- United States

- /

- Capital Markets

- /

- NYSE:WHG

Westwood Holdings Group (WHG) Margin Surge Reinforces Bullish Value Narrative

Reviewed by Simply Wall St

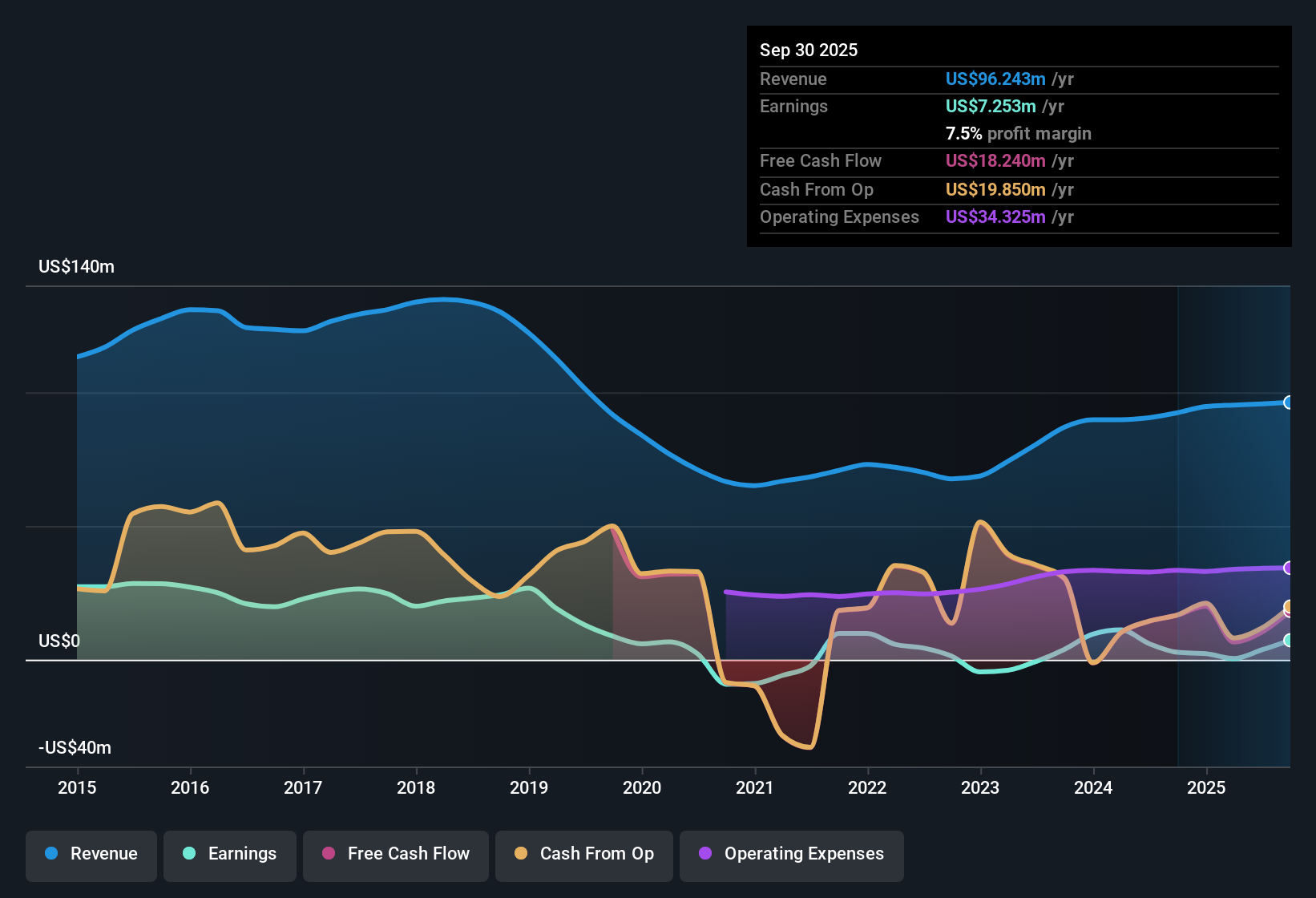

Westwood Holdings Group (WHG) delivered a sharp turnaround in profitability, reporting net profit margins of 7.5%, up from 3% a year prior, and earnings growth of 165.3% that far outpaces their five-year average growth of 33.3% per year. With the stock trading at a Price-to-Earnings Ratio of 19.3x, notably below both the peer average of 43.6x and the US Capital Markets industry average of 25.6x, investors are seeing a combination of improved profit margins, accelerated growth, and relative value. Market participants are likely interpreting these results as a strong shift for the company after several years of transitioning to sustainable profitability, with no major risk flags on the horizon.

See our full analysis for Westwood Holdings Group.Next up, we will put these headline figures side by side with the current narratives around Westwood Holdings Group to see which takes hold and which might shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Jump as Cost Discipline Shows

- Net profit margin climbed to 7.5% from 3% last year, reflecting a clear upswing in profitability thanks to tighter cost management.

- What’s striking in the prevailing market view is that this improvement in margin heavily supports arguments in favor of sustained earnings quality.

- The company has maintained high quality earnings even as margins advanced, which strengthens its credibility for long-term investors.

- Reduced costs contributed directly to this margin increase, reinforcing the narrative that WHG is able to convert growth into actual shareholder benefit rather than burning through cash to grow revenue.

Profit Growth Surpasses Long-Term Trends

- Year-on-year profit growth of 165.3% dramatically overshoots WHG’s five-year annual average of 33.3%, emphasizing just how outsized this year’s leap has been relative to recent history.

- There is tension in the prevailing market view, as some observers might ask if such rapid profit acceleration can be sustained.

- The sustained pace over several years suggests the company has established the foundation for more consistent profitability, lessening the concern that these results are a one-off.

- Still, with profit growth this sharp, it is natural for long-term investors to ask if further upside is realistic or if normalization should be expected in the coming quarters.

Valuation Discount Draws Attention

- At a Price-to-Earnings Ratio of 19.3x, shares are valued well below both the peer group average of 43.6x and the wider US Capital Markets industry average of 25.6x, highlighting a discount that is rarely seen following periods of strong profit delivery.

- According to the prevailing market view, investors are debating whether this discount fairly reflects residual caution about WHG’s longevity.

- The absence of major flagged risks, such as insider selling or dividend sustainability issues, lends support to the argument that the stock’s current valuation may be overly conservative.

- However, with a share price of $16.75, it raises the question of whether the market is waiting for further proof that recent gains can be repeated before closing that valuation gap.

See what the community is saying about Westwood Holdings Group

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Westwood Holdings Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive profit growth, there are still concerns that such rapid acceleration may not be sustainable or could normalize in future quarters.

For investors seeking more consistent financial results, check out stable growth stocks screener (2103 results) to find companies with stable earnings and steady long-term growth that could better anchor your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westwood Holdings Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WHG

Westwood Holdings Group

Through its subsidiaries, manages investment assets and provides services for its clients.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives