- United States

- /

- Capital Markets

- /

- NYSE:PIPR

Piper Sandler (PIPR): Profit Margin Jumps to 13.2%, Reinforcing High-Quality Earnings Narrative

Reviewed by Simply Wall St

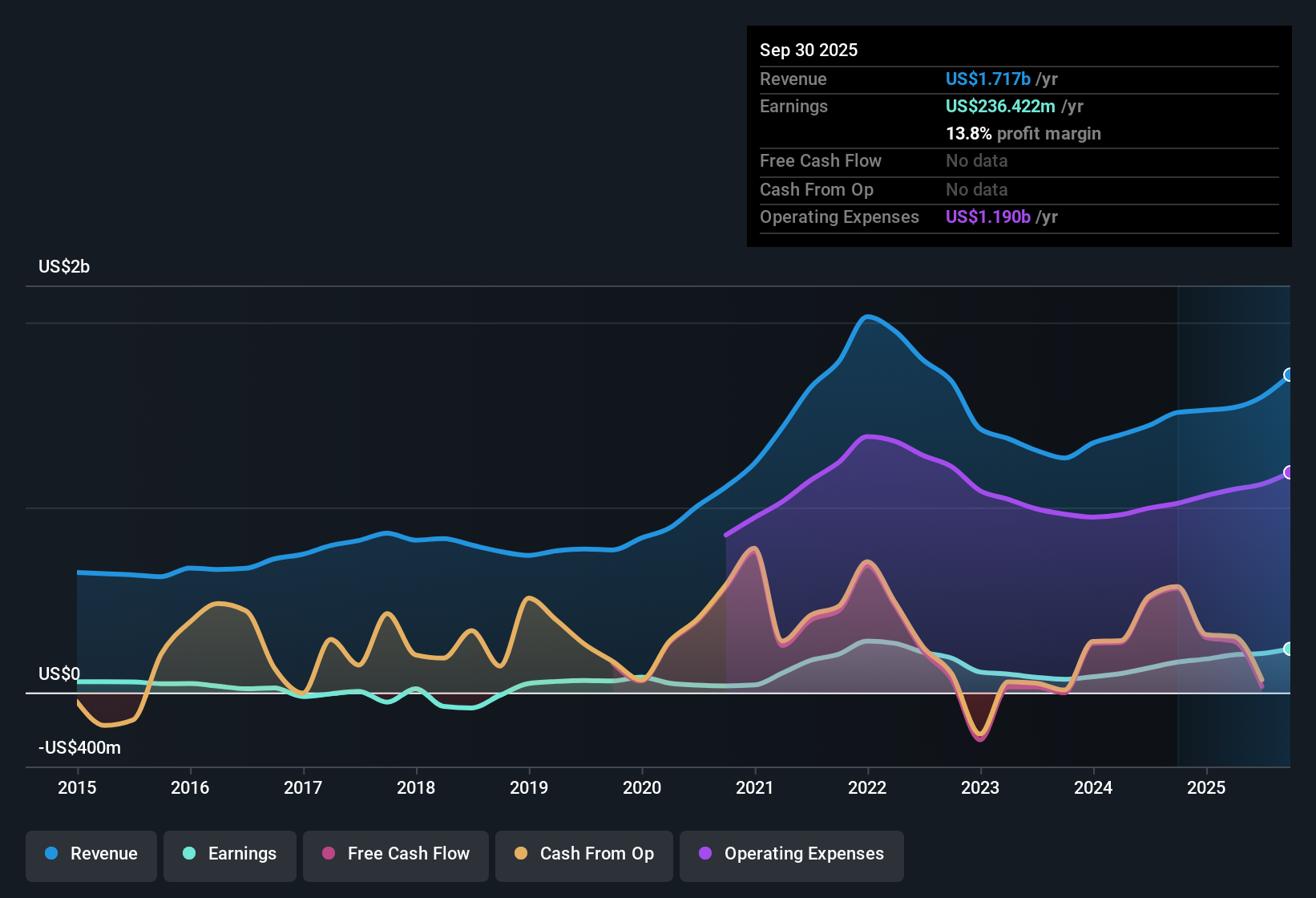

Piper Sandler Companies (PIPR) delivered standout earnings growth over the past year, with profits rising 58.4% and net profit margins reaching 13.2%, up from 9.2% a year ago. Revenue is forecast to grow 10.97% annually, ahead of the US market average. Over the past five years, earnings growth has averaged 4.9% each year. Investors will be watching the company’s premium valuation, as the P/E ratio sits at 26.8x and shares are trading at $319.26, well above an estimated fair value of $61.94. The profit and margin momentum remains a key focus.

See our full analysis for Piper Sandler Companies.Up next, we'll put these latest results side-by-side with the most popular narratives for Piper Sandler on Simply Wall St, spotlighting where the numbers confirm the buzz and where they raise new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Maintain Momentum

- Net profit margins reached 13.2%, a meaningful jump from last year’s 9.2% and a notable strength for an investment banking firm.

- Sustained margin expansion gives extra support to the view that Piper Sandler’s growth is not just a one-off acceleration.

- The steady climb in margins contrasts with marketing narratives that sometimes doubt profit durability, especially in cyclical financials.

- Backing claims of “high quality earnings,” today’s profitability points to disciplined cost structures as well as solid fee income.

Revenue Growth Outpaces Peers

- Forecast revenue is set to grow by 10.97% annually, putting Piper Sandler ahead of the broader US market average of 10.3%.

- Pushing beyond the typical sector pace lends weight to optimism about Piper Sandler capturing share in specialty niches.

- This above-market projection aligns with bullish arguments that the firm’s expansion strategy and focus on advisory services are paying off in faster revenue gains than rivals.

- Such growth expectations signal ongoing demand for Piper Sandler’s services, reducing the risk that recent profit acceleration fades quickly.

Premium Valuation Widens the Gap to DCF Fair Value

- The share price of $319.26 trades at more than five times the DCF fair value of $61.94 and lifts Piper Sandler’s P/E ratio to 26.8x, above peer (16.9x) and industry (25.6x) averages.

- What stands out is that while robust revenue and margin improvement may warrant a stock premium, this current valuation far exceeds traditional metrics, raising the hurdle for future performance to justify the price.

- Investors looking at strong profit growth must still weigh whether such a steep price-to-fair-value gap builds in too much optimism too soon.

- The degree of outperformance versus benchmarks adds pressure for Piper Sandler to maintain its recent momentum or risk a sharp re-rating.

See how the latest earnings stack up against prevailing investment narratives, and what that could mean for Piper Sandler's future moves. 📊 Read the full Piper Sandler Companies Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Piper Sandler Companies's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Piper Sandler’s rapid profit and revenue gains are overshadowed by a steep valuation premium. This premium could expose investors to future downside risk.

If you’re looking for companies trading closer to their fair value, check out these 831 undervalued stocks based on cash flows to discover opportunities with stronger upside and less valuation pressure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PIPR

Piper Sandler Companies

Operates as an investment bank and institutional securities firm that serves corporations, private equity groups, public entities, non-profit entities, and institutional investors in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives