How Recent Fintech Partnerships Could Impact Visa’s 2025 Share Price Valuation

Reviewed by Bailey Pemberton

- Ever wondered if Visa stock is a smart buy or if the current price is giving you second thoughts? You are not alone. With Visa’s reputation, it is a question worth digging into.

- The stock has been on an interesting ride lately, with a 3.0% uptick in the past week. However, it is still down 4.0% over the last month. Year-to-date it is sitting at a 6.2% gain, while the past year has delivered a modest 6.8% return.

- Visa has stayed in the headlines over recent weeks thanks to new fintech partnerships and ongoing industry discussions around payment security. Both of these can drive investor excitement or caution. These developments provide extra context for the recent price action and highlight how much sentiment can shift, even for an established industry leader.

- Currently, Visa holds a valuation score of 1 out of 6. This indicates that only one of the key metrics suggests the stock is undervalued right now. We will break down what those numbers actually mean using a few common valuation tools, and later reveal a method that goes beyond the basics to find out if Visa might be more interesting than it looks on the surface.

Visa scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Visa Excess Returns Analysis

The Excess Returns Model evaluates whether a company is creating value by generating returns on invested capital that exceed its cost of equity capital. This approach is particularly useful for established firms like Visa, whose profitability and consistency set them apart within the industry.

For Visa, this model starts with a Book Value of $19.38 per share and estimates a Stable Earnings Per Share (EPS) of $16.34. These EPS projections are grounded in weighted future Return on Equity estimates from 13 analysts. The company commands an impressive average Return on Equity of 72.09%, signaling robust profitability well beyond the industry norm. Meanwhile, the Cost of Equity sits at $1.68 per share. This allows Visa to capture an Excess Return of $14.67 per share. Looking ahead, the Stable Book Value is expected to reach $22.67 per share, based on forecasts from nine analysts.

According to this valuation, Visa’s intrinsic value is around $377 per share. Compared to the current market price, this implies the stock is about 11.5% undervalued. In practical terms, the Excess Returns analysis suggests Visa is still delivering strong value for investors relative to its share price.

Result: UNDERVALUED

Our Excess Returns analysis suggests Visa is undervalued by 11.5%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: Visa Price vs Earnings

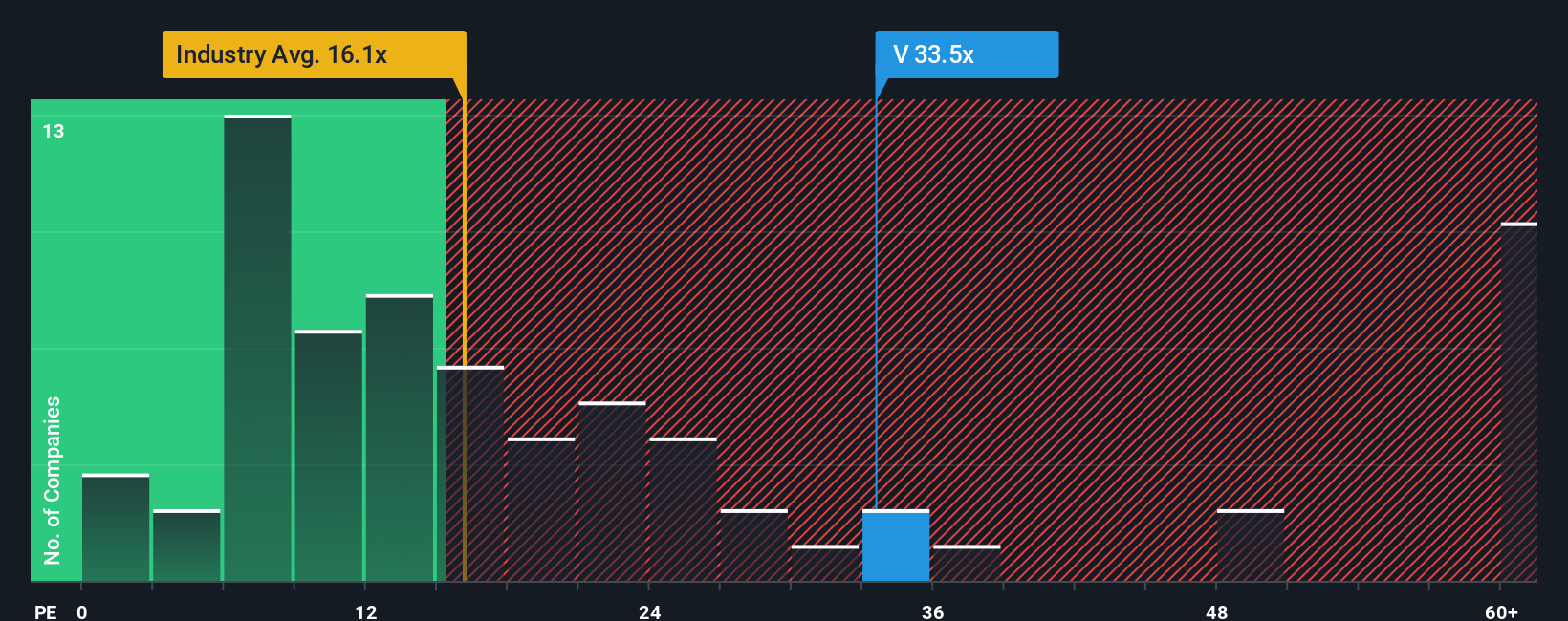

The Price-to-Earnings (PE) ratio is a widely used tool for valuing profitable companies like Visa because it directly connects a company’s share price to its actual earnings. For established and consistently profitable businesses, the PE ratio provides investors with a simple way to gauge whether shares are trading at a reasonable price compared to profits.

Growth expectations and risk play an important role in what counts as a “normal” or “fair” PE. Typically, companies with higher expected earnings growth or lower risk are assigned higher PE ratios by the market. In contrast, slower-growing or riskier companies tend to trade at a discount.

Visa’s current PE ratio stands at 32.18x. This is substantially above the Diversified Financial industry average of 13.61x and the peer average of 16.94x. This reflects the market’s confidence in Visa’s growth prospects and earnings stability. However, peer and industry averages often miss the nuances that set Visa apart, such as its scale, growth trajectory, and risk profile.

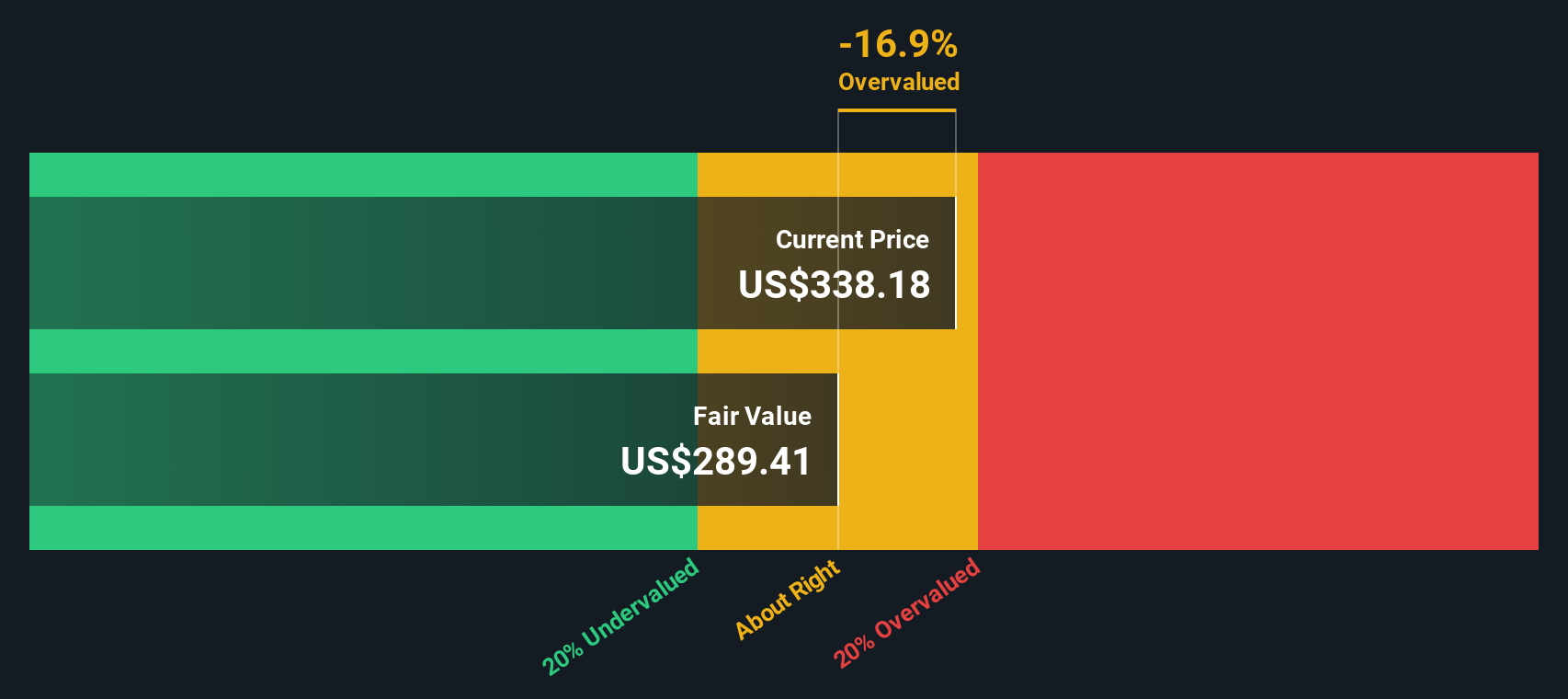

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio represents what a reasonable PE would be after accounting for all the crucial factors unique to Visa, including its future earnings growth, profit margins, risks, industry dynamics, and market cap. Unlike simple peer or industry comparisons, the Fair Ratio delivers an apples-to-apples assessment tailored to the company’s reality. For Visa, the Fair Ratio is calculated to be 20.85x.

Comparing the Fair Ratio (20.85x) with Visa’s actual PE (32.18x), the stock appears to be trading above what would be considered reasonable given its profile. This suggests Visa is currently overvalued based on this metric, even though the company’s quality and consistency justify a premium.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Visa Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful way to connect your perspective about a company, such as Visa’s future growth, risks, and business drivers, with the financial forecasts and fair value you think are most likely. Narratives let you tell the story behind the numbers by combining your own assumptions about future revenue, earnings, and margins with the fair value these projections suggest.

On Simply Wall St’s Community page, millions of investors are already using Narratives to make sense of the market. They are easy and accessible even for beginners, and help you decide whether Visa is a buy or a sell by instantly comparing your fair value to today’s share price. Plus, Narratives update automatically as new information, like quarterly earnings or regulatory news, appears so your picture of fair value always reflects the latest developments.

For Visa, one bullish Narrative might highlight strong digital adoption and cross-border innovation to set a fair value as high as $430, while a more cautious Narrative could focus on technology disruption and regulatory risk, supporting a fair value closer to $305.

Do you think there's more to the story for Visa? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success