- United States

- /

- Capital Markets

- /

- NYSE:PX

Assessing P10 (PX) Valuation Following Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for P10.

Over the past year, P10’s share price return has lagged, with momentum fading further in recent weeks. This is evidenced by a 1-month share price return of -15.7%. The 1-year total shareholder return stands at -6.7%, while the 3-year total return remains positive, which hints at some resilience despite near-term pressures. Recent swings suggest investors are weighing shifting growth prospects against evolving market risks.

If you're curious about other companies showing strong growth and insider confidence, now is a timely moment to explore fast growing stocks with high insider ownership

Given the recent pullback and current discount to analyst price targets, the question for investors is whether P10 is undervalued at these levels or if the market is already factoring in all future growth prospects.

Most Popular Narrative: 28.9% Undervalued

P10's most followed valuation narrative points to a fair value well above its last close, suggesting significant upside in the eyes of the consensus. The market price currently appears far beneath that assessed by the narrative's underlying projections. This gap sets the stage for a closer look at the foundation of these expectations.

The commitment to more than double their fee-paying AUM over the next five years suggests significant potential for increased revenue, as AUM is directly tied to fee generation. Ongoing investments in key personnel, especially in distribution, are expected to drive revenue growth and improve operational efficiencies. This could potentially enhance net margins over time due to a higher ROI from these human capital investments.

How could expanding into new markets and bold hiring bets power future growth? The value in this narrative rests on aggressive revenue strategies and operational scaling that most investors would not expect for a company at this stage. Want to uncover the exact projections generating this discrepancy between narrative and market price? Find out what numbers are moving the needle behind the scenes.

Result: Fair Value of $14.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty around fee expirations and the costs of strategic investments could weigh on margins and serve as potential roadblocks to the expected growth.

Find out about the key risks to this P10 narrative.

Another View: Price-to-Earnings Raises Red Flags

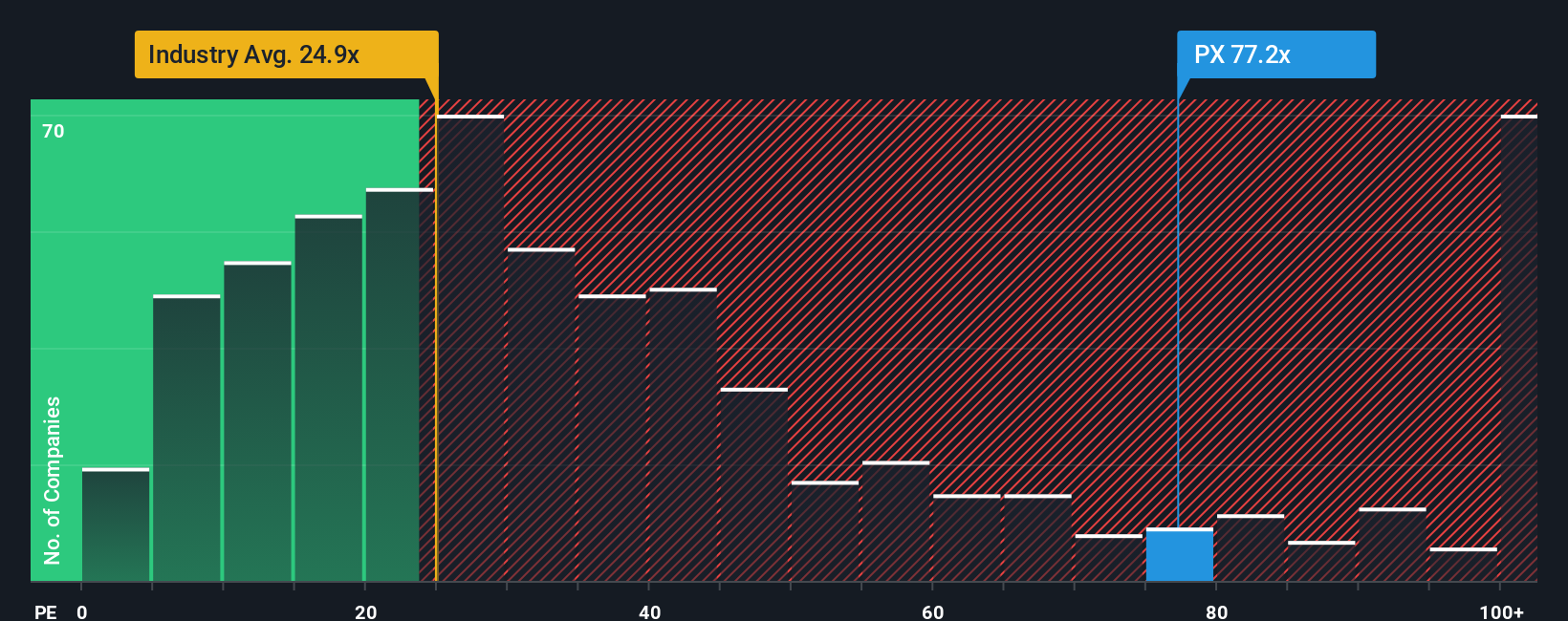

While one narrative sees P10 as undervalued, comparing its price-to-earnings ratio to the industry average tells a different story. P10 trades at a striking 77.2x, which is far higher than both the industry average of 25.6x and the peer average of 7.6x. This makes the stock look expensive and exposes it to valuation risk if market sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own P10 Narrative

Keep in mind, if you prefer to analyze the data independently or have a different perspective on P10, you can develop your own narrative in just a few minutes. Do it your way

A great starting point for your P10 research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit their search, and right now, some of the most outpaced growth stories and high-yield opportunities are just a click away. Don’t let your next big win pass you by. Put these powerful screeners to work for your portfolio now.

- Tap into tomorrow’s financial disruptors by checking out these 79 cryptocurrency and blockchain stocks where top companies are driving new innovations in digital assets and blockchain infrastructure.

- Start stacking potential passive income by assessing these 19 dividend stocks with yields > 3% with yields over 3% and a track record of rewarding shareholders.

- Accelerate your search for value by targeting these 899 undervalued stocks based on cash flows which highlights stocks priced below their intrinsic worth by cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PX

P10

Operates as a multi-asset class private market solutions provider in the alternative asset management industry in the United States.

Moderate risk with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026