- United States

- /

- Capital Markets

- /

- NYSE:SF

Stifel Financial (SF): Valuation Insights Following Strong Q3 Results and Rising Client Activity

Reviewed by Simply Wall St

Stifel Financial (SF) posted third quarter results that outpaced market expectations, driven by record client engagement and increased activity in both equity and fixed income markets. Management highlighted disciplined capital allocation and a growing adviser base.

See our latest analysis for Stifel Financial.

Momentum has been building for Stifel Financial, thanks to upbeat earnings, a fresh acquisition deal, and an active buyback program catching investor attention. With a 14.8% total shareholder return over the past year and a three-year total return topping 100%, the stock’s performance stands out in the diversified financials space. This highlights ongoing growth potential as the company continues to expand its platform and reward shareholders.

If Stifel’s recent moves have you thinking bigger, now is a prime moment to broaden your search and discover fast growing stocks with high insider ownership

But after such robust gains and management’s upbeat outlook, is Stifel Financial still trading at a bargain? Or have investors already priced in the company’s next leg of growth?

Most Popular Narrative: 10.9% Undervalued

Stifel Financial’s latest close of $117.56 sits noticeably below the narrative’s fair value estimate of $132. This sets up a debate around just how realistic the pathway to that higher valuation really is, given expected growth and ongoing share repurchases.

Stifel's recruitment focus on higher-producing advisers and the addition of new advisers and teams, including 36 from the B. Riley acquisition, is expected to enhance productivity and drive significant revenue growth in Global Wealth Management. The firm’s strong pipelines in financial advisory and institutional banking, particularly in sectors like technology, industrial services, and a growing appetite for bank M&A, suggest potential for increased investment banking revenue as market conditions stabilize.

Want to see what bold assumptions drive this valuation? There is a surprising forecast for margin expansion and big leaps in future profitability. The future profit multiple and expected earnings jump could rewrite where this stock trades in a few years. Ready to find out exactly how Stifel could get there? All is revealed in the full narrative.

Result: Fair Value of $132 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing legal issues and unpredictable market volatility could threaten Stifel Financial’s growth trajectory and challenge the optimistic outlook reflected in current valuations.

Find out about the key risks to this Stifel Financial narrative.

Another View: Is the Market Getting Ahead of Itself?

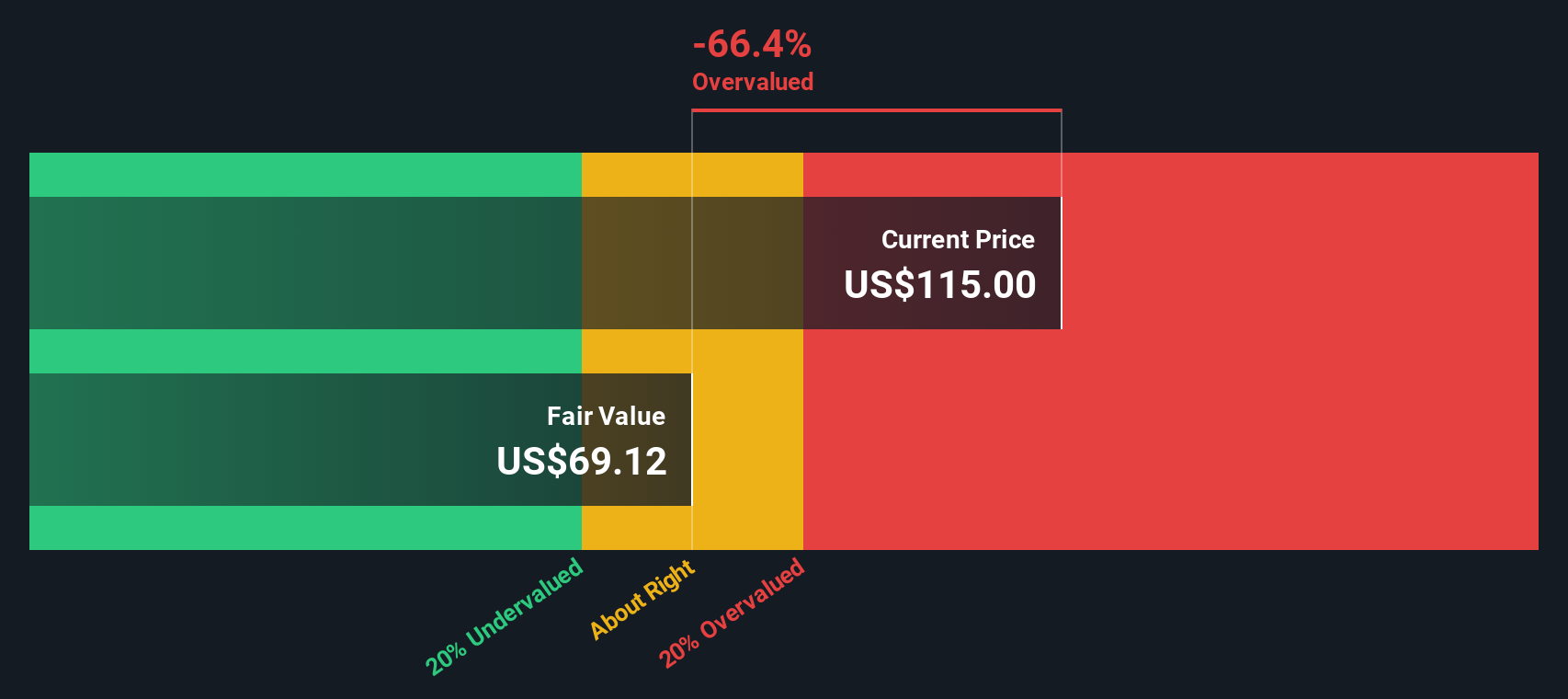

Taking a look through the lens of our DCF model tells a more cautious story. Here, Stifel Financial's recent price of $117.56 sits well above the DCF fair value estimate of $70.80. This raises a red flag that shares might be overvalued if slower growth or market shifts hit expectations. Could this be a sign that optimism is running a bit too hot?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stifel Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stifel Financial Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can craft your own take in just a few minutes, and see how your view stacks up. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Stifel Financial.

Looking for More Smart Investment Ideas?

Don’t stop with just one opportunity. Tap into some of the most exciting growth and income trends on the market to give your portfolio a serious edge.

- Capture steady income by targeting reliable payers with these 21 dividend stocks with yields > 3%, where you’ll uncover stocks with attractive yields above 3%.

- Strengthen your position in technology by evaluating game-changers in artificial intelligence through these 26 AI penny stocks, featuring companies at the forefront of AI breakthroughs.

- Ride the digital transformation wave and position yourself early with these 81 cryptocurrency and blockchain stocks, highlighting innovators driving the future of blockchain and cryptocurrency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SF

Stifel Financial

Operates as the bank holding company for Stifel, Nicolaus & Company, Incorporated that provides retail and institutional wealth management, and investment banking services to individual investors, corporations, municipalities, and institutions in the United States and internationally.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives