- United States

- /

- Capital Markets

- /

- NYSE:WT

WisdomTree (WT) Is Up 6.2% After Launching Europe Defense Fund on NYSE - What's Changed

Reviewed by Simply Wall St

- Earlier this month, WisdomTree announced the launch of the WisdomTree Europe Defense Fund (WDEF) on the New York Stock Exchange, offering investors passive exposure to key European defense companies involved in advanced weapon systems, aerospace, cybersecurity, and engineering, with an expense ratio of 0.45%.

- This product introduction follows a series of international defense ETF launches and underscores WisdomTree's commitment to aligning its offerings with prevailing geopolitical and macroeconomic themes affecting Europe’s defense sector.

- We’ll examine how the introduction of a Europe-focused defense ETF amplifies WisdomTree’s thematic innovation and diversification opportunities.

WisdomTree Investment Narrative Recap

To be a shareholder in WisdomTree, you need to believe in the firm’s ability to capitalize on fast-moving themes such as defense and digitization in wealth management. The launch of the WisdomTree Europe Defense Fund is thematically relevant, yet not a material near-term catalyst for overall revenue growth, as the biggest risk remains potential regulatory delays and volatility impacting product asset inflows.

Among recent announcements, the July debut of the WisdomTree GeoAlpha Opportunities Fund stands out as closely related, as it also targets shifting global policy themes. These new funds both speak to WisdomTree’s ongoing effort to diversify offerings tied to geopolitical and macroeconomic shifts.

By contrast, investors should be aware that Europe-focused products can face sudden volatility and risks linked to...

Read the full narrative on WisdomTree (it's free!)

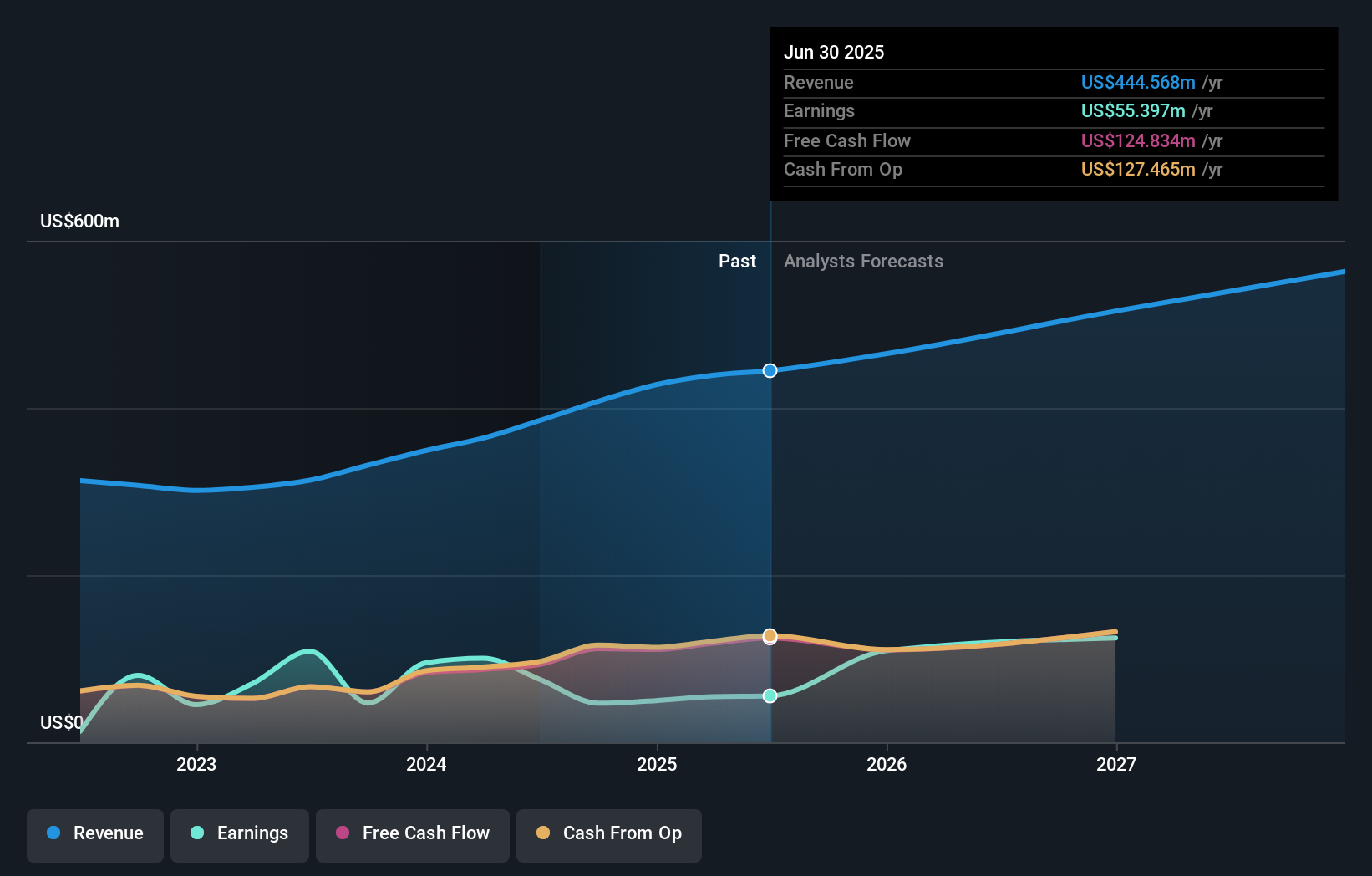

WisdomTree's narrative projects $482.6 million revenue and $140.2 million earnings by 2028. This requires 4.1% yearly revenue growth and a $90.3 million earnings increase from $49.9 million today.

Uncover how WisdomTree's forecasts yield a $11.52 fair value, a 14% downside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members valued WisdomTree shares between US$6.53 and US$11.52 before this event. With regulatory delays and market volatility risks still looming, you can see just how differently investors can assess future prospects.

Explore 2 other fair value estimates on WisdomTree - why the stock might be worth as much as $11.52!

Build Your Own WisdomTree Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WisdomTree research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free WisdomTree research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WisdomTree's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WisdomTree might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WT

WisdomTree

Through its subsidiaries, operates as an exchange-traded funds (ETFs) sponsor and asset manager.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives