- United States

- /

- Mortgage REITs

- /

- NYSE:PMT

How Investors Are Reacting To PennyMac Mortgage Investment Trust (PMT) Amid Sales Declines and Capital Management Challenges

Reviewed by Sasha Jovanovic

- In recent news, PennyMac Mortgage Investment Trust has faced ongoing sales declines along with challenges related to net interest income and capital management during a difficult market cycle.

- This situation has prompted fresh concerns among investors about the company's operational health and its suitability for portfolio inclusion.

- We will examine how these persistent operational hurdles might influence PennyMac's investment narrative moving forward.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

PennyMac Mortgage Investment Trust Investment Narrative Recap

To be a PennyMac Mortgage Investment Trust shareholder, you have to believe in the company's ability to leverage its integrated origination and servicing platform to access high-quality loans and drive long-term earnings, especially as mortgage demand shifts. However, the recent news of continued sales declines and pressure on net interest income makes the sustainability of its dividend one of the most important catalysts in the near term, while highlighting the ongoing risk from volatile interest rates and capital management. These developments increase the importance of near-term operational resilience and prudent capital allocation for PennyMac’s outlook.

One of the most relevant recent announcements is PennyMac's Q3 2025 dividend declaration of US$0.40 per common share, which came amid reported ongoing challenges in net interest income and sales volume. As earnings have struggled to consistently cover the dividend, this announcement is tightly linked to investor concerns about dividend sustainability and points to the balancing act management faces between rewarding shareholders and maintaining financial flexibility. If current operating headwinds persist, investors are likely to pay close attention to future dividend coverage ratios and capital allocation decisions.

But before you get comfortable with a high dividend, be aware that concentrated exposure to interest rate volatility and current payout levels could mean...

Read the full narrative on PennyMac Mortgage Investment Trust (it's free!)

PennyMac Mortgage Investment Trust is projected to reach $354.4 million in revenue and $194.9 million in earnings by 2028. This outlook assumes a 16.8% annual revenue decline and an earnings increase of $132 million from the current $62.9 million.

Uncover how PennyMac Mortgage Investment Trust's forecasts yield a $13.43 fair value, a 11% upside to its current price.

Exploring Other Perspectives

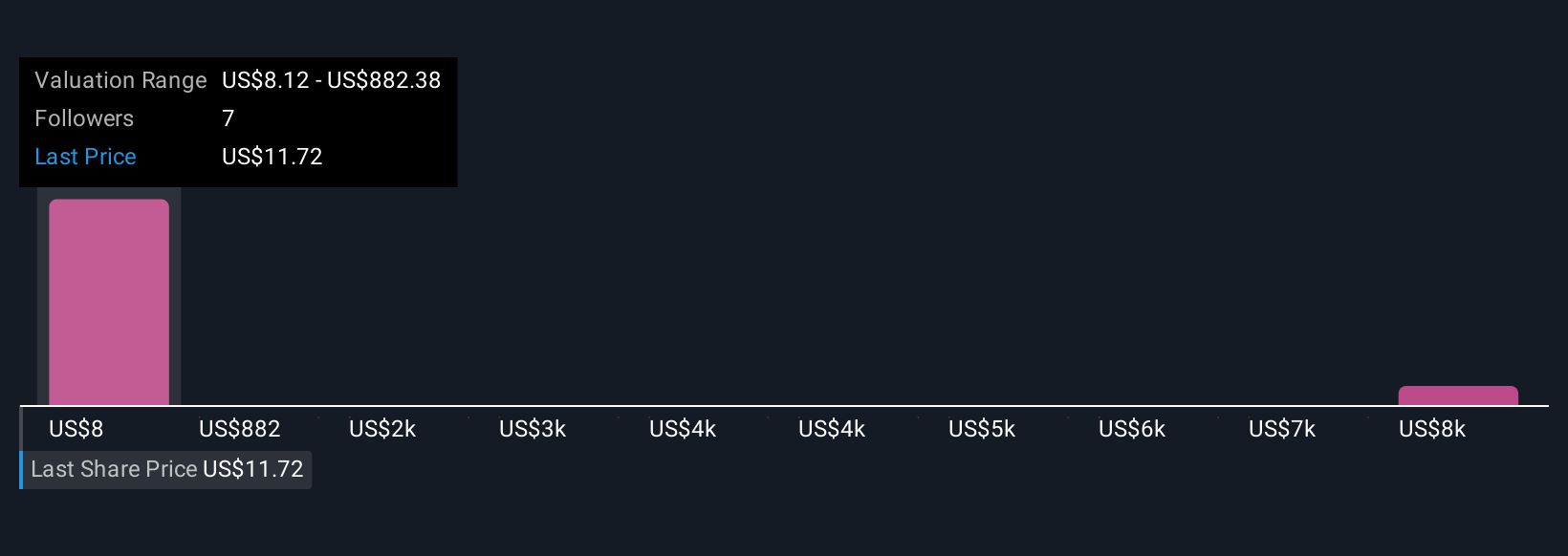

Four members of the Simply Wall St Community estimate PennyMac’s fair value at anywhere from US$7.98 to a staggering US$8,750.76. With recent challenges to capital management and dividend cover in focus, you can see how strongly opinions differ on the company’s outlook.

Explore 4 other fair value estimates on PennyMac Mortgage Investment Trust - why the stock might be worth 34% less than the current price!

Build Your Own PennyMac Mortgage Investment Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PennyMac Mortgage Investment Trust research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PennyMac Mortgage Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PennyMac Mortgage Investment Trust's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PMT

PennyMac Mortgage Investment Trust

Through its subsidiary, primarily invests in residential mortgage-related assets in the United States.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives