- United States

- /

- Diversified Financial

- /

- NYSE:PFSI

PennyMac Financial Services (PFSI): Evaluating Current Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

PennyMac Financial Services (PFSI) has seen its stock steadily climb over the past month, gaining about 6%. Investors are taking a closer look at what is behind this momentum and where the valuation stands now.

See our latest analysis for PennyMac Financial Services.

While the last month’s 5.8% share price return has grabbed attention, PennyMac’s momentum is part of a longer trend. Its year-to-date share price return stands at a robust 27.2%, and the one-year total shareholder return is 25.4%. This ongoing strength suggests investors are increasingly optimistic about earnings growth and the company’s ability to navigate a changing market.

If you’re curious what else is building momentum lately, now’s the perfect chance to broaden your search and discover fast growing stocks with high insider ownership

With shares outperforming the broader market and trading somewhat below analyst targets, the key question is whether PennyMac is still undervalued or if the market has already taken the company’s future growth potential into account.

Most Popular Narrative: 8.3% Undervalued

PennyMac’s most widely followed narrative pegs fair value notably above its recent closing price, signaling higher expectations from analysts as shares rally ahead of Wall Street targets.

PennyMac's AI-driven technology platform and continuous investment in process automation are expected to deliver significant cost reductions and expanded operating efficiencies. This positions the company to improve net margins and return on equity as loan volumes scale.

Want to know what’s powering this bullish narrative? The magic lies in ambitious forecasts for profitability, future earnings, and a profit multiple that rivals blue-chip benchmarks. Which jaw-dropping assumptions did analysts plug in to reach their high conviction price? Dive deeper to uncover the numbers driving this potential upside.

Result: Fair Value of $138.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates or a downturn in mortgage demand could quickly challenge these bullish projections and put pressure on PennyMac’s growth story.

Find out about the key risks to this PennyMac Financial Services narrative.

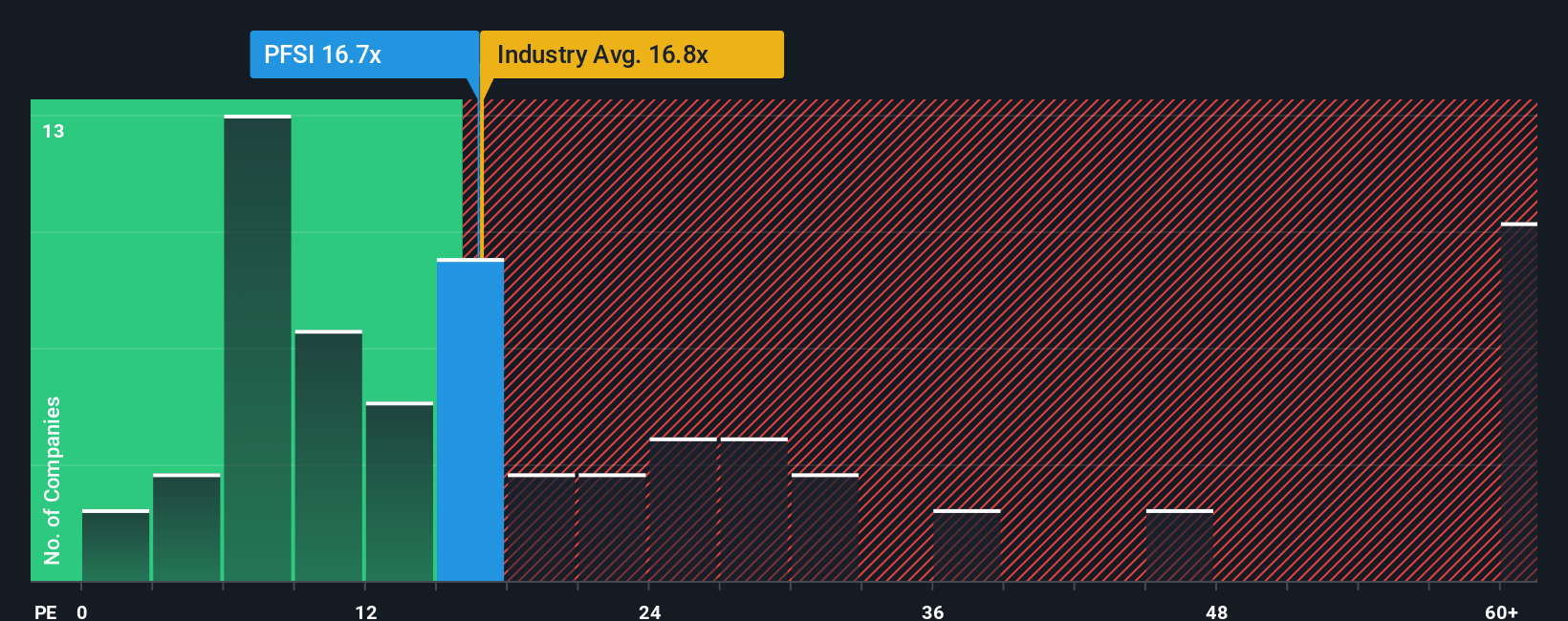

Another View: Multiple-Based Valuation

Looking at PennyMac’s valuation through the lens of price-to-earnings, the company trades at 13.2x, which is not only below the U.S. market average (18.2x) but also in line with the diversified financial industry and well under its peer group’s 25.5x average. This gap suggests the market sees either caution or an overlooked opportunity. Could that change as sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PennyMac Financial Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PennyMac Financial Services Narrative

If you see the story differently or simply want to dig deeper into the numbers, you can shape your own perspective using our tools in just a few minutes. Do it your way

A great starting point for your PennyMac Financial Services research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stick with just one opportunity, especially when the market is full of possibilities. Take charge and tap into fresh stocks using these handpicked strategies:

- Access remarkable value by scanning for companies priced well below their true worth with these 886 undervalued stocks based on cash flows. Seize the bargains others might overlook.

- Boost your potential income by zeroing in on these 16 dividend stocks with yields > 3%, which delivers attractive yields above 3%. Set yourself up for strong portfolio returns.

- Ride the continued rise of artificial intelligence by checking out these 25 AI penny stocks and get ahead with businesses powering the next tech boom.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFSI

PennyMac Financial Services

Through its subsidiaries, engages in the mortgage banking and investment management activities in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives