- United States

- /

- Mortgage REITs

- /

- NYSE:RITM

Does Rithm Capital’s Acquisition Strategy Reveal a New Risk-Reward Balance for RITM Investors?

Reviewed by Sasha Jovanovic

- Rithm Capital recently reported strong third-quarter results, achieving US$1.1 billion in revenue and highlighting its acquisitions of Paramount and Crestline, while also disclosing considerable financial risks and challenges associated with integrating these new businesses.

- This combination of record earnings and acknowledged integration hurdles provides insight into the balancing act Rithm Capital faces as it expands its operations through major acquisitions.

- Next, we'll explore how management's openness about acquisition-related risks may influence Rithm Capital's future investment outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Rithm Capital Investment Narrative Recap

To be a shareholder in Rithm Capital, you need to be confident in its ability to capitalize on US housing demand and execute on growth through acquisitions, while managing the risks that come with quickly expanding into new markets. The recent disclosure of significant integration risks following the Paramount and Crestline acquisitions does not materially disrupt the main short-term catalyst, expansion beyond traditional mortgage servicing, but it does bring the biggest current risk, successful integration, into sharper focus. One particularly relevant update is Rithm’s ongoing participation in the bidding process for Paramount Group, Inc., announced on August 27, 2025. This move closely aligns with the company’s broader push to diversify its revenue streams and drive future profit growth, but it comes as integration of past acquisitions still presents real operational and financial challenges. Yet, despite the recent excitement, investors should also consider the risk that Rithm’s ambitious acquisitions could result in ...

Read the full narrative on Rithm Capital (it's free!)

Rithm Capital's narrative projects $6.3 billion in revenue and $1.3 billion in earnings by 2028. This requires 19.5% yearly revenue growth and a $619 million increase in earnings from the current $680.7 million.

Uncover how Rithm Capital's forecasts yield a $14.40 fair value, a 31% upside to its current price.

Exploring Other Perspectives

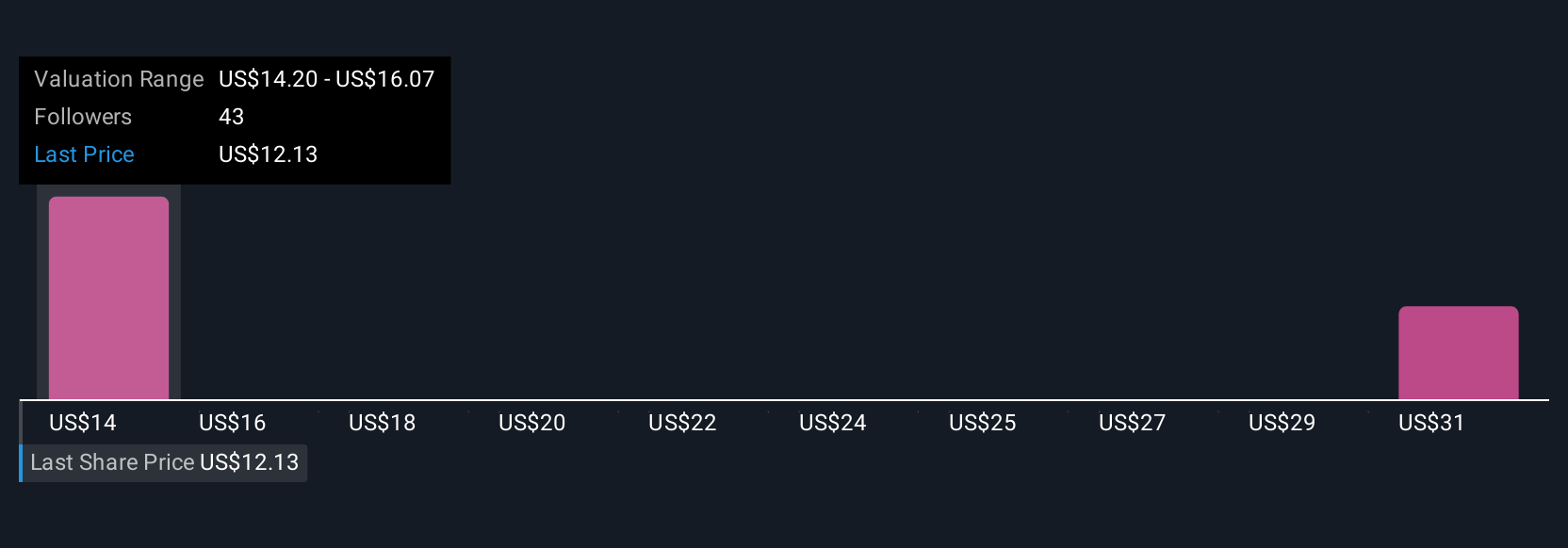

Three Simply Wall St Community members set fair values between US$14.40 and US$16.17 per share, with a range that exceeds US$1.70. While you weigh these perspectives, keep in mind that integration challenges could impact Rithm’s ability to sustain its expansion pace. Explore how your own outlook matches up with these varied opinions.

Explore 3 other fair value estimates on Rithm Capital - why the stock might be worth just $14.40!

Build Your Own Rithm Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rithm Capital research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Rithm Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rithm Capital's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RITM

Rithm Capital

Operates as an asset manager focused on real estate, credit, and financial services in the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives