Visa (V) Margin Compression Undercuts Bullish Profit Narratives Despite Strong Earnings Track Record

Reviewed by Simply Wall St

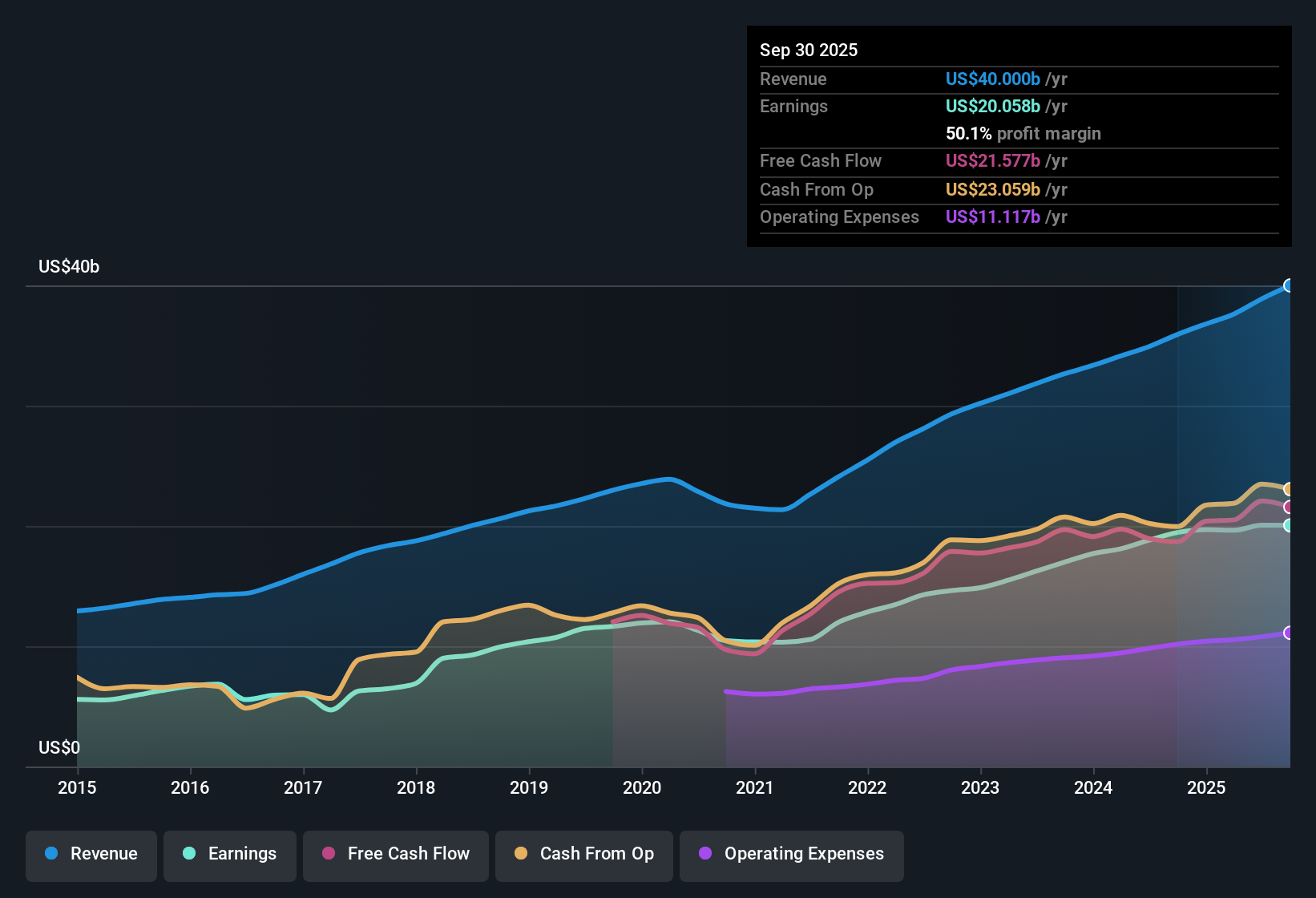

Visa (V) posted a net profit margin of 50.1%, down from last year's 54.2%, pointing to margin compression year-over-year. While the company's earnings have grown at an average rate of 14.4% annually over the past five years, recent annual earnings growth slowed to 3.1%, which is notably below its historical pace. Looking forward, earnings are forecast to rise by 11.46% per year and revenue by 9.5% annually, although both are trailing behind broader US market expectations. Visa's consistent earnings quality and track record of profit and revenue growth remain bright spots, even as investors weigh the elevated price-to-earnings ratio and recent margin pressures.

See our full analysis for Visa.Next up, we’ll see how these numbers compare to the most widely circulated narratives on Simply Wall St, where some market assumptions may be confirmed and others put to the test.

See what the community is saying about Visa

Margin Mix Shifts Toward Value-Added Services

- Value-added services revenue jumped 26% year-over-year, indicating a faster-growing, higher-margin segment now taking a larger share of Visa's business mix.

- Analysts' consensus view highlights that expanding into areas like AI-powered risk solutions and open banking is steadily improving Visa's net margins and earnings quality.

- Cross-border solutions, with Visa Direct transactions up 25%, also broaden revenue opportunities and provide a hedge against slower core transaction growth.

- The focus on higher-margin lines means future earnings could outpace the headline revenue rate, strengthening long-term financial resilience compared to traditional payment competitors.

Share Buybacks Push EPS Growth

- About $4.8 billion returned via buybacks in Q3, with analysts expecting shares outstanding to decrease by 1.64% annually over the next three years, directly supporting per-share earnings growth.

- Analysts' consensus view notes robust free cash flow enables this program, cushioning potential downside if Visa's valuation compresses or top-line growth slows.

- Declining share count, together with projected earnings of $27.5 billion and earnings per share (EPS) of $15.21 by 2028, is forecast to lift long-term shareholder returns even as market growth rates moderate.

- Stability in buybacks and dividends is seen as a buffer that helps Visa remain attractive to investors who might be wary of higher price-to-earnings multiples relative to peers.

Valuation Premium and Growth Gap

- At a current price-to-earnings ratio of 32.6x, Visa trades at a substantial premium to its industry benchmark of 16.5x and a peer average of 19.3x.

- Analysts' consensus view weighs this premium against expected annual earnings growth of 11.46%, which lags US market forecasts, leading to a debate over whether Visa’s premium valuation is justified by its consistency and future growth mix.

- With the current share price at $341.28, Visa is trading about 8.8% below the analyst price target of $394.78, highlighting a narrower margin of upside in the short term compared to some historical periods.

- While bulls may view Visa as a quality leader worthy of a premium, others argue that any slowdown in margin or revenue advancement could make the stock more vulnerable to re-rating.

Consensus sees Visa’s steady platform and rising value-added mix as offering predictability, but staying alert to margin and valuation risks remains key. For a narrative-driven perspective on these trends, including how bulls and bears frame the outlook, check the full analyst discussion at the link below. 📊 Read the full Visa Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Visa on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? Shape your personal outlook and add your narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Visa.

See What Else Is Out There

Visa’s elevated valuation and slowing earnings growth raise concerns about whether its premium price is justified in today’s market.

If you’re seeking better value and stronger upside potential, check out these 854 undervalued stocks based on cash flows to spot companies that are currently trading at more attractive prices based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives