- United States

- /

- Capital Markets

- /

- NYSE:VIRT

Do Industry Awards Signal a New Era for Virtu Financial’s (VIRT) Technology Leadership?

Reviewed by Sasha Jovanovic

- Earlier this month, Virtu Financial was honored in seven categories at the 2025 TRADE Awards ceremonies in London and New York, receiving major recognitions such as TCA Provider of the Year, Best Dark Pool Capabilities, and Best Customer Support & Consulting.

- This series of international awards highlights Virtu's execution technology leadership and the success of its Triton multi-asset platform across both UK & Europe and North America.

- We'll examine how Virtu’s industry-leading technology reputation, underscored by its Triton recognition, may shape its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Virtu Financial Investment Narrative Recap

To be a Virtu Financial shareholder, you need to believe in the enduring value of best-in-class trading technology and resilient client relationships in a sector where speed, execution quality, and adaptability drive results. While Virtu's haul of TRADE Awards underscores the firm's reputation for technological leadership, these recognitions are unlikely to materially alter the most important short-term catalyst, client trading activity, or offset the biggest risk from intensifying competition and changing industry structure.

Among recent announcements, Virtu's third-quarter results stand out: revenue rose to US$824.79 million and net income climbed to US$77.63 million year over year. Solid profitability is a positive signal, but it is Virtu’s ongoing platform enhancements, highlighted by the Triton EMS’s award wins, that are most relevant to understanding the company’s pursuit of service differentiation amid margin pressures.

However, against the backdrop of these achievements, investors should not overlook the growing threat from aggressive tech-driven competitors who are targeting the very trading profits Virtu relies on…

Read the full narrative on Virtu Financial (it's free!)

Virtu Financial's narrative projects $1.5 billion in revenue and $561.6 million in earnings by 2028. This requires a 17.3% annual revenue decline and a $182.4 million increase in earnings from the current $379.2 million.

Uncover how Virtu Financial's forecasts yield a $43.75 fair value, a 29% upside to its current price.

Exploring Other Perspectives

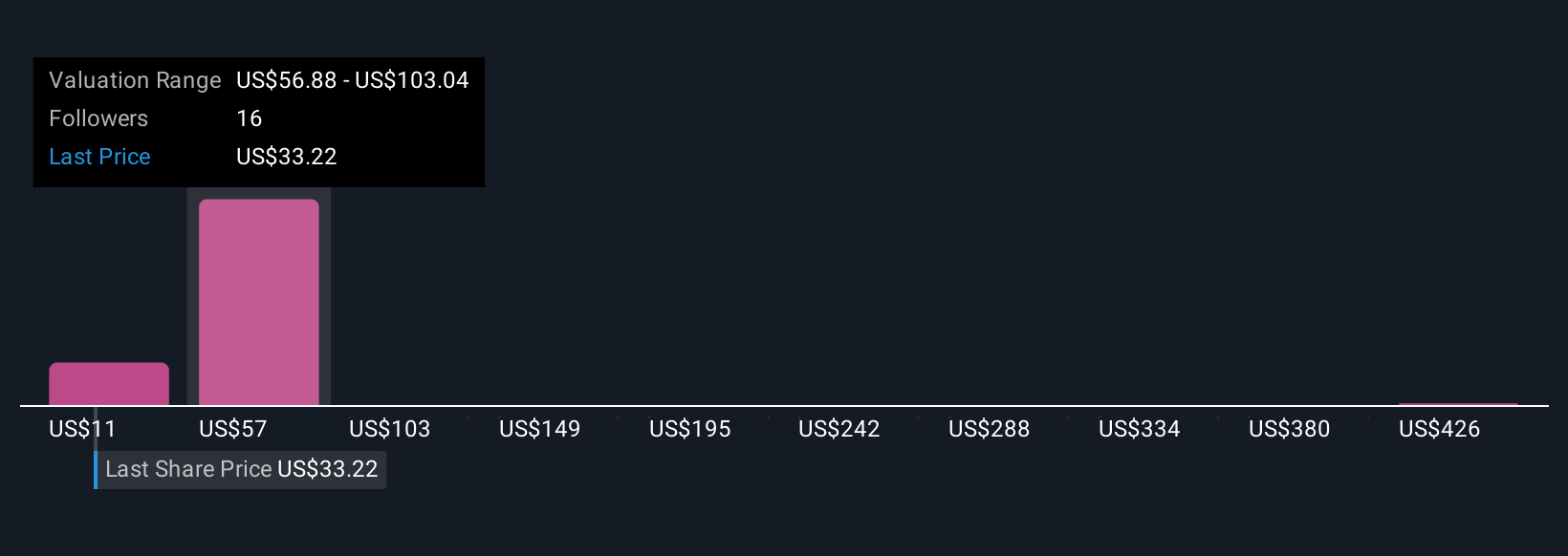

Five members of the Simply Wall St Community value Virtu Financial between US$43.75 and US$472.36 per share, reflecting significant divergence on its future prospects. Despite industry accolades, concerns around increased competition and potential margin compression remain central to any outlook on Virtu’s ongoing performance; consider exploring this range of investor viewpoints for a fuller picture.

Explore 5 other fair value estimates on Virtu Financial - why the stock might be a potential multi-bagger!

Build Your Own Virtu Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Virtu Financial research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Virtu Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Virtu Financial's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIRT

Virtu Financial

Operates as a financial services company in the United States, Ireland, and internationally.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives