- United States

- /

- Capital Markets

- /

- NYSE:WT

WisdomTree (WT): Assessing Valuation After Recent 15% Pullback in Share Price

Reviewed by Simply Wall St

WisdomTree (WT) has recently seen its stock price slip over the past month, dropping around 15%. With shares trading at $11.23, some investors may be wondering whether this presents a discounted entry point or signals deeper concerns.

See our latest analysis for WisdomTree.

While WisdomTree’s share price has dipped nearly 15% over the past month, it’s worth remembering the bigger picture. Momentum has faded recently, but the stock still shows a 3-year total shareholder return of 131% and a 5-year return of 188%. That kind of longer-term growth means the latest dip could be seen as a typical pause rather than a red flag, especially after such a strong run.

If the recent pullback in WisdomTree has you wondering what else is gaining steam, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

After a notable pullback and impressive multi-year gains, the question now is whether WisdomTree is trading below its true value or if the current price already reflects all the company’s future potential, leaving limited upside for investors.

Most Popular Narrative: 25% Undervalued

With the most recent closing price at $11.23 and the narrative's fair value at $15.04, a sizable gap has emerged. This points to a major divergence between current sentiment and projected upside.

The acquisition of Ceres Partners positions WisdomTree to capitalize on growing investor demand for private market and alternative asset exposures, particularly in underpenetrated, income-generating sectors like U.S. farmland. This supports future AUM and fee revenue growth.

Why do analysts think WisdomTree is worth so much more than its current price? The answer lies in bold margin expansion calls and market-defying revenue forecasts, locked inside this narrative. Find out which daring projections fuel the potential for a re-rating. Could this be a rare opportunity hiding in plain sight?

Result: Fair Value of $15.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, headwinds such as fee compression and intensified competition could slow WisdomTree’s growth and challenge the bullish case if these risks materialize.

Find out about the key risks to this WisdomTree narrative.

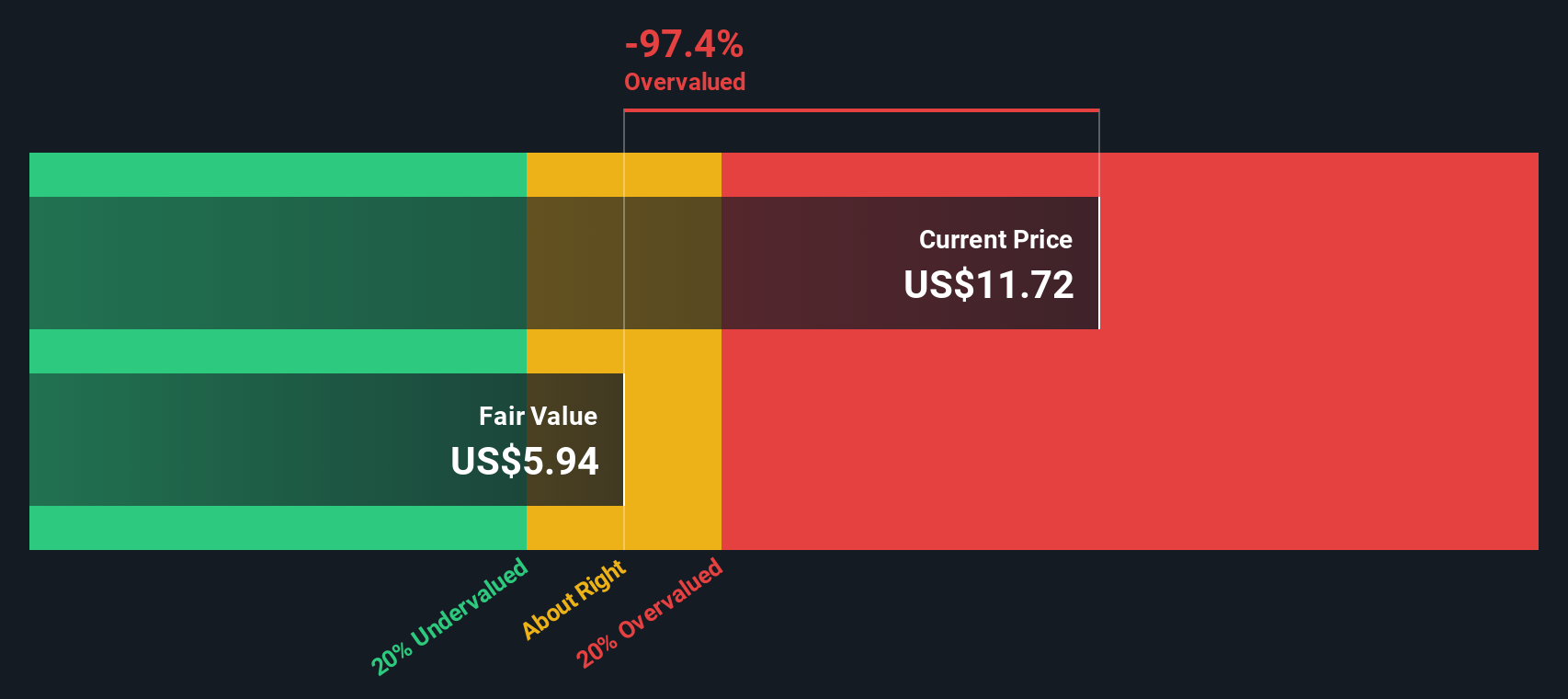

Another View: What Does the SWS DCF Model Say?

Looking at WisdomTree through the SWS DCF model lens presents a different perspective. This approach currently suggests the shares might be trading above fair value, implying less room for upside than the multiple-based valuations suggest. Could the market be too optimistic about future cash flows, or is there hidden value others are missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out WisdomTree for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own WisdomTree Narrative

If you have a different perspective or like to approach the data hands-on, you can build your own view in just a few minutes. Do it your way

A great starting point for your WisdomTree research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let great opportunities pass you by. Tap into unique investing angles and broaden your portfolio with these proven strategies from the Simply Wall Street Screener.

- Multiply your potential by targeting companies paying reliable yields. Check out these 16 dividend stocks with yields > 3% to uncover stocks generating over 3% in returns.

- Capture the future of medicine as artificial intelligence transforms healthcare by evaluating these 31 healthcare AI stocks for tomorrow’s industry leaders.

- Find untapped opportunities in stocks trading below intrinsic value with these 878 undervalued stocks based on cash flows and position yourself ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WisdomTree might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WT

WisdomTree

Through its subsidiaries, operates as an exchange-traded funds (ETFs) sponsor and asset manager.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives