- United States

- /

- Mortgage REITs

- /

- NYSE:PMT

PennyMac Mortgage Investment Trust (PMT): Is the Stock Undervalued After Recent Performance?

Reviewed by Simply Wall St

PennyMac Mortgage Investment Trust (PMT) has drawn renewed attention as investors look for direction after recent price moves. With the stock’s performance showing little change over the past week, many are examining the underlying numbers for clues on future trends.

See our latest analysis for PennyMac Mortgage Investment Trust.

Looking at the bigger picture, PennyMac Mortgage Investment Trust’s recent share price softness follows a period of steady progress, with total shareholder returns up 1.9% over the past year and a three-year total return of nearly 23%. That longer-term performance highlights the trust’s ability to reward patient investors, even as momentum pauses after recent moves and the outlook remains in flux.

If you’re open to what else is making waves beyond real estate finance, now could be the right moment to discover fast growing stocks with high insider ownership

But with shares treading water and analysts seeing some upside, the key question now is whether PennyMac Mortgage Investment Trust still trades below its true value or if future growth is already reflected in the price.

Most Popular Narrative: 10.3% Undervalued

With PennyMac Mortgage Investment Trust’s most widely followed narrative putting fair value at $13.43, the latest close of $12.04 leaves the shares trading below this key estimate. This gap suggests room for upside, but what’s fueling this optimism?

The continued growth in U.S. household formation and the steady demand for residential mortgages, combined with PennyMac's robust vertically integrated origination and servicing platform, position PMT to access a consistent pipeline of high-quality loans, supporting future revenue and earnings growth.

Want to know what’s really behind this value call? The narrative hinges on aggressive profit margin expansion and ambitious earnings transformation. It is the detailed expectations for revenue growth and efficiency gains that might surprise you. Unlock the story to see which financial moves drive this bullish target and where the sharpest growth assumptions really lie.

Result: Fair Value of $13.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent exposure to interest rate swings or a potential dividend cut remain real risks that could quickly undermine this optimistic narrative.

Find out about the key risks to this PennyMac Mortgage Investment Trust narrative.

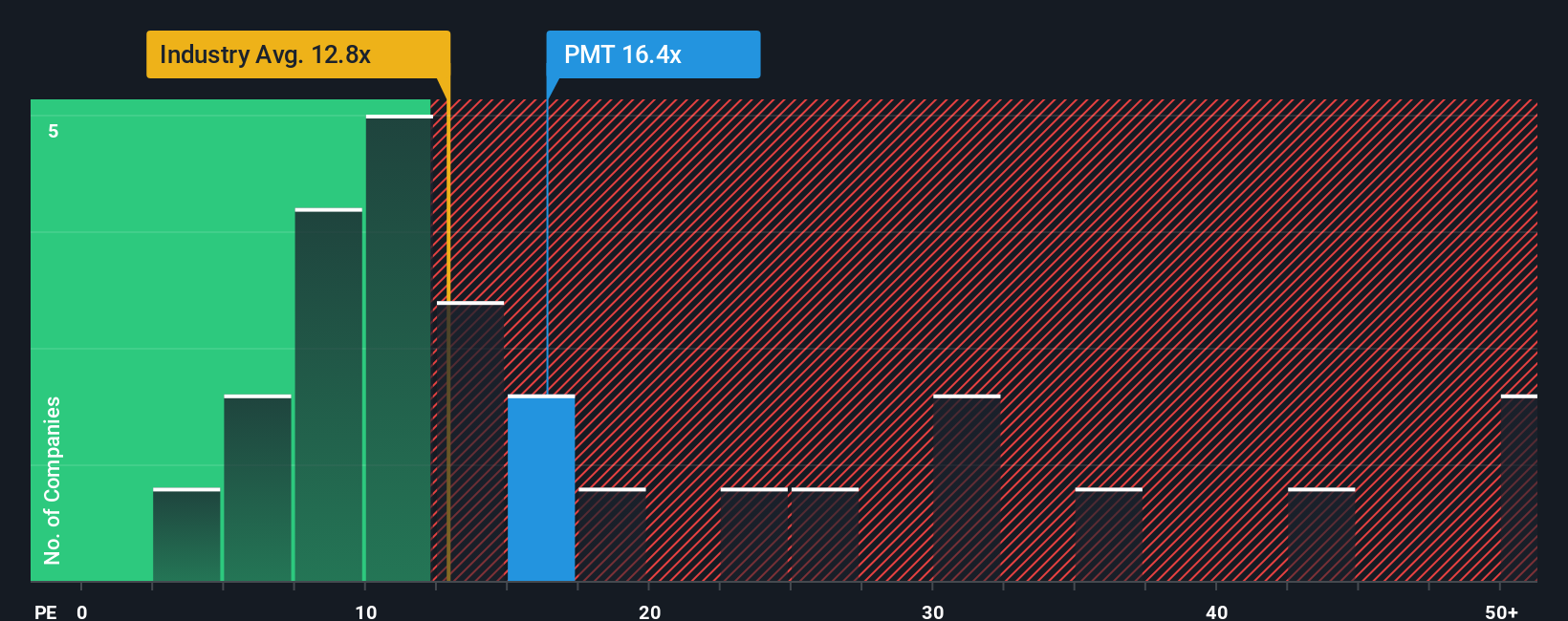

Another Perspective: Multiples Raise a Red Flag

Switching gears to look at value through earnings multiples, PennyMac Mortgage Investment Trust trades at 13.1 times earnings. That is higher than both the peer average (10.7x) and its industry (12.8x), but it actually sits below its fair ratio of 15.3x, hinting at mixed signals. Does this premium price reflect investor confidence, or is it a warning that the shares could cool off from here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PennyMac Mortgage Investment Trust Narrative

If you see things differently or want to dig deeper on your terms, you can build your own analysis in under three minutes. Do it your way

A great starting point for your PennyMac Mortgage Investment Trust research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step beyond what you already know. Uncover unique growth prospects and untapped opportunities by checking stocks that fit powerful trends catching smart investors’ attention right now.

- Unleash your potential for market-beating growth with these 26 AI penny stocks, where companies are harnessing artificial intelligence for breakthroughs across industries.

- Tap into hidden value by reviewing these 843 undervalued stocks based on cash flows, which features stocks that stand out for their strong fundamentals and compelling cash flow metrics.

- Secure steady returns with these 18 dividend stocks with yields > 3%, a selection of investments offering attractive yields above 3% for reliable income potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PMT

PennyMac Mortgage Investment Trust

Through its subsidiary, primarily invests in residential mortgage-related assets in the United States.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives