- United States

- /

- Diversified Financial

- /

- NYSE:WD

Walker & Dunlop (WD): Assessing Valuation After Recent Momentum and Net Income Growth

Reviewed by Simply Wall St

Walker & Dunlop (WD) shares have seen some movement lately, gaining a bit of ground over the past week and month. Investors may be weighing the company’s longer-term performance, especially after recent double-digit annual net income growth.

See our latest analysis for Walker & Dunlop.

Despite some ups and downs this year, Walker & Dunlop shares have climbed noticeably in recent weeks, which suggests that investor sentiment could be shifting. While the year-to-date share price return remains in the red, momentum has picked up over the past quarter, and its five-year total shareholder return of 46% shows that longer-term growth potential has certainly been present.

If rising momentum has you scanning for other compelling stories, now’s a great chance to discover fast growing stocks with high insider ownership

With shares bouncing back and solid net income growth on display, the big question now is whether Walker & Dunlop stock is undervalued or if the market has already factored in future gains. Is there still a buying opportunity?

Most Popular Narrative: 6.5% Undervalued

Walker & Dunlop's latest fair value estimate stands above the last close, suggesting there may be more room to grow if the narrative proves out. With the current market price trailing the consensus fair value, investors are watching closely for the catalysts that could unlock further upside.

The structural shortage and unaffordability of single-family housing, along with record apartment absorption and high multifamily occupancy (96%), are expected to drive up rents and property values. This could lead to increased demand for multifamily financing, higher origination fees, and a larger servicing portfolio. Together, these factors may support both revenue and earnings expansion.

What if one shift in housing demand transformed everything? The full narrative unpacks the numbers behind this bullish case, hinting at growth rates and profit margins rarely seen outside booming sectors. Eager to discover the underlying assumptions that power such a confident price target? Delve inside to see what sets this valuation apart.

Result: Fair Value of $92.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates or unfavorable regulatory shifts could quickly dampen loan demand and challenge this optimistic outlook for Walker & Dunlop.

Find out about the key risks to this Walker & Dunlop narrative.

Another View: Market Multiples Send a Different Signal

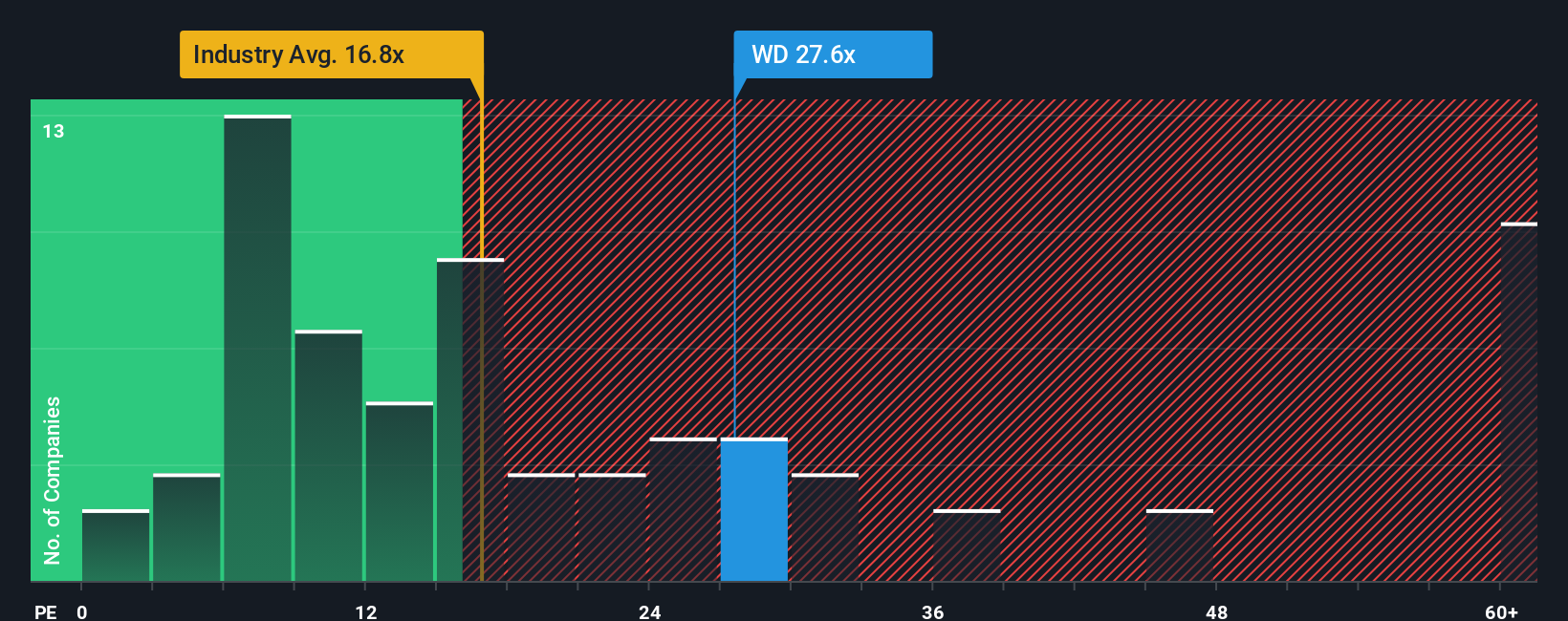

While analysts say Walker & Dunlop is undervalued, a look at its commonly used price-to-earnings ratio tells a different story. The company's ratio is 27.3x, much higher than both the US diversified financials industry average of 16.2x and the peer average of 18.2x. The market’s fair ratio could be even lower, at 17.9x. This premium suggests investors expect much stronger performance ahead, or are they taking on more risk than necessary?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Walker & Dunlop Narrative

Of course, if you’re keen to challenge this view or run your own numbers, you can build a custom narrative yourself in just a few minutes using the tool here: Do it your way

A great starting point for your Walker & Dunlop research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't wait on the sidelines while others uncover tomorrow's next winners. Use these powerful tools to broaden your portfolio and gain an edge right now:

- Spot rising income trends by checking out these 17 dividend stocks with yields > 3%, which offers reliable yields and strong financial health for steady returns.

- Uncover innovative companies making breakthroughs in robotics and automation with these 27 AI penny stocks, reshaping how industries operate worldwide.

- Seize growth at an attractive price through these 875 undervalued stocks based on cash flows, where cash flow fundamentals point to stocks trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walker & Dunlop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WD

Walker & Dunlop

Through its subsidiaries, originates, sells, and services a range of multifamily and other commercial real estate financing products and services for owners and developers of real estate in the United States.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives