A Fresh Look at Visa (V) Valuation After Month of Steady Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Visa.

Visa's share price has steadily gained momentum, notching a 3.1% gain over the past month and pushing its year-to-date price return to 10.6%. In addition, long-term investors have enjoyed a robust 24% total shareholder return over the past year, reflecting the company's solid position and ongoing optimism around payment trends.

If this steady climb piques your interest, it could be the perfect moment to broaden your investing scope and discover fast growing stocks with high insider ownership

With strong returns and ongoing growth in Visa's fundamentals, investors are left to wonder if the current share price undervalues the company's future prospects or if the market has already factored in all that growth potential.

Most Popular Narrative: 11% Undervalued

Visa's narrative fair value estimate stands at $391.46, about 12% higher than the last closing price of $347.82. This sets the stage for a deeper look into why analysts see notable upside even after recent share price gains.

Ongoing global shift away from cash and increasing e-commerce adoption, evidenced by strong growth in Tap to Pay penetration (at 78% of face-to-face transactions globally) and record growth in tokenized credentials, are poised to expand Visa's addressable market and transaction volumes, providing a durable tailwind for long-term revenue growth.

Ever wondered what accelerates a company’s fair value beyond its recent rally? The narrative’s fair value argument hinges on powerful shifts in consumer habits and aggressive bets on operating margin expansion. Interested in discovering what detailed projections and bold financial targets have driven analysts to their confident price target? Unlock the secrets behind these ambitious valuation assumptions inside the full narrative.

Result: Fair Value of $391.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid growth in alternative payment systems or stricter regulation could meaningfully impact Visa’s earnings and challenge the bullish outlook.

Find out about the key risks to this Visa narrative.

Another View: What Do Multiples Say?

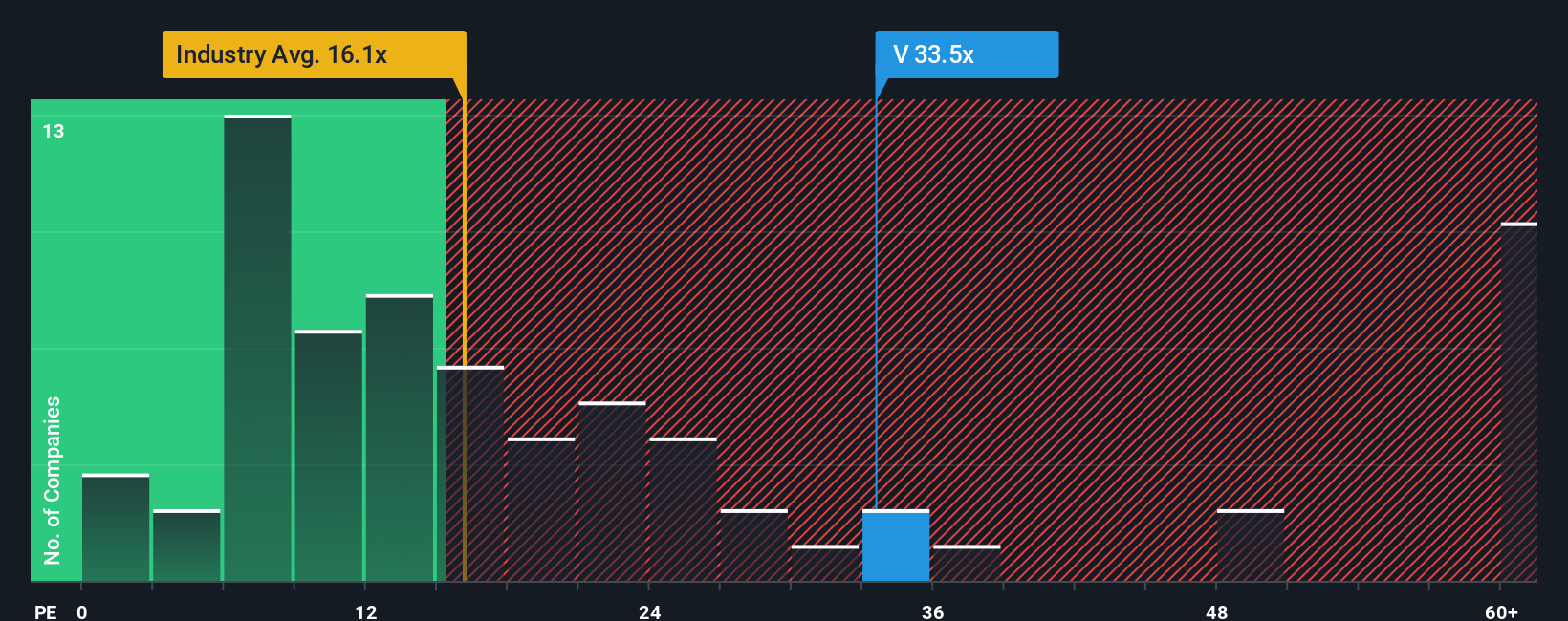

Taking a look through the lens of valuation ratios, Visa’s price-to-earnings ratio sits at 33.4x. This is sharply higher than both the US Diversified Financial industry average of 16.6x and the peer average of 22.3x, as well as its own fair ratio of 23.4x. Such a wide gap suggests investors are paying a steep premium. Does the strength of future growth truly justify it, or could expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Visa Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can build your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Visa.

Looking for more investment ideas?

Smart investors know that the best opportunities rarely wait around. Set your sights on winning sectors and fresh prospects by checking out these handpicked lists today.

- Capture income potential with high-yield standouts by checking out these 19 dividend stocks with yields > 3%.

- Get ahead of the curve with fast-moving innovators using these 27 AI penny stocks and shape your portfolio for tomorrow’s growth.

- Uncover value where others overlook it. Take a closer look at these 874 undervalued stocks based on cash flows before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives