- United States

- /

- Diversified Financial

- /

- NYSE:WD

Walker & Dunlop (WD): Valuation Check After Showcasing Its Integrated Role in a Major Multifamily Property Deal

Reviewed by Simply Wall St

Walker & Dunlop (WD) just showcased its integrated model by arranging both the $53.6 million sale and a $37.1 million Fannie Mae loan for the 929 MASS mixed use property in Cambridge, drawing fresh investor attention.

See our latest analysis for Walker & Dunlop.

Deals like 929 MASS help explain why sentiment is mixed, with a 1 day share price return of 2.06 percent suggesting a tentative rebound against a sharply negative year to date share price return and weak longer term total shareholder returns.

If this kind of deal flow has you curious about what else might be setting up for a turn, it could be worth exploring fast growing stocks with high insider ownership.

With shares down sharply this year yet trading at a steep discount to analyst targets despite solid revenue and profit growth, investors face a key question: Is Walker & Dunlop undervalued, or is the market already pricing in a recovery?

Most Popular Narrative Narrative: 30.5% Undervalued

With Walker & Dunlop last closing at 61.54 dollars versus a narrative fair value of 88.50 dollars, the valuation story leans firmly toward upside potential.

The structural shortage and unaffordability of single family housing, along with record apartment absorption and high multifamily occupancy (96%), are expected to drive up rents and property values, leading to increased demand for multifamily financing, higher origination fees, and a larger servicing portfolio that all support both revenue and earnings expansion.

Curious how this demand wave turns into a higher valuation? The narrative leans on ambitious growth, rising margins, and a future earnings multiple that implies serious confidence.

Result: Fair Value of $88.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case hinges on rate volatility easing and multifamily demand staying resilient, as regulatory shifts or weaker volumes could quickly cap margin expansion.

Find out about the key risks to this Walker & Dunlop narrative.

Another View: Market Multiple Sends A Different Signal

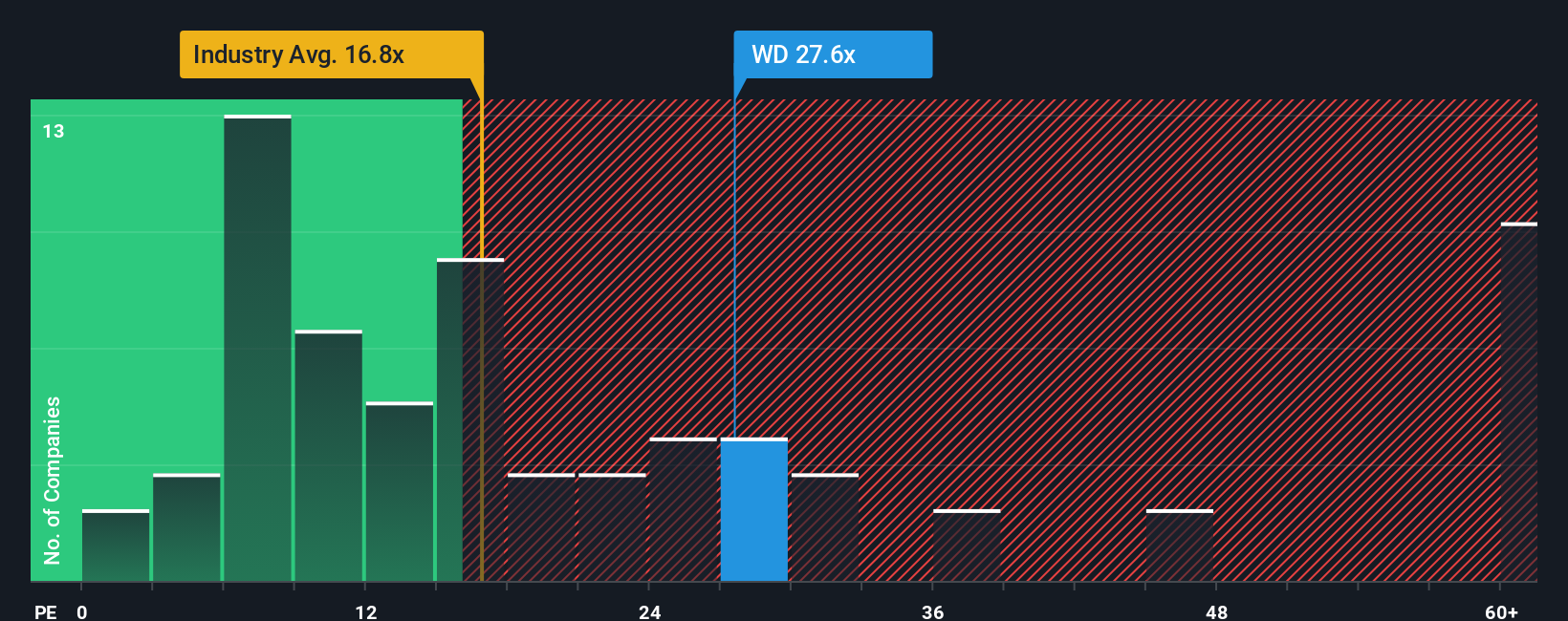

While the narrative fair value suggests upside, the actual price to earnings ratio of 18.7 times tells a tougher story. It sits above the 16.8 times fair ratio, well above the 13.8 times industry average, and far above peers at 8.8 times, raising the question of whether expectations are already too rich.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Walker & Dunlop Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Walker & Dunlop research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with one stock. Use the Simply Wall St Screener to chase fresh ideas, compare opportunities quickly, and stay ahead of slower investors.

- Capture potential bargains early by scanning these 901 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Seek out income opportunities by reviewing these 10 dividend stocks with yields > 3% that could strengthen your portfolio with reliable, above-average yields.

- Explore the next tech shift by evaluating these 24 AI penny stocks that harness artificial intelligence for scalable, long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Walker & Dunlop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WD

Walker & Dunlop

Through its subsidiaries, originates, sells, and services a range of multifamily and other commercial real estate financing products and services for owners and developers of real estate in the United States.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion