- United States

- /

- Diversified Financial

- /

- NYSE:WD

Walker & Dunlop (WD): Exploring Valuation Following Major Multifamily Loans and European Leadership Expansion

Reviewed by Kshitija Bhandaru

Walker & Dunlop (WD) has been busy on both sides of the Atlantic, arranging large refinancings for major U.S. multifamily projects and expanding its European presence with new leadership in London.

See our latest analysis for Walker & Dunlop.

Walker & Dunlop’s recent run of headline deals and its London expansion come on the back of an 11.6% 90-day share price return. However, the bigger picture reveals some caution, with the latest share price at $82.97 and a one-year total shareholder return of -24.9%. Short-term momentum has picked up, but the stock is still recovering from a tougher stretch over the past year.

If Walker & Dunlop’s moves have you wondering where growth and leadership converge, it could be the ideal moment to broaden your watchlist and discover fast growing stocks with high insider ownership

With shares hovering below analyst targets after a challenging year, the real question is whether Walker & Dunlop’s current valuation leaves room for upside, or if the market has already factored in its growth ambitions.

Most Popular Narrative: 10.3% Undervalued

With analysts setting a fair value of $92.50 for Walker & Dunlop, the most widely followed narrative sees the stock as trading notably below that estimate, given its last close of $82.97. The focus here is on whether anticipated sector tailwinds and strategic moves will power further gains, or if the current valuation already reflects most of the good news.

Investments in technology platforms (small balance lending, appraisal, Galaxy, Client Navigator) are resulting in higher client acquisition (17% of YTD volume from new clients), increased operational efficiency, and improved margins, suggesting longer-term enhancement of net margins and top-line growth.

Curious how aggressive digital moves and shifting client dynamics drive this bullish outlook? The real secret behind the valuation lies in ambitious forecasts for margins and topline growth. Want to see what financial leap the narrative is truly forecasting? Unlock the details and the full set of assumptions fueling the upside with a deeper dive.

Result: Fair Value of $92.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued high interest rates and overreliance on Fannie Mae and Freddie Mac could put pressure on revenue growth and threaten this optimistic outlook.

Find out about the key risks to this Walker & Dunlop narrative.

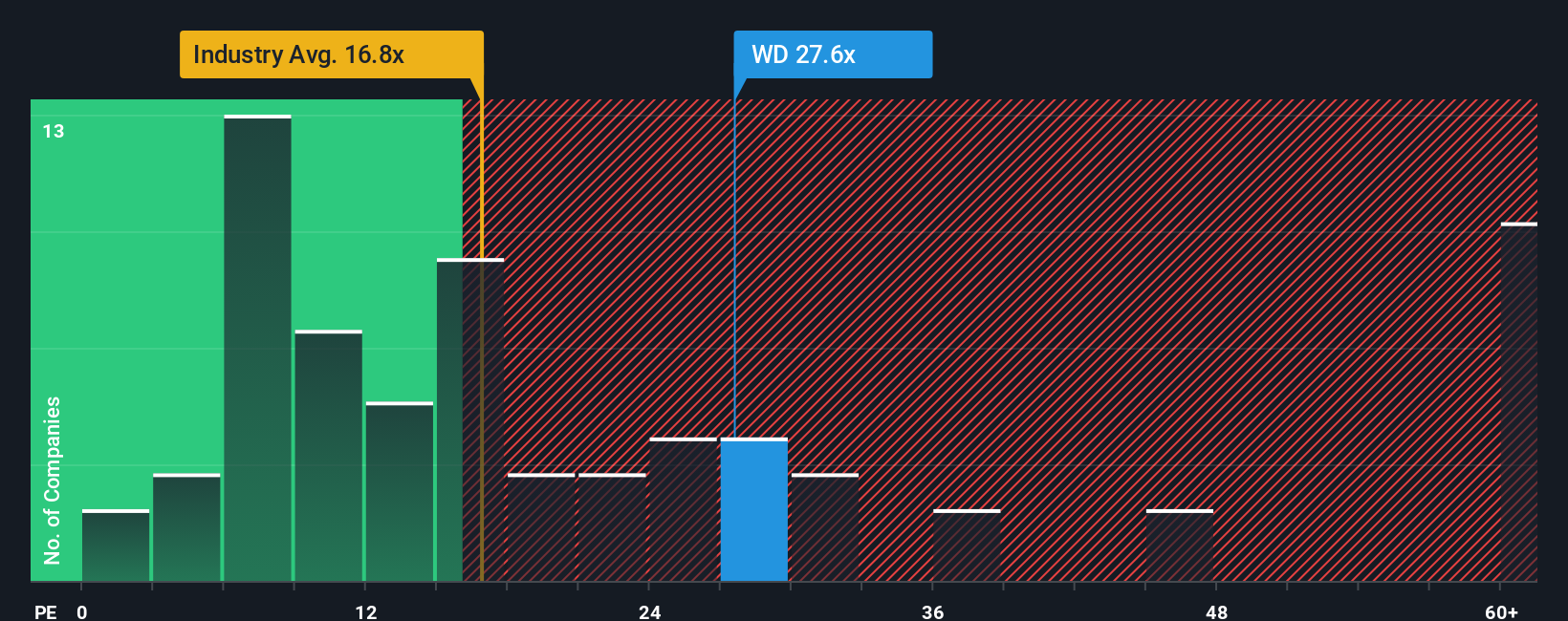

Another View: Market Multiples Comparison

Looking through the lens of the earnings multiple, Walker & Dunlop trades at 26.2 times earnings, which is noticeably higher than both the US Diversified Financial industry average of 15.6 times and its peer group’s 18.2 times. The fair ratio, estimated at 17.8 times earnings, is also well below the company's current level. This valuation gap signals that, based on this metric, the shares appear expensive and raises the question: does current optimism leave enough margin for safety?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Walker & Dunlop Narrative

If you see the story evolving differently or want to dig into the data yourself, you can quickly build your own narrative in just minutes. Do it your way

A great starting point for your Walker & Dunlop research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sharpen your investing edge and stay ahead of the market by searching beyond just one stock. Uncover new opportunities where innovation and value meet potential.

- Tap into tomorrow’s breakthroughs by checking out these 24 AI penny stocks set to benefit from the rapid acceleration of artificial intelligence across major sectors.

- Grow your passive income stream. See which companies made the list among these 18 dividend stocks with yields > 3% with standout yields and winning track records.

- Step into the future of computing with these 26 quantum computing stocks at the forefront of revolutionary technology that’s transforming industries from finance to healthcare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walker & Dunlop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WD

Walker & Dunlop

Through its subsidiaries, originates, sells, and services a range of multifamily and other commercial real estate financing products and services for owners and developers of real estate in the United States.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives