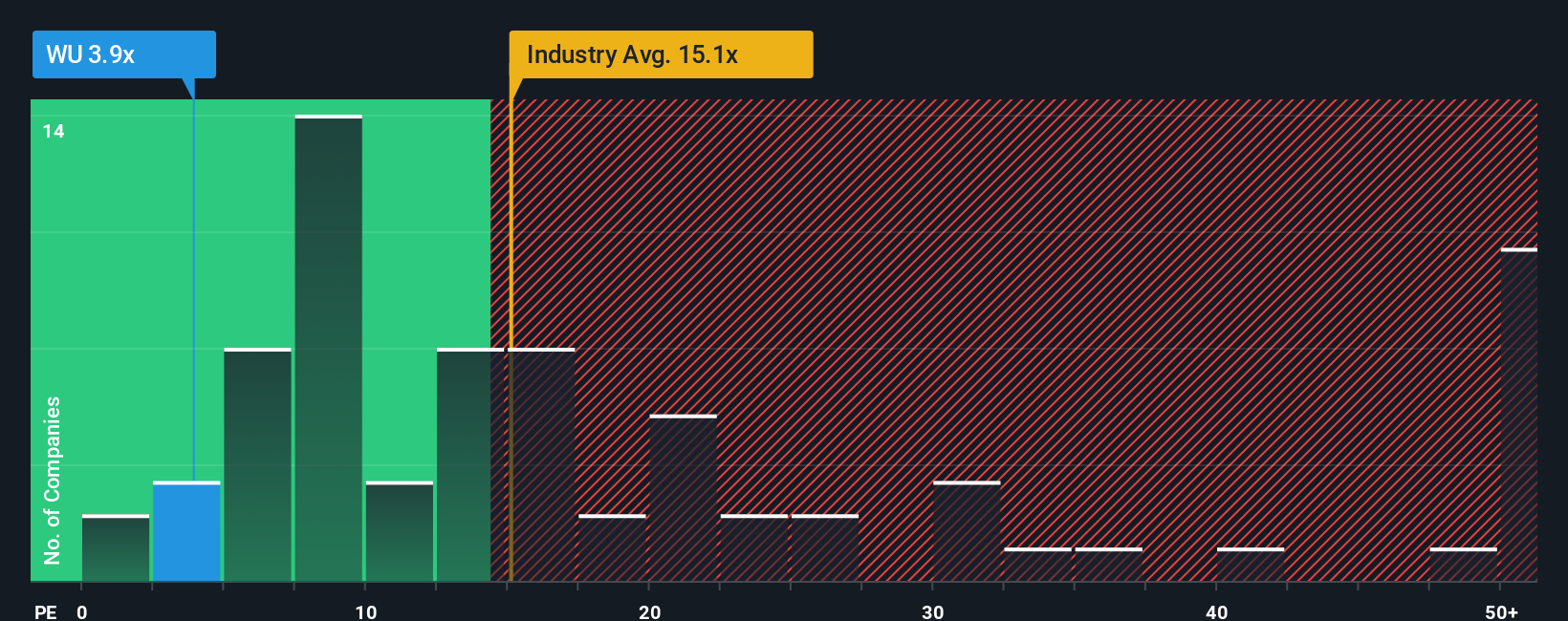

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Western Union, as it directly compares a company’s share price to its earnings. Since Western Union is generating consistent profits, the PE ratio offers a clear way to judge whether the market is pricing in too much optimism or too much skepticism.

Generally, a company with strong growth prospects or lower risks commands a higher PE ratio, while slower growth or more uncertainty warrants a lower PE. Market sentiment and expectations for future earnings also play major roles in what investors view as a "normal" or "fair" PE ratio for a company.

Currently, Western Union trades at a PE ratio of just 3.68x, which is notably lower than both the Diversified Financials industry average of 16.63x and the average among its peers of 13.44x. This large gap suggests the market is quite cautious on Western Union’s outlook.

However, Simply Wall St's proprietary "Fair Ratio" offers a more nuanced benchmark by factoring in Western Union’s earnings growth, profit margins, sector, market cap, and risk. This tailored approach is useful because industry averages can be skewed by fast-growing outliers or companies with very different risk profiles. Western Union’s calculated Fair Ratio is 11.36x, implying the stock is trading well below what would be warranted based on these holistic factors.

In other words, Western Union’s current valuation looks very undemanding and may indicate a potential opportunity for value-focused investors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Western Union Narrative

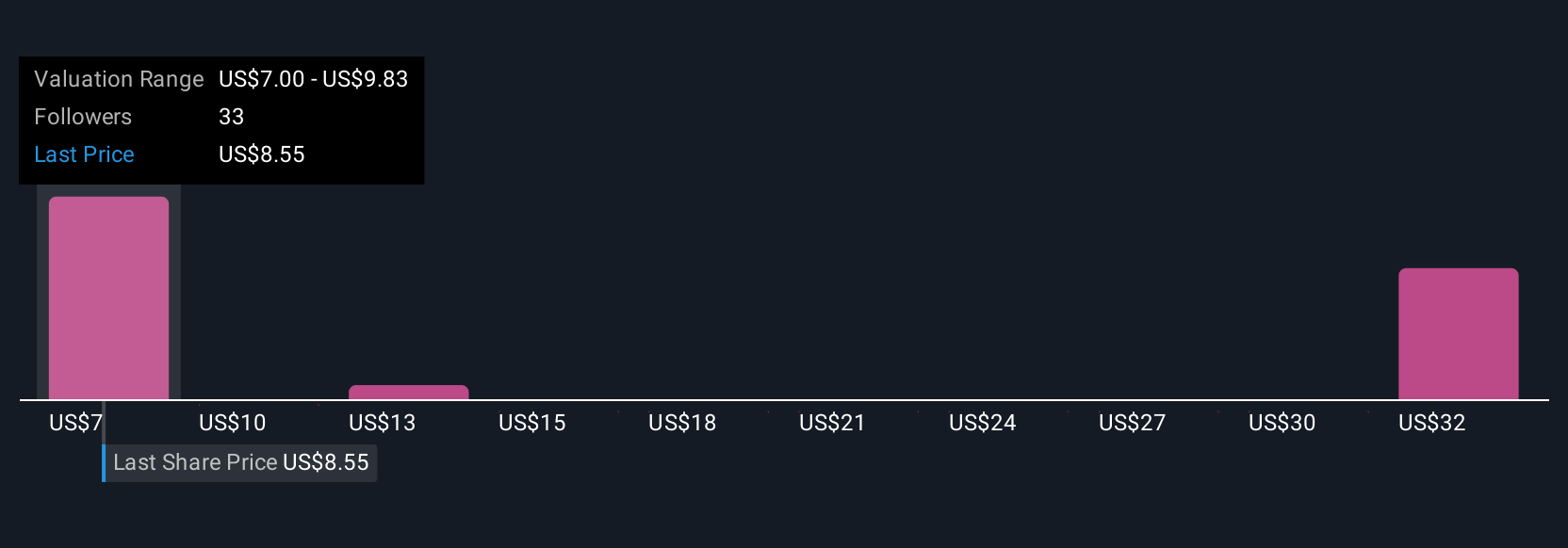

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a short, easy-to-edit story that sums up what you believe about Western Union’s business and future, such as your expectations for its revenue growth, profit margins, and fair value. This gives real context behind the numbers. Unlike traditional valuation tools that focus only on math, Narratives link the company’s evolving business story to a financial forecast and then directly to a fair value, so you can see how assumptions stack up against the current share price.

Narratives are available for free on Simply Wall St’s Community page, where millions of other investors use them to quickly compare stories and test scenarios. They help you decide if you want to buy, sell, or hold by showing if the fair value from your Narrative lines up with today's market price. Since Narratives update automatically when new information, like financial results or news, comes out, they stay relevant and actionable.

For example, some investors see digital transformation and cost savings ahead, assigning a fair value of $17.00 per share. Others worry about growing regulatory risk and pricing pressure, and use a $7.00 figure. Narratives empower you to make decisions based on your own informed perspective.

Do you think there's more to the story for Western Union? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Union might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WU

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives