- United States

- /

- Diversified Financial

- /

- NYSE:WEX

Assessing the Value of WEX After Regulatory Scrutiny and New Partnerships

Reviewed by Bailey Pemberton

If you’re wondering whether WEX is a buy, sell, or hold right now, you’re not alone. Investors have watched the stock rebound 5.2% over the past week but are likely still feeling the sting of its 8.1% drop so far this year. There is no ignoring that over the past year, WEX has shed 10.0% of its value. Its five-year return of 25.7% points to longer-term resilience. Clearly, the market is trying to figure out what WEX is worth and whether recent headwinds are temporary or more lasting.

Some of these headwinds are tied to recent regulatory comments targeting the payment solutions industry, which sparked tough questions about compliance and growth across companies like WEX. At the same time, new partnerships announced in the past month suggest a strategic pivot that could influence future growth and profitability, even if investors are still assessing the real impact.

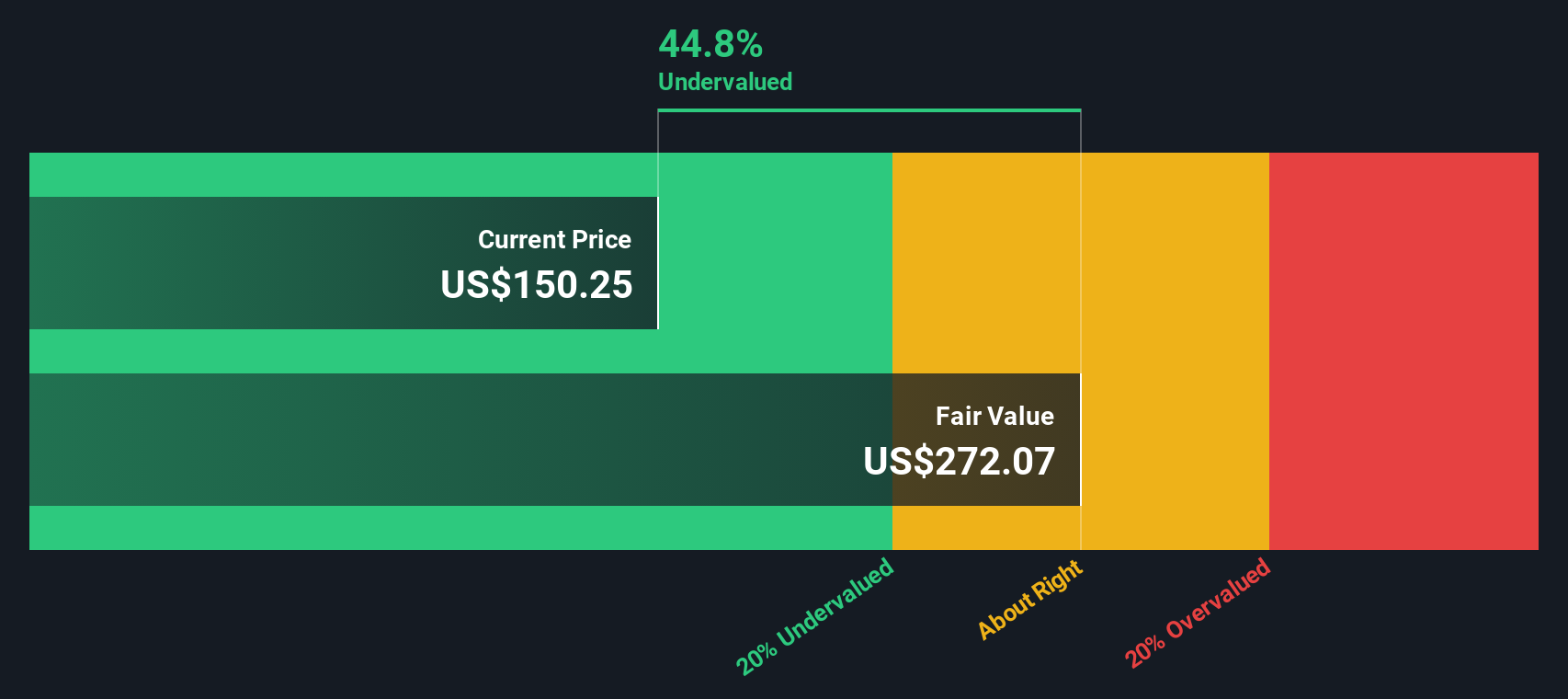

With all this in mind, a look at WEX’s valuation is more important than ever. Based on the latest checks, WEX scores a 3, meaning it appears undervalued in three out of six core metrics. What does that mean for investors deciding if the current price around $160.92 is attractive?

Let’s dig into the key valuation methods and what they say about WEX right now, but keep in mind that the most effective way to judge valuation might surprise you.

Why WEX is lagging behind its peers

Approach 1: WEX Excess Returns Analysis

The Excess Returns model evaluates how efficiently a company generates profits from its invested capital relative to the cost of that capital. For WEX, this method helps investors understand not just how much the company is earning, but also whether those profits are above what shareholders could earn elsewhere with similar risk.

According to analyst data, WEX has a Book Value of $28.53 per share and a projected stable Earnings Per Share (EPS) of $19.34, based on weighted future Return on Equity (ROE) estimates from five analysts. With an average ROE of a striking 43.02%, the company significantly outpaces the cost of equity, which stands at $4.29 per share. This creates a substantial Excess Return of $15.05 per share. Looking forward, the model estimates a Stable Book Value at $44.96 per share, increasing the company’s intrinsic value powerfully over time and further validated by future book value outlooks from four analysts.

Pulled together, the Excess Returns model calculates WEX’s intrinsic value at $277.81 per share. Compared to the current share price of $160.92, this suggests WEX is trading at a steep 42.1% discount to its fair value, positioning the stock as clearly undervalued according to this method.

Result: UNDERVALUED

Our Excess Returns analysis suggests WEX is undervalued by 42.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: WEX Price vs Earnings

The Price-to-Earnings (PE) ratio is a time-tested way to value profitable companies like WEX because it ties a company’s share price directly to its ability to generate earnings. For healthy, growing businesses, the PE ratio quickly shows how much investors are willing to pay today for each dollar of current profits. This makes it especially relevant for companies that consistently deliver positive earnings.

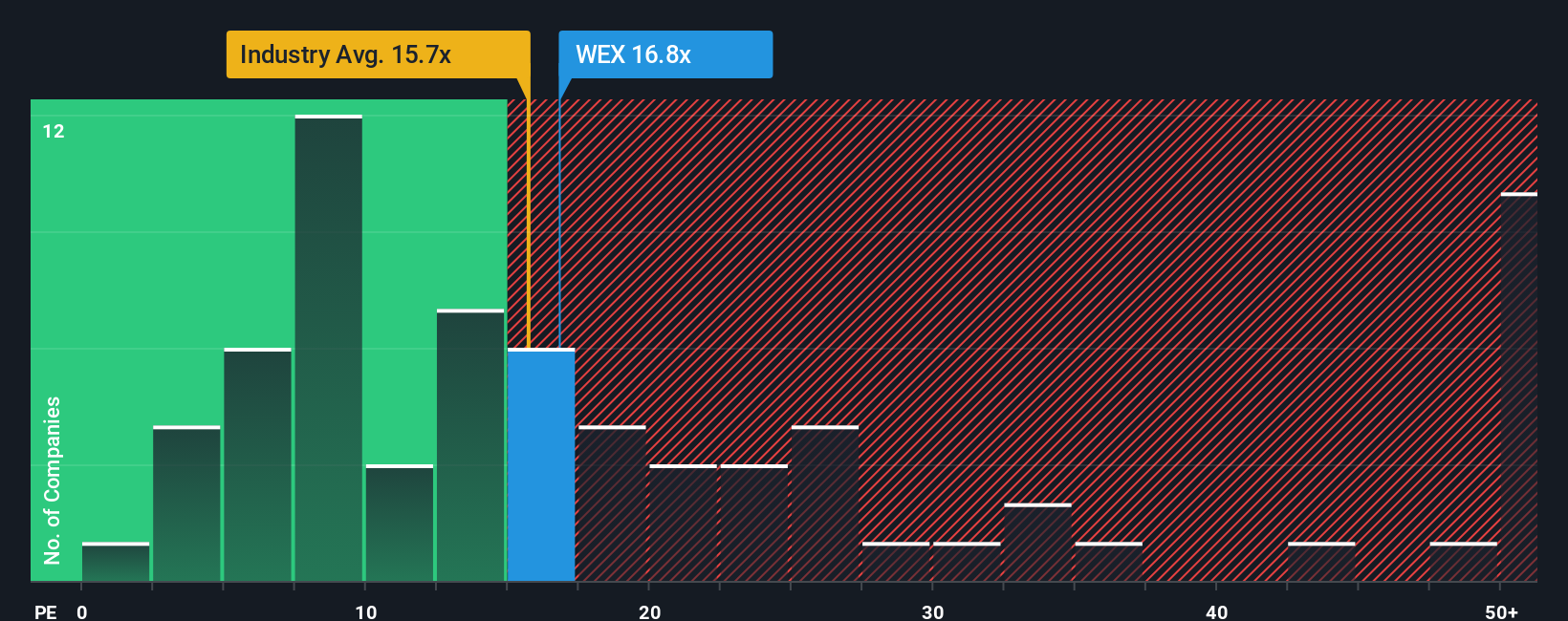

It is important to recognize that a “normal” or “fair” PE ratio isn’t one-size-fits-all. Higher growth expectations or lower risk usually warrant a higher PE, while slower-growing or riskier companies trade at lower multiples. Context is key. WEX currently trades at a PE ratio of 18x. When benchmarked, this is below both its Diversified Financial industry average of 16.6x and the peer average of 23x, suggesting it trades at a discount to many similar companies.

Simply Wall St’s proprietary “Fair Ratio” pegs WEX’s fair PE at 16.7x. Unlike raw peer or industry comparisons, the Fair Ratio accounts for a broader set of factors such as earnings growth, profit margins, risk profile, industry norms, and market capitalization. By weighing these elements together, the Fair Ratio delivers a more nuanced and tailored benchmark for what makes sense for WEX right now.

With WEX’s actual PE just 1.3x above its Fair Ratio, the stock is only slightly above fair value. This places it squarely in line with expectations based on its fundamentals and risk-reward outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your WEX Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative puts the story you believe about a company, such as your expectations for WEX’s revenue, earnings, and margins, at the center of your investment decision by connecting each assumption directly to a specific, data-driven fair value.

This approach lets you see your own reasoning and assumptions in action. Narratives link WEX's business story, such as growth drivers from new partnerships or risks from industry disruption, to a forward-looking forecast and then a calculated fair value. This makes the connection between numbers and what is actually happening on the ground crystal clear.

Available to everyone on Simply Wall St’s Community page, Narratives make it simple for investors to compare their viewpoint to others and see how current news, earnings releases, or industry changes may alter the story and WEX's fair value in real time. By comparing your Narrative's fair value to the current share price, you can easily see how WEX's value may compare, and decisions update dynamically as new information flows in.

For example, in the WEX Community, one Narrative values WEX at $184.56 based on expectations for steady growth and margin expansion, while another more cautious perspective sees lower fair value due to concerns around competitive pressure and industry risks. This illustrates how your unique perspective drives your investment approach.

Do you think there's more to the story for WEX? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WEX

WEX

Operates a commerce platform in the United States and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives