- United States

- /

- Capital Markets

- /

- NYSE:SF

Stifel Financial (SF): Examining Valuation Following Recent Momentum in Shareholder Returns

Reviewed by Simply Wall St

Stifel Financial (SF) has been making moves that have caught the attention of investors. With recent shifts in its stock performance over the past month, many are taking a closer look at what might be driving activity in this financial services name.

See our latest analysis for Stifel Financial.

While Stifel Financial’s latest moves have certainly drawn some notice, what’s more telling is the overall trend in its stock. The 1-year total shareholder return of 12.4% outpaced the underlying share price growth, and with the stock recently trading at $112.15, momentum seems to be building again after a slower month. This suggests many investors are seeing renewed upside potential for the long term.

If you’re eager to see what else is gathering steam in the market, now’s an ideal time to broaden your search and discover fast growing stocks with high insider ownership

But with the stock still trading below analysts’ average price target and solid growth in both revenues and profits, the question remains: Is Stifel Financial undervalued, or is the market already pricing in the road ahead?

Most Popular Narrative: 10.6% Undervalued

With Stifel Financial last closing at $112.15, the leading narrative places its fair value about 10% higher. This gives bulls some justification for optimism. The narrative’s estimate not only outpaces the most recent close; it also reflects several core business drivers that supporters believe the market may be underestimating.

The ongoing investment in technology and adviser productivity tools is positioned to strengthen Stifel’s Global Wealth Management segment. This could potentially improve net margins by increasing efficiency and delivering tailored advice, enhancing future asset growth and stability.

Want to unravel the logic behind this valuation? The secret sauce is a blend of robust profit growth and much rosier efficiency projections than you might guess. What are the assumptions powering this bold take? Click to expose the calculations others might be missing.

Result: Fair Value of $125.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing legal challenges and lingering market volatility could undermine Stifel Financial’s earnings potential and disrupt optimistic forecasts for growth.

Find out about the key risks to this Stifel Financial narrative.

Another View: What Does Our DCF Model Say?

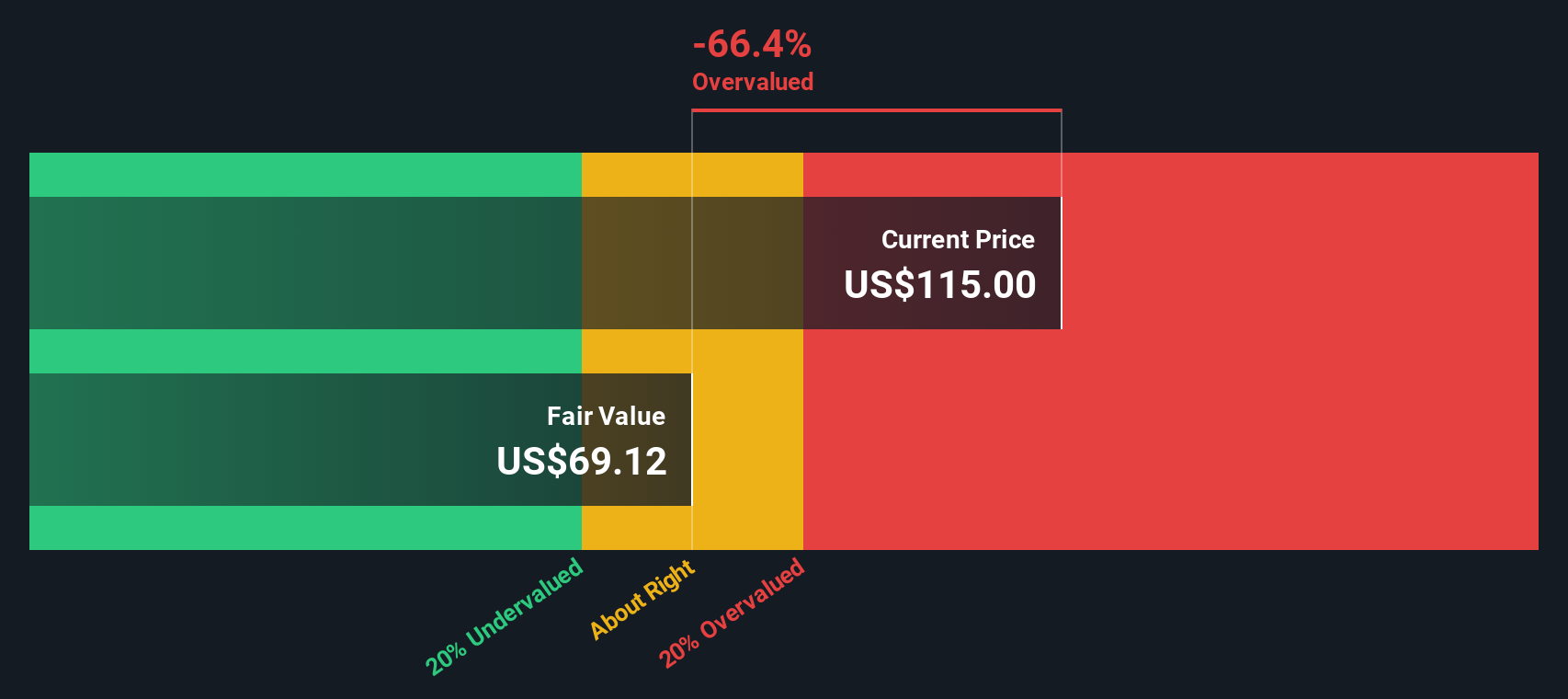

While some see Stifel Financial as undervalued using traditional measures, our SWS DCF model points in another direction. According to this approach, the stock price of $112.15 actually sits above the estimated fair value of $86.10. This may suggest a potential overvaluation if those cash flow forecasts hold true. Could the market be too optimistic, or is it pricing in more upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stifel Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stifel Financial Narrative

If you see things differently, or want to dive into the numbers your own way, you can piece together your personal narrative in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Stifel Financial.

Looking for More Investment Ideas?

Set yourself up for smarter decisions by using the Powerful Screener on Simply Wall Street and uncovering standout companies you might otherwise miss. Don’t let these opportunities slip by and see what the market’s best-kept secrets can do for your portfolio:

- Unlock opportunities for steady income by reviewing these 17 dividend stocks with yields > 3% offering yields above 3% to potentially strengthen your cash flow.

- Jump ahead of the trend as artificial intelligence shapes industries, with these 24 AI penny stocks positioned at the forefront of this transformation.

- Capitalize on strong fundamentals at attractive prices by searching through these 873 undervalued stocks based on cash flows that could signal your next wise move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SF

Stifel Financial

Operates as the bank holding company for Stifel, Nicolaus & Company, Incorporated that provides retail and institutional wealth management, and investment banking services to individual investors, corporations, municipalities, and institutions in the United States and internationally.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives