- United States

- /

- Capital Markets

- /

- NYSE:PJT

Will PJT Partners’ (PJT) Nordic Expansion Reveal a New Edge in European Dealmaking?

Reviewed by Sasha Jovanovic

- PJT Partners recently announced the opening of a new Stockholm office, hiring up to 10 dealmakers and appointing former Goldman Sachs banker Thomas Westin to lead its Nordics effort.

- This marks a shift from previously serving the Nordics from London, emphasizing PJT Partners' intent to build deeper local expertise in a competitive European market.

- We'll explore how the decision to establish a physical Nordic presence and onboard key leadership shapes PJT Partners' broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is PJT Partners' Investment Narrative?

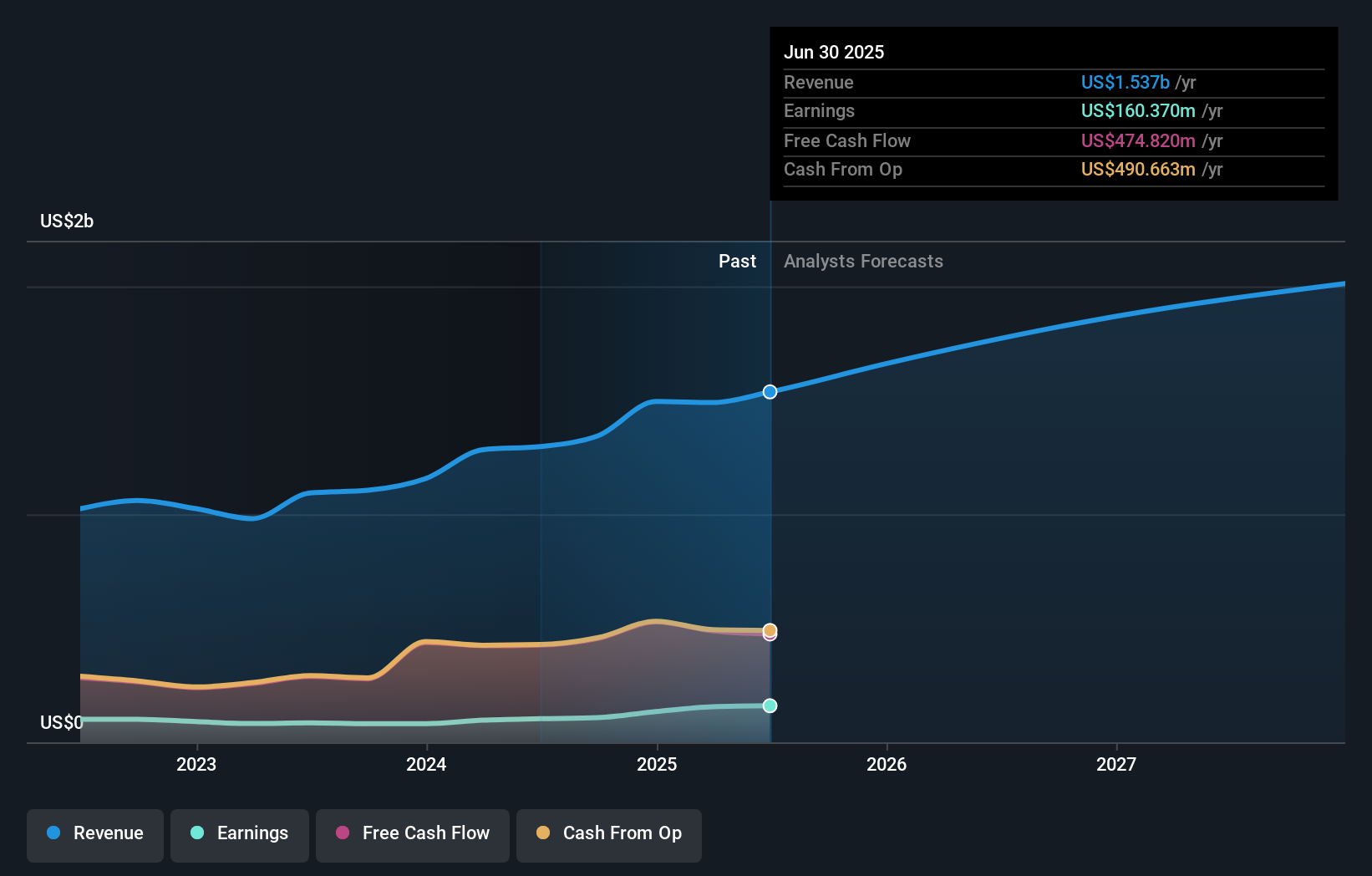

Being a shareholder in PJT Partners means having confidence in the firm's ability to drive value through its advisory model and global expansion, which now includes the recent launch of its Stockholm office. This local entry into the Nordics, guided by experienced leadership, signals a commitment to deeper client access and stronger regional relationships that may support future deal flow. However, with PJT trading above some consensus fair value estimates and forecast revenue growth trailing broader US markets, the most important near-term catalysts remain tied to sustaining elevated earnings and expanding margins. The Nordic office may boost long-term visibility but is unlikely to move the needle on immediate results, so key risks like competitive pressure and potential deal activity slowdowns still matter most in the short term. PJT’s strong recent earnings growth is encouraging, but the true impact of its Nordic push will take time to emerge. But as PJT tries to grow in competitive European markets, competition risk can't be ignored.

PJT Partners' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on PJT Partners - why the stock might be worth less than half the current price!

Build Your Own PJT Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PJT Partners research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free PJT Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PJT Partners' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PJT

PJT Partners

An investment bank, provides various strategic advisory, shareholder advisory, capital markets advisory, and restructuring and special situations services to corporations, financial sponsors, institutional investors, and governments worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives