- United States

- /

- Diversified Financial

- /

- NYSE:UWMC

Will Recent Insider Selling at UWM Holdings (UWMC) Hint at Shifting Management Confidence?

Reviewed by Sasha Jovanovic

- On November 18 and 19, 2025, UWM Holdings’ 10% shareholder Mat Ishbia sold 1.19 million shares of the company’s common stock, with the transaction also involving related parties such as SFS Holding Corp.

- This substantial insider sale by a key stakeholder is required to be disclosed under federal securities laws and can influence market sentiment, as investors often scrutinize these moves for potential signals about the company’s prospects.

- We’ll examine what the insider sale by a major shareholder could mean for UWM Holdings’ investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

UWM Holdings Investment Narrative Recap

To be a shareholder in UWM Holdings, you generally need confidence in the ongoing shift toward broker-driven mortgage origination, the potential for advanced tech adoption to boost margins, and resilience amid housing market cycles. The recently disclosed sale of 1.19 million shares by 10% stakeholder Mat Ishbia is unlikely to affect the immediate catalysts, which continue to center on mortgage volume growth and AI-driven cost efficiencies, although it does bring heightened attention to near-term concentration and operational risks.

Among recent announcements, the company’s November 2025 quarterly results provided updated Q4 production guidance of US$43 billion to US$50 billion in originations, which reinforces ongoing bullishness for near-term loan volume as a main catalyst. While insider sales often raise questions, UWM’s operational momentum remains largely tied to persistent origination trends and broker market share.

But keep in mind, if origination volumes fall short of management’s expectations or if competition intensifies, investors should seriously consider the potential impact on…

Read the full narrative on UWM Holdings (it's free!)

UWM Holdings is projected to reach $3.6 billion in revenue and $119.3 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 10.8% and represents a $107.4 million increase in earnings from the current $11.9 million.

Uncover how UWM Holdings' forecasts yield a $7.00 fair value, a 36% upside to its current price.

Exploring Other Perspectives

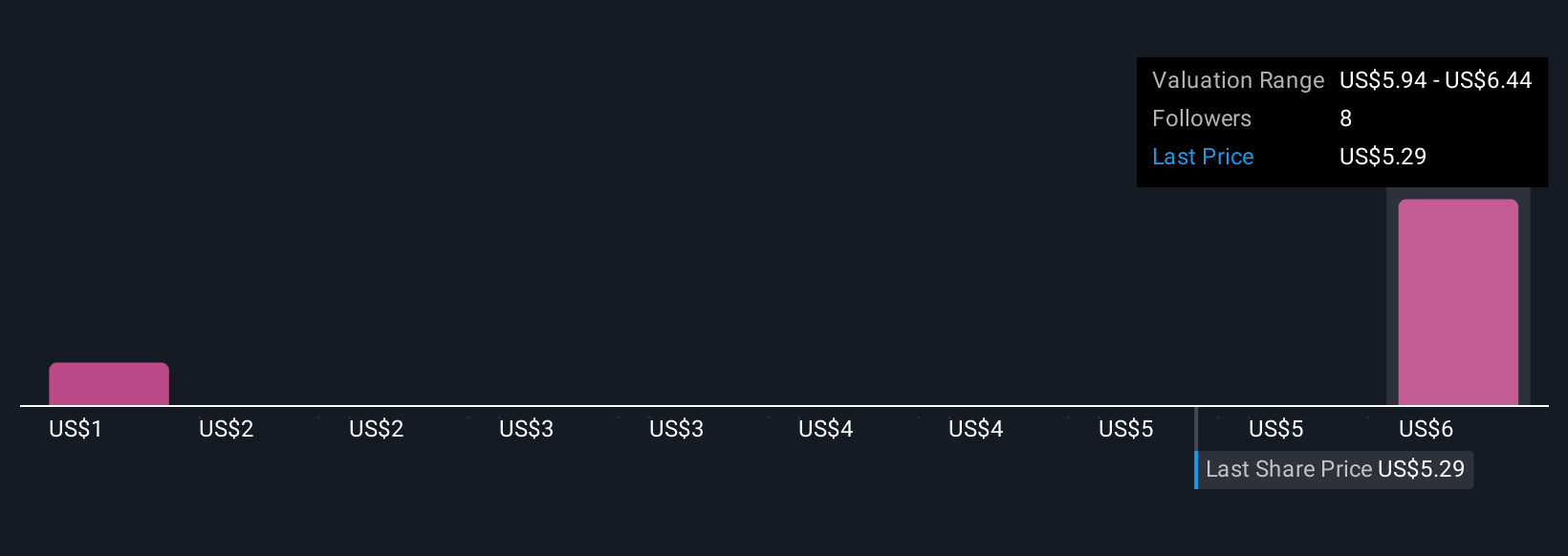

Simply Wall St Community members estimate UWM Holdings’ fair value in a wide US$1.76 to US$7.00 range across three perspectives. With some expecting strong earnings growth, many investors are watching closely to see if the company’s origination volumes can keep up with rising fixed costs.

Explore 3 other fair value estimates on UWM Holdings - why the stock might be worth as much as 36% more than the current price!

Build Your Own UWM Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UWM Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free UWM Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UWM Holdings' overall financial health at a glance.

No Opportunity In UWM Holdings?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UWMC

UWM Holdings

Engages in the origination, sale, and servicing residential mortgage lending in the United States.

Exceptional growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives