- United States

- /

- Diversified Financial

- /

- NYSE:PFSI

PennyMac Financial Services (PFSI): Assessing Valuation After Robust Q3 Earnings Beat and Positive Shareholder Momentum

Reviewed by Simply Wall St

PennyMac Financial Services (NYSE:PFSI) shares climbed after the company posted third-quarter earnings and revenue that beat expectations. Investors responded positively to the clear year-over-year gains and improved business momentum.

See our latest analysis for PennyMac Financial Services.

PennyMac’s standout quarter capped off a remarkable run. The stock’s share price soared 42% over the past 90 days, and the one-year total shareholder return now sits above 33%. Recent announcements, including share buybacks and a dividend affirmation, have underscored growing investor confidence and suggest momentum is gaining strength both in the near term and long term.

If you want to find more companies showing rapid momentum and resilient fundamentals, now’s a great time to discover fast growing stocks with high insider ownership.

The big question is whether PennyMac’s stellar run still leaves room for upside, or if robust earnings and strong business momentum mean that future growth is already priced in. Could there be a real buying opportunity here?

Most Popular Narrative: Fairly Valued

With PennyMac Financial Services closing at $132.67 and the narrative’s calculated fair value at $131.57, there is almost no gap between price and estimated worth. This balance sets the stage for a lively debate about whether stronger earnings and future profit potential have already been fully reflected in today’s price.

PennyMac's AI-driven technology platform and continuous investment in process automation are expected to deliver significant cost reductions and expanded operating efficiencies. These initiatives position the company to improve net margins and return on equity as loan volumes scale. The large and growing servicing portfolio, with $700 billion UPB and a significant proportion of loans above current market rates, creates a strong recurring revenue base and positions the company for outsized refinancing revenue and higher earnings growth when mortgage rates decline.

Want to know what big assumptions power this razor-thin valuation gap? The growth ingredients—scale, efficiencies, margin leaps—are carefully projected here. Discover what the narrative thinks will catapult future earnings. One overlooked forecast could change your perspective.

Result: Fair Value of $131.57 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates or unexpected shocks to the mortgage servicing market could quickly undermine PennyMac’s bullish earnings projections and valuation optimism.

Find out about the key risks to this PennyMac Financial Services narrative.

Another View: Discounted Cash Flow Poses a Different Question

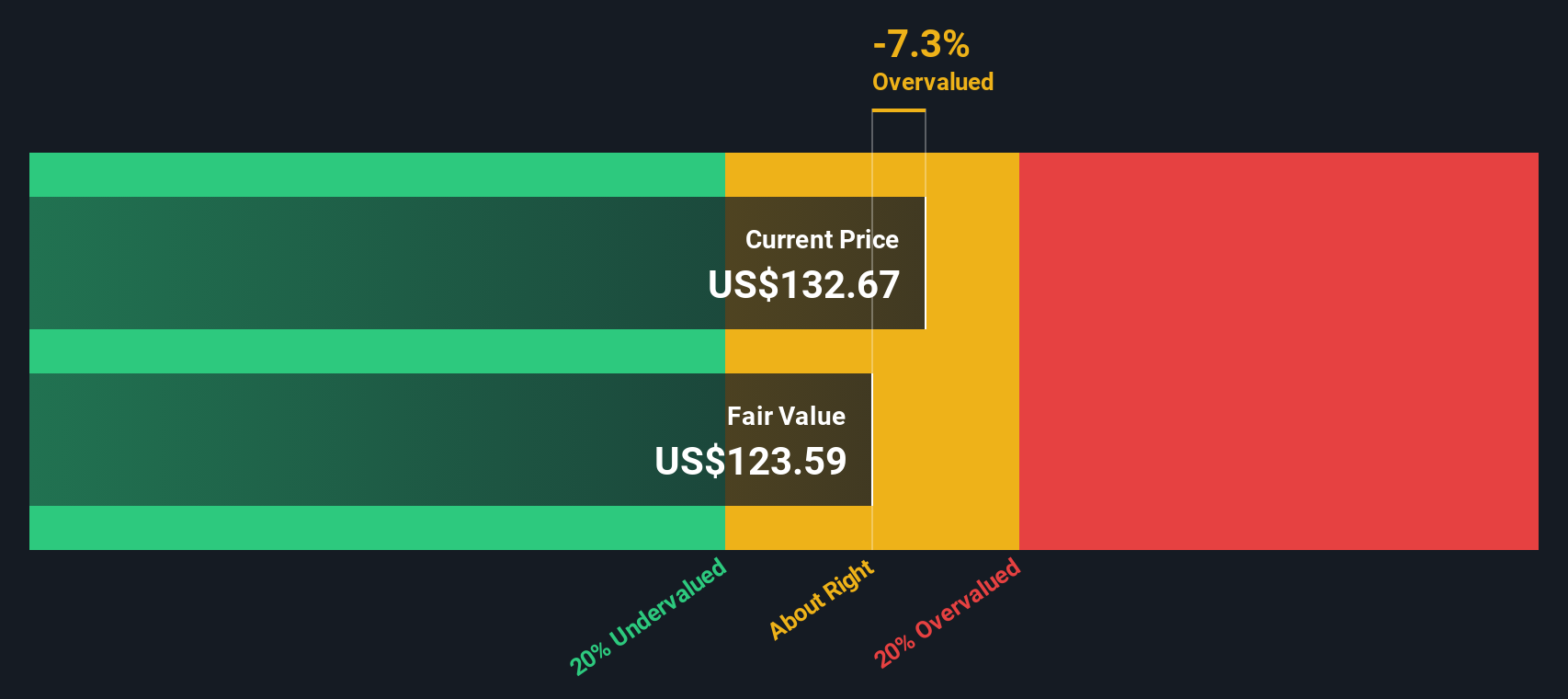

While the narrative and price targets focus on fundamentals, our DCF model offers a different perspective. According to the SWS DCF model, PennyMac trades above its estimate of fair value, which suggests it could be overvalued at current prices. Which picture do you believe reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own PennyMac Financial Services Narrative

If you would like to put these claims to the test or bring your own research and viewpoint to the table, you can craft a narrative from scratch in just a few minutes. Do it your way.

A great starting point for your PennyMac Financial Services research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let smart investing opportunities pass you by. The right screener could help you spot the next breakout stock, collect reliable dividends, or profit from industry shifts.

- Capitalize on the growth of artificial intelligence by analyzing these 27 AI penny stocks, which may offer breakthrough potential across automation and machine learning.

- Secure long-term returns by evaluating these 17 dividend stocks with yields > 3%, known for consistent income and solid financial strength.

- Get ahead of the curve with these 877 undervalued stocks based on cash flows, where market pricing may not yet reflect true business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFSI

PennyMac Financial Services

Through its subsidiaries, engages in the mortgage banking and investment management activities in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives