- United States

- /

- Capital Markets

- /

- NYSE:PJT

Should You Rethink PJT Partners After Its Dealmaking Headlines and 133% Three-Year Gain?

Reviewed by Bailey Pemberton

- Wondering if PJT Partners is a bargain or a premium pick? You are not alone; plenty of investors want to know what makes this stock tick.

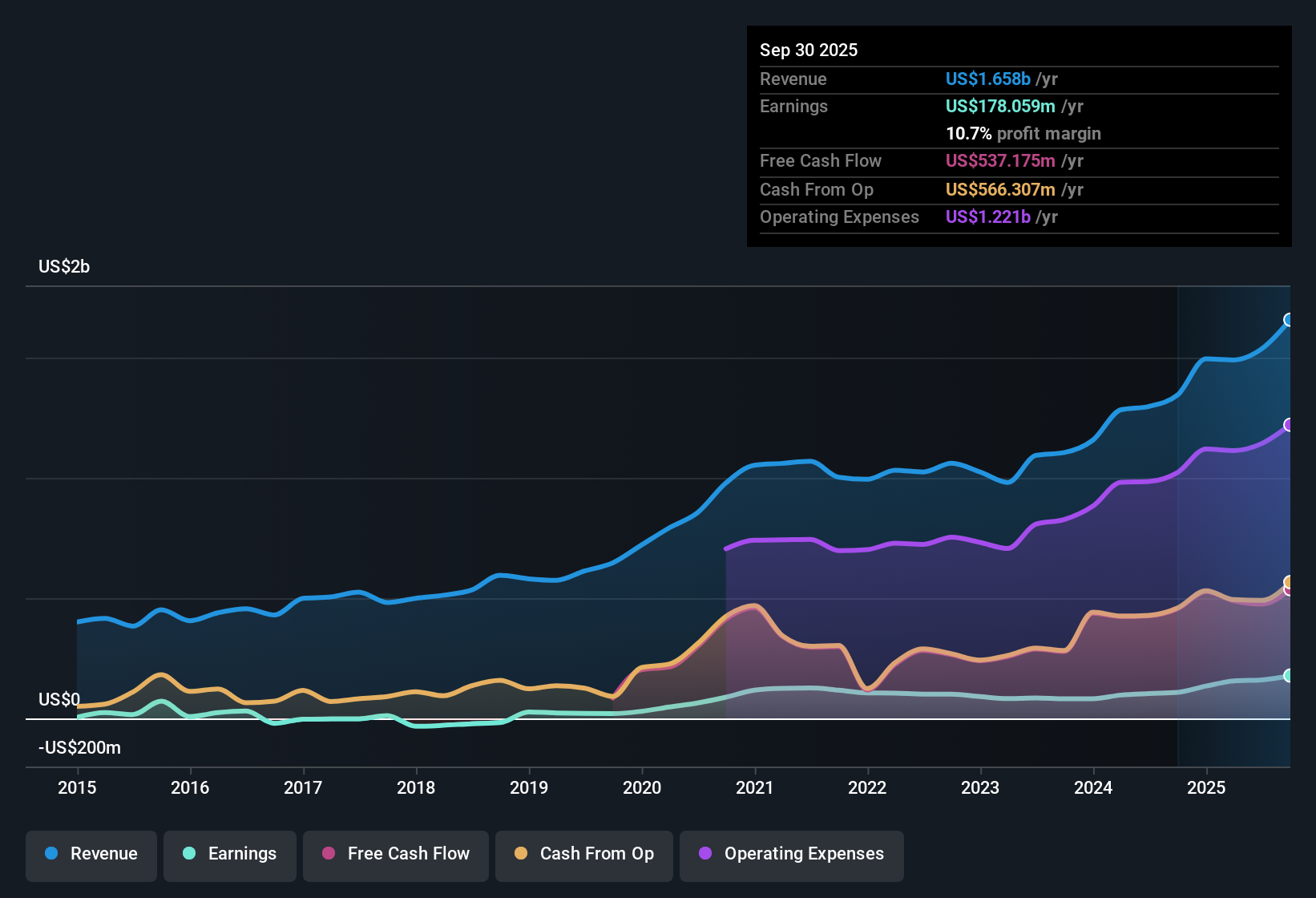

- The stock has seen some swings lately, dipping 1.0% over the past week and 7.3% in the last month. It remains up 6.8% year-to-date and has posted a solid 133.0% gain over three years.

- Recent headlines have focused on PJT's growing influence in advisory roles and notable dealmaking activity. Both of these factors have caught Wall Street’s attention and helped explain the recent share price movements. These stories highlight how leadership in key transactions can drive sentiment in either direction.

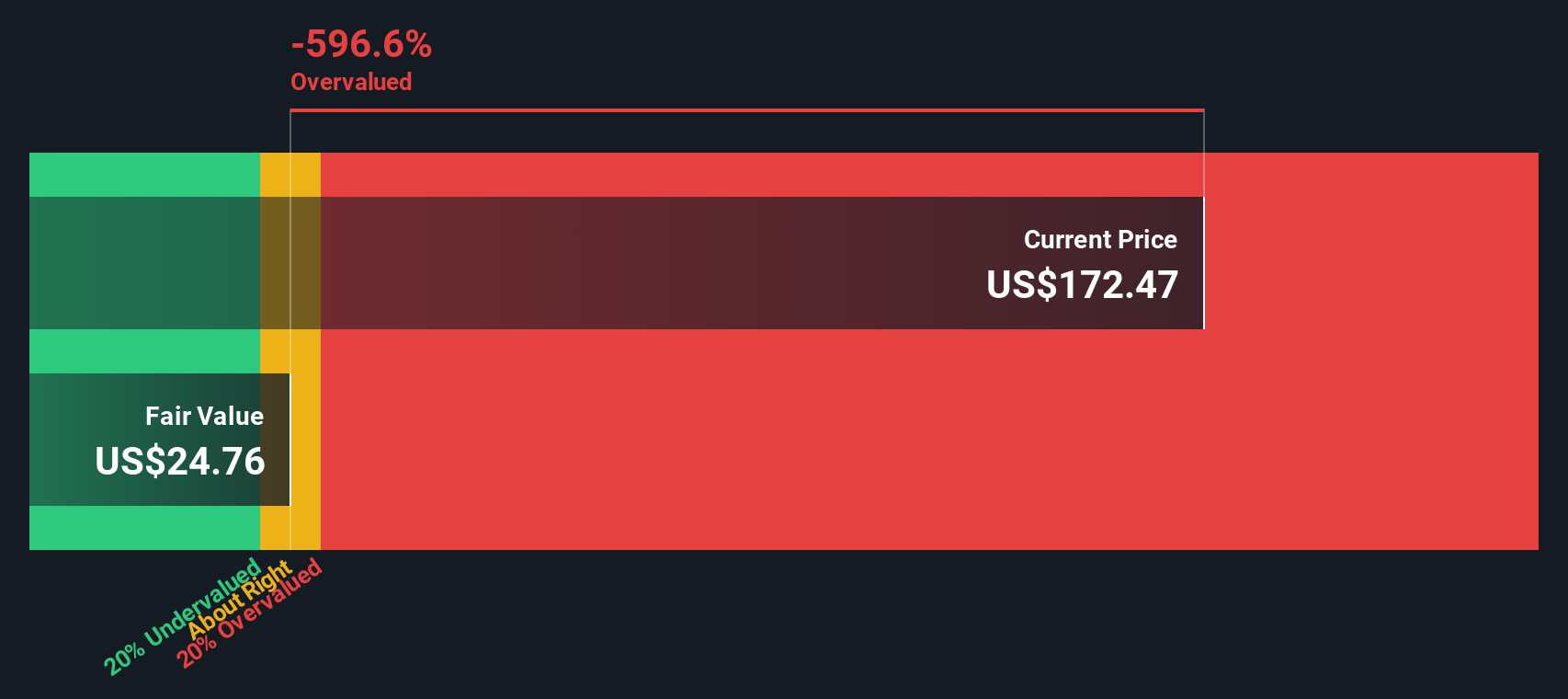

- According to our valuation checks, PJT Partners scores a 1 out of 6 for under-valuation. There is plenty to unpack about how the market values this business, which is why many investors look beyond basic ratios for a fuller picture.

PJT Partners scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: PJT Partners Excess Returns Analysis

The Excess Returns valuation model evaluates how much value a company generates above its cost of equity by focusing on return on invested capital and its sustainability. For PJT Partners, this analysis considers both recent financial performance and longer-term stability.

The model uses the following financial metrics:

- Book Value: $6.89 per share

- Stable Earnings per Share (EPS): $1.50 per share (Source: Median Return on Equity from the past 5 years.)

- Cost of Equity: $0.55 per share

- Excess Return: $0.95 per share

- Average Return on Equity: 22.13%

- Stable Book Value: $6.80 per share (Source: Median Book Value from the past 5 years.)

This approach calculates how much profit PJT generates in excess of its expected cost of capital, signaling the firm's ability to efficiently use shareholder money over time. According to the model, the estimated intrinsic value per share is $25.67.

When compared to the current market price, the Excess Returns model implies PJT Partners is 551.6% overvalued, meaning the market price is substantially higher than the valuation calculated with this methodology.

Result: OVERVALUED

Our Excess Returns analysis suggests PJT Partners may be overvalued by 551.6%. Discover 836 undervalued stocks or create your own screener to find better value opportunities.

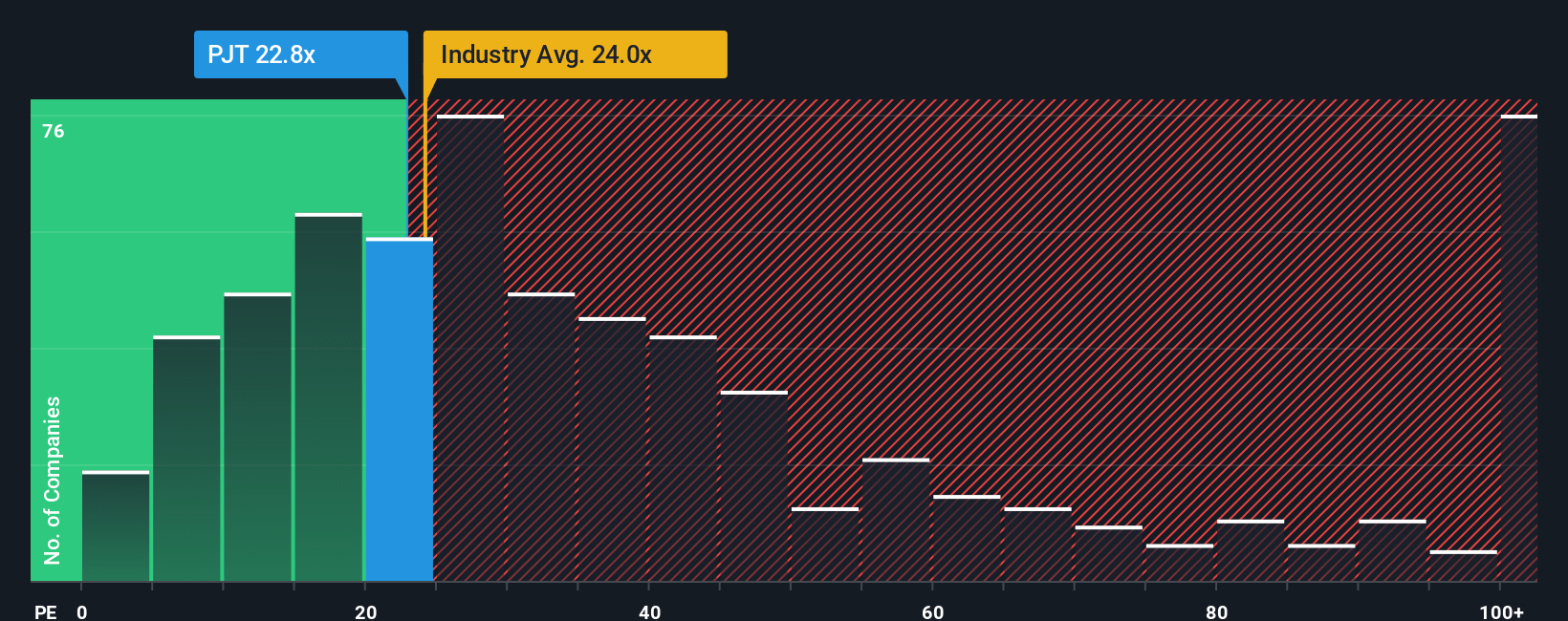

Approach 2: PJT Partners Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it connects a company’s share price to its earnings, giving investors a sense of how much they are paying for each dollar of profit. For companies like PJT Partners, which has a solid earnings track record, the PE ratio helps set clear expectations around valuation.

Growth prospects and risk profile heavily influence what is considered a “normal” PE ratio. Higher growth companies often command a premium, while businesses facing uncertainties or risks can trade at a discount. Thus, context is key.

PJT Partners currently trades at a PE ratio of 22.83x. This is in line with the broader Capital Markets industry average of 23.79x, but notably higher than the 15.44x average among peers. To add further insight, Simply Wall St’s proprietary “Fair Ratio” model calculates a fair PE of 13.15x for PJT Partners. This Fair Ratio goes beyond basic peer and industry comparisons, as it considers not just earnings but also factors like expected growth, profit margins, size and specific risks facing the business.

Comparing PJT Partners' actual PE (22.83x) against its Fair Ratio (13.15x), the stock appears to be trading above what is justified by its underlying fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PJT Partners Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful approach where investors tell their story about a company by connecting their unique assumptions, such as growth rates, profitability, and risks, with financial forecasts and a fair value estimate.

Narratives bridge the gap between a company’s story and the numbers, making it easy to see how different views on the future can impact what a stock is really worth. On Simply Wall St’s Community page, millions of investors use Narratives to capture, update, and share their perspectives with no finance degree required.

This tool lets you compare your Narrative's Fair Value to today’s price, helping you decide if it might be time to buy, sell, or hold. As new information like earnings or headlines is released, Narratives update automatically so your view stays current.

For instance, some investors believe PJT Partners could be worth significantly more in the future with strong growth, while others see limited upside and a lower fair value, all based on their own Narratives and forecasts.

Do you think there's more to the story for PJT Partners? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PJT

PJT Partners

An investment bank, provides various strategic advisory, shareholder advisory, capital markets advisory, and restructuring and special situations services to corporations, financial sponsors, institutional investors, and governments worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives