- United States

- /

- Mortgage REITs

- /

- NYSE:RWT

Redwood Trust (RWT) Trades at Discount as Forecast Revenue Growth Tops Market Narrative

Reviewed by Simply Wall St

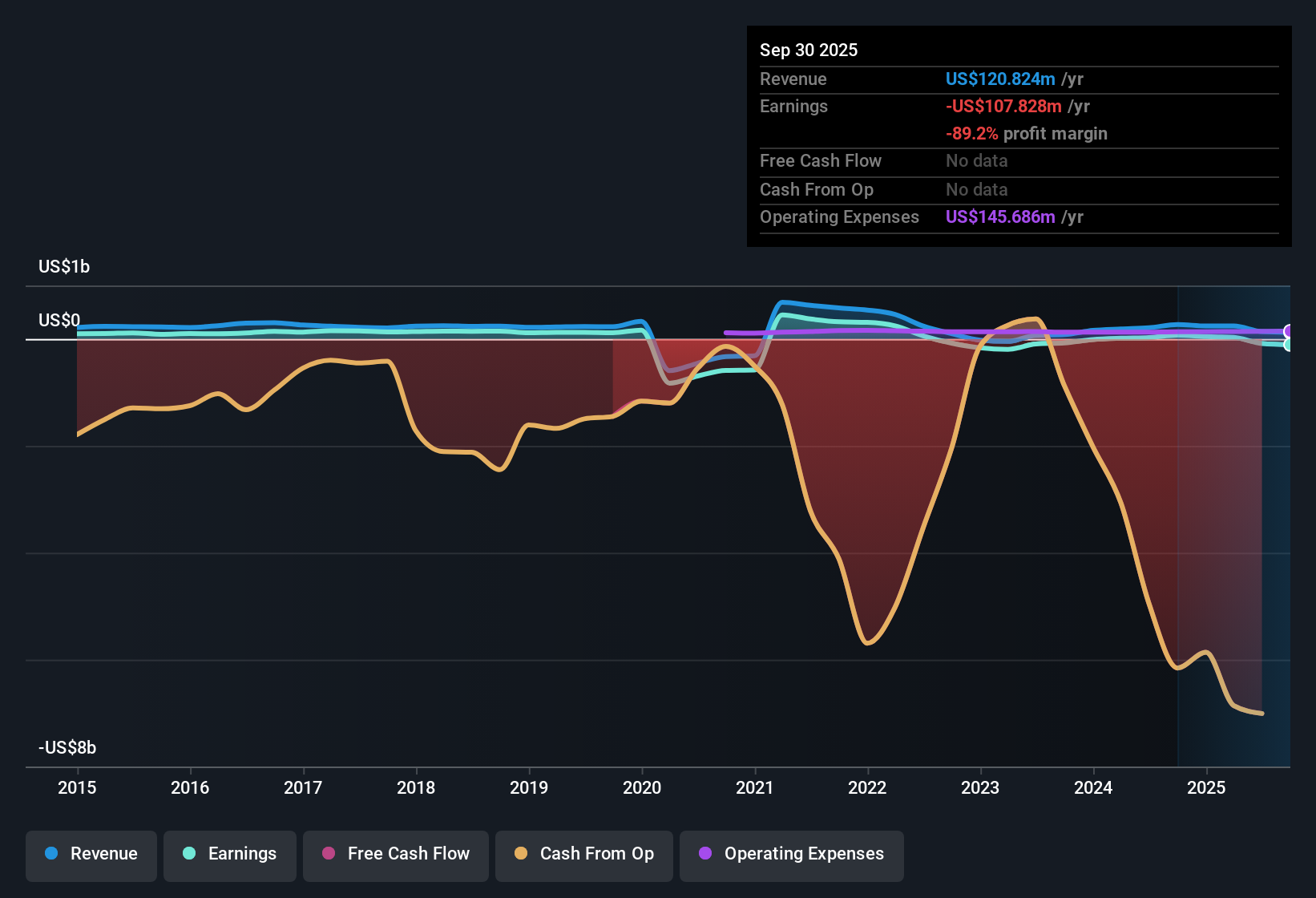

Redwood Trust (RWT) continues to report losses, but has reduced its annual losses by 2.3% per year over the last five years. Looking ahead, analysts forecast revenue growth of 21.4% per year and a striking 98.07% annual increase in earnings, with the company potentially reaching profitability within three years. While shares trade at $5.34, well below the estimated fair value of $9.83 and analyst targets, investors are balancing the upbeat growth outlook with concerns about unsustainable dividends, a challenging financial position, and valuation multiples that run higher than industry averages.

See our full analysis for Redwood Trust.With the headline results on the table, it’s time to see how they stack up against the most-discussed narratives within the community, and where any lingering assumptions may be upended.

See what the community is saying about Redwood Trust

Margins Expected to Surge

- Analysts predict net profit margins will climb from 17.6% today to 71.3% in three years, showcasing a dramatic improvement in the company’s efficiency and earning power.

- Analysts’ consensus view sees Redwood Trust positioned to benefit from policy changes and technology advances. Operational streamlining and new loan products are expected to support these robust margin gains.

- Partnerships and AI-driven efficiencies could help the company offset industry headwinds, driving sustainable growth beyond the sector average.

- Strategic moves into underserved lending areas and bank-originated mortgage pools are highlighted as catalysts that may help fuel the anticipated margin expansion.

- Backed by a remarkable margin forecast, the latest report suggests a transformation may be underway if Redwood hits these growth levers. 📊 Read the full Redwood Trust Consensus Narrative.

Valuation at a Premium to Peers

- Redwood Trust’s Price-To-Sales Ratio stands at 5.1x, notably above the US Mortgage REIT industry average of 4.2x and the peer average of 2.8x, highlighting that the stock commands a premium even as it remains unprofitable.

- In the analysts' consensus view, this valuation is justified by expectations of rapid margin improvement and future profitability. It also raises questions about whether the company can deliver on its ambitious earnings targets.

- If net margins hit forecasts, the premium may be warranted. However, if financial risks materialize, the current valuation leaves little room for disappointment.

- Elevated multiples underline both market confidence and the risk that above-industry pricing could correct if operating progress stalls.

Shares Still Trading Below DCF Fair Value

- The current share price of $5.34 trades at a 45.7% discount to the estimated DCF fair value of $9.83, indicating the market remains cautious despite analysts’ price target of $6.86, which is 14.2% above today’s price.

- According to the consensus narrative, this gap reflects investor skepticism about near-term dividend sustainability and the company’s financial strength, even as growth and profitability forecasts point much higher.

- With the DCF fair value significantly above the current price, there is clear upside if Redwood Trust delivers on forecasted improvements.

- However, the discount also signals persistent worries about risks like credit quality, housing policy shifts, and exposure to volatile mortgage rates.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Redwood Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the data? Share your perspective and craft a fresh narrative in just a few minutes: Do it your way

A great starting point for your Redwood Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite optimism around margin recovery, Redwood Trust’s above-average valuation, lingering losses, and balance sheet questions highlight ongoing financial vulnerability.

If you want to focus on financial strength and stability, check out solid balance sheet and fundamentals stocks screener (1984 results) to discover companies with lower debt and healthier fundamentals designed to withstand uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RWT

Redwood Trust

Operates as a specialty finance company in the United States.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives