- United States

- /

- Mortgage REITs

- /

- NYSE:RITM

Rithm Capital's Strong Q3 and New Acquisitions Might Change the Case for Investing in RITM

Reviewed by Sasha Jovanovic

- In the past week, Rithm Capital Corp. reported third-quarter 2025 earnings that surpassed expectations, with net income of US$221.54 million and announced two acquisitions: Crestline and Paramount, aimed at expanding its asset management and real estate capabilities.

- An interesting aspect is that Rithm plans to finance these business expansions through internal resources and third-party partnerships, without issuing new equity, while highlighting potential future options like a spin-off or IPO for parts of its business.

- Let's explore how these stronger-than-expected earnings and acquisition announcements could influence Rithm Capital's investment narrative and growth trajectory.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Rithm Capital Investment Narrative Recap

To own Rithm Capital, an investor needs conviction that diversified asset management and real estate expansion will drive earnings and resilience, even as rising competition and fluctuating interest rates remain top concerns. The third-quarter earnings beat and new acquisitions signal operational momentum, but these developments do not fundamentally alter the near-term catalyst of benefiting from lower interest rates, nor do they materially reduce the integration risks tied to expanding into new business lines.

Among Rithm’s recent announcements, the acquisition of Crestline stands out as most relevant, broadening the company’s reach into direct lending and insurance, which directly ties into ambitions to scale earnings and support growth beyond traditional mortgage origination. While this move mirrors Rithm's strategy to diversify and reduce dependence on any single sector, it does bring integration complexities to the front and poses questions about managing new lines alongside established ones.

Yet, in contrast, investors should also be aware that the challenge of smoothly integrating Crestline, alongside new business units, is...

Read the full narrative on Rithm Capital (it's free!)

Rithm Capital is projected to reach $6.3 billion in revenue and $1.3 billion in earnings by 2028. Achieving these targets implies an annual revenue growth rate of 19.5% and an earnings increase of $619 million from the current earnings of $680.7 million.

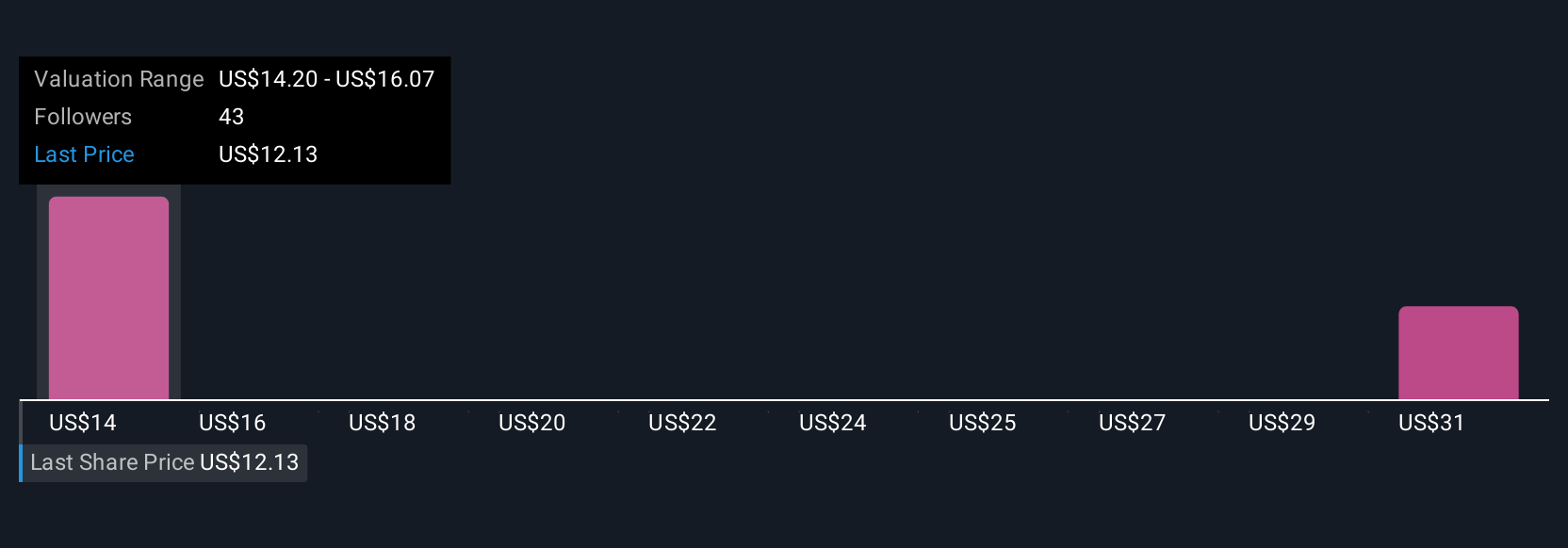

Uncover how Rithm Capital's forecasts yield a $14.40 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Four individual fair value estimates from the Simply Wall St Community range from US$13.52 to US$17.94 per share. While forecasts emphasize growth from asset management, differing opinions highlight the range of possible outcomes for Rithm’s diversification strategy, check out what others think before deciding.

Explore 4 other fair value estimates on Rithm Capital - why the stock might be worth just $13.52!

Build Your Own Rithm Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rithm Capital research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Rithm Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rithm Capital's overall financial health at a glance.

No Opportunity In Rithm Capital?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RITM

Rithm Capital

Operates as an asset manager focused on real estate, credit, and financial services in the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives