- United States

- /

- Diversified Financial

- /

- NYSE:WU

Is Western Union’s Digital Expansion Creating Opportunity After This Week’s 2.6% Price Gain?

Reviewed by Bailey Pemberton

- Wondering if Western Union is undervalued or if there is hidden upside in the stock? You are not alone; investors are watching this company for clues about future opportunity.

- The share price has moved up 2.6% this week, but despite some short-term gains, it remains down 17.0% year-to-date and 44.8% over five years.

- Recent headlines have highlighted Western Union’s push into digital money transfers and partnerships expanding its global reach. These developments have fueled speculation about how successfully the company can pivot in a fiercely competitive fintech landscape and whether the market is accurately pricing in the potential rewards or risks.

- On our 6-point valuation checklist, Western Union scores 5 out of 6 for being undervalued, which is an impressive result. Next, we break down how different valuation approaches line up with the current price, but stick around to find out a smarter, more nuanced way to look at value that most overlook.

Find out why Western Union's -13.0% return over the last year is lagging behind its peers.

Approach 1: Western Union Excess Returns Analysis

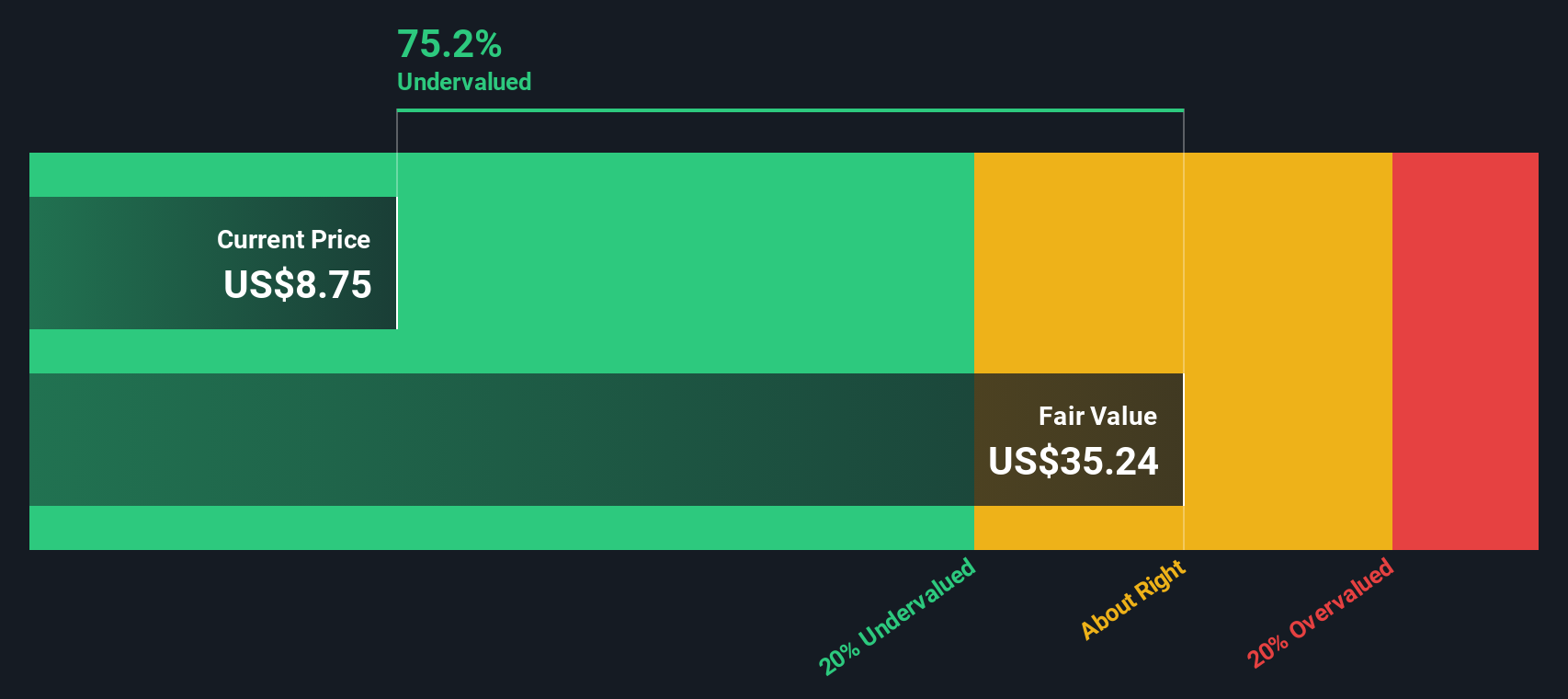

The Excess Returns valuation model evaluates whether a company is adding value on top of its cost of equity capital by analyzing returns on invested capital. For Western Union, the key metrics highlight strong fundamentals: the Book Value stands at $2.91 per share, and Stable Earnings Per Share (EPS) are $1.69, based on a weighted average of future Return on Equity estimates from six analysts.

Western Union’s Cost of Equity is $0.25 per share, meaning the company’s excess return, or value created above its cost of equity, is a robust $1.43 per share. The company’s average Return on Equity is a striking 50.05%, indicating substantial efficiency in generating profit from its shareholder equity. Additionally, the Stable Book Value is projected at $3.37 per share, using aggregated estimates from five analysts.

Using these inputs, the Excess Returns model arrives at an intrinsic value that implies the stock is trading at a 76.5% discount to its fair value. This suggests that, based on return on capital and growth assumptions, Western Union shares are deeply undervalued in the market right now.

Result: UNDERVALUED

Our Excess Returns analysis suggests Western Union is undervalued by 76.5%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Western Union Price vs Earnings

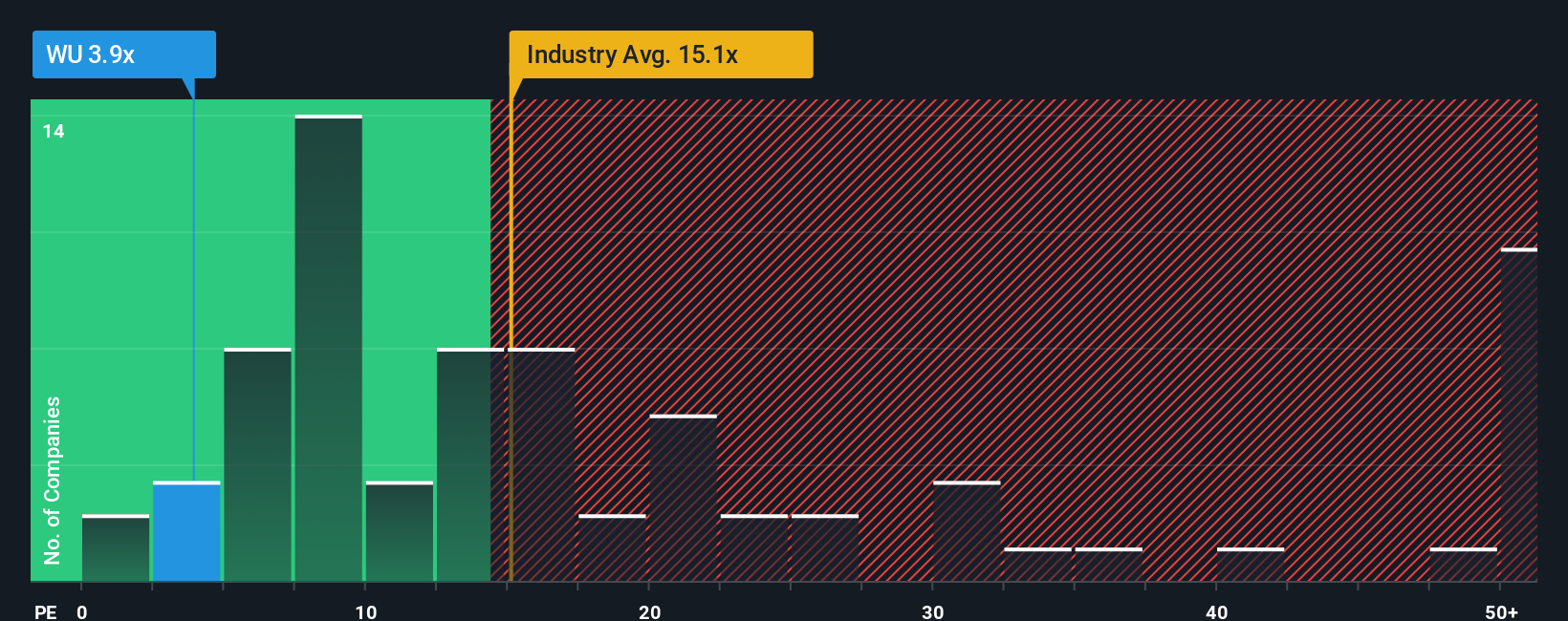

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies like Western Union. Because it relates a company’s share price to its earnings, the PE ratio helps investors quickly assess how much they are paying relative to each dollar of profit. This makes it especially useful when evaluating stable, mature businesses where earnings are fairly predictable.

Growth expectations and a company's risk profile both play a major role in determining what is considered a “normal” PE ratio. Companies with higher expected earnings growth or lower risk typically deserve higher PE multiples, while riskier or slower-growing companies trade on lower multiples.

Currently, Western Union trades at a PE ratio of 3.6x. This stands in stark contrast to the diversified financial industry average of 13.6x, and is much lower than the peer average of 12.7x. At first glance, this steep discount suggests the market may be underestimating the company’s profitability or growth potential.

To provide deeper context, Simply Wall St’s Fair Ratio estimates what a reasonable PE multiple would be by factoring in Western Union’s unique characteristics, such as its potential for earnings growth, profit margins, market cap, and industry risks. This proprietary approach goes beyond simple peer or industry comparisons and offers a more tailored evaluation based on the company’s fundamentals rather than broad averages.

Western Union’s Fair Ratio is calculated at 10.2x. Comparing this figure to the current PE of 3.6x, the stock appears notably undervalued, as it is trading at a significant discount to what would be considered fair under current conditions.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Western Union Narrative

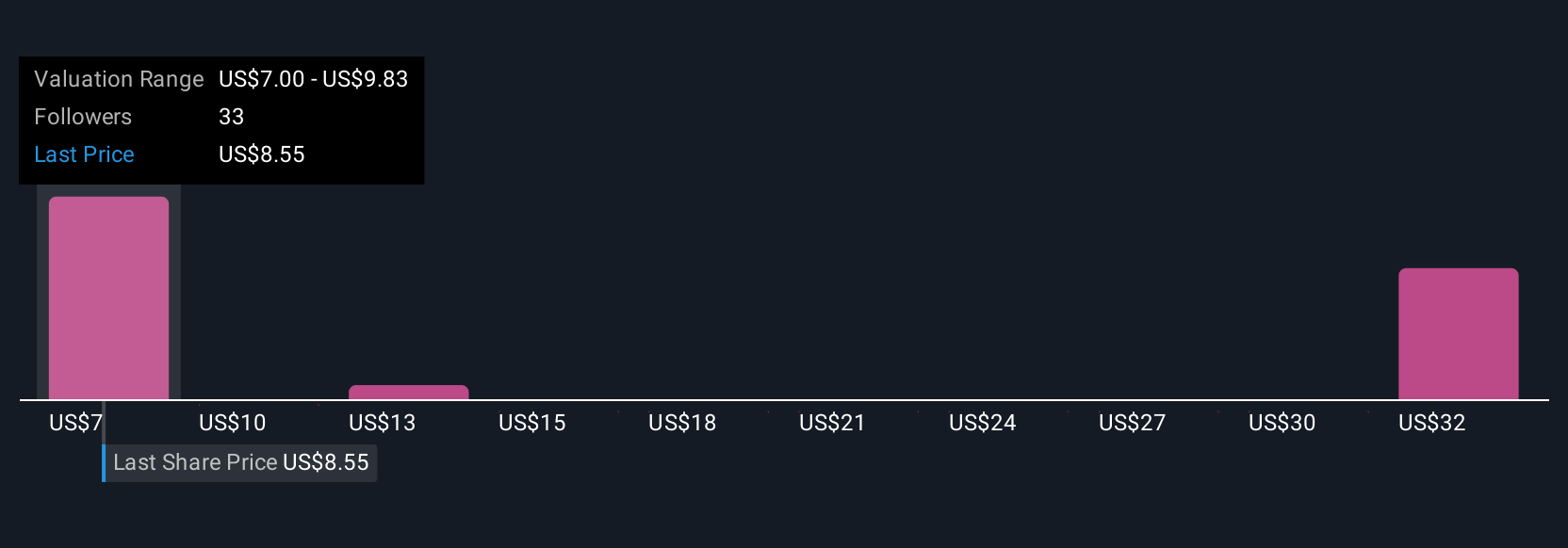

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple yet powerful investment tool that lets you describe your story or perspective on a company, combining your view of future revenue, earnings, and margins with the numbers and a fair value estimate that flows directly from those assumptions.

Think of a Narrative as a bridge connecting the company’s real-world story, such as Western Union’s push into digital assets, shifting remittance trends, or evolving regulations, directly to your financial forecast and a practical fair value. Narratives are available on Simply Wall St’s Community page and used by millions of investors, making it easy to share ideas and see how others are interpreting the same data.

Because every Narrative ties current news and updates to your investment outlook, you can quickly see how changes, such as new product launches or regulatory shifts, impact Western Union’s fair value. This helps you decide when the stock looks attractive or if it may be time to reconsider your position. Narratives are automatically updated whenever new information arrives, ensuring your outlook is always fresh and actionable.

For example, one investor’s Narrative projects Western Union’s fair value at $17.00, seeing potential from digital expansion, while another sets it at $7.00 due to concerns about regulation and competition.

Do you think there's more to the story for Western Union? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Union might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WU

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success