- United States

- /

- Mortgage REITs

- /

- NYSE:STWD

How Investors May Respond To Starwood Property Trust (STWD) $502M Equity Raise and Dividend Announcement

Reviewed by Simply Wall St

- Earlier this month, Starwood Property Trust completed a follow-on equity offering, raising US$502.35 million through the sale of 25,500,000 shares, while its board also declared a quarterly dividend of US$0.48 per share and issued earnings guidance for the June quarter.

- The combination of a large capital raise and continued dividend payments reflects management's commitment to both strengthening the balance sheet and maintaining shareholder returns.

- We'll examine how the substantial US$502 million equity raise shapes the company's investment outlook and future capital allocation.

Starwood Property Trust Investment Narrative Recap

To own shares in Starwood Property Trust, you need to believe in the appeal of reliable income through dividends and the company’s ability to manage the risks tied to commercial real estate lending, especially with significant exposure to offices and multifamily properties. The recent US$502.35 million equity raise, alongside steady dividend payments, is intended to support near-term stability, but doesn’t materially change the key short-term catalyst, Starwood’s push to free up capital and reinvest in higher-yielding assets, or address its main risk: potential loan portfolio impairments.

Among recent announcements, the new earnings guidance for the June quarter stands out, projecting GAAP earnings per diluted share between US$0.36 and US$0.38. This guidance is particularly relevant, as it offers insight into how the company may be managing profitability amid ongoing efforts to reposition legacy assets and face portfolio risks.

In contrast, investors should be aware that ongoing loan portfolio challenges...

Read the full narrative on Starwood Property Trust (it's free!)

Starwood Property Trust's narrative projects $2.6 billion in revenue and $578.4 million in earnings by 2028. This requires 82.5% yearly revenue growth and a $267.4 million earnings increase from the current $311.0 million.

Exploring Other Perspectives

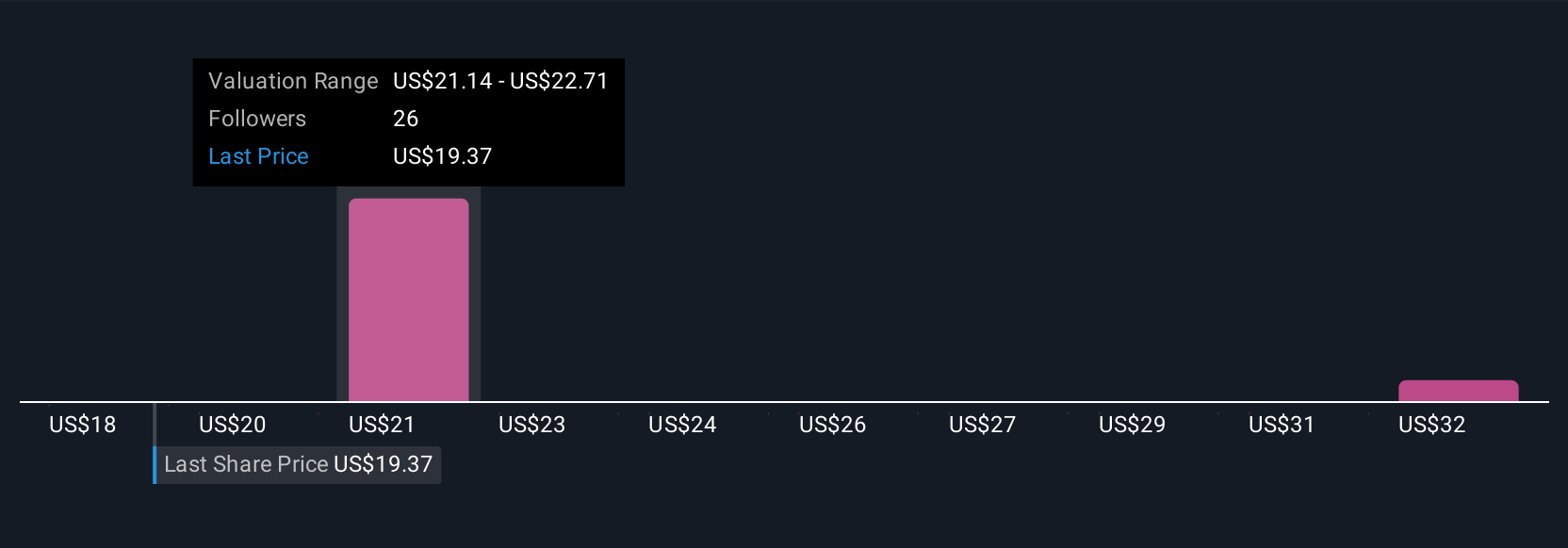

Three fair value estimates for Starwood Property Trust from the Simply Wall St Community span a wide range, from US$18 to over US$33 per share. While many see potential, continued loan impairments remain a concern that could weigh on the company’s ability to deliver sustained returns.

Build Your Own Starwood Property Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Starwood Property Trust research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Starwood Property Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Starwood Property Trust's overall financial health at a glance.

No Opportunity In Starwood Property Trust?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STWD

Starwood Property Trust

Operates as a real estate investment trust (REIT) in the United States and internationally.

Moderate with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives