- United States

- /

- Capital Markets

- /

- NYSE:PEO

Shareholders Will Probably Be Cautious Of Increasing Adams Natural Resources Fund, Inc.'s (NYSE:PEO) CEO Compensation At The Moment

The disappointing performance at Adams Natural Resources Fund, Inc. (NYSE:PEO) will make some shareholders rather disheartened. There is an opportunity for shareholders to influence management to turn the performance around by voting on resolutions such as executive remuneration at the AGM coming up on 15 April 2021. We think most shareholders will probably pass the CEO compensation, based on what we gathered.

View our latest analysis for Adams Natural Resources Fund

How Does Total Compensation For Mark Stoeckle Compare With Other Companies In The Industry?

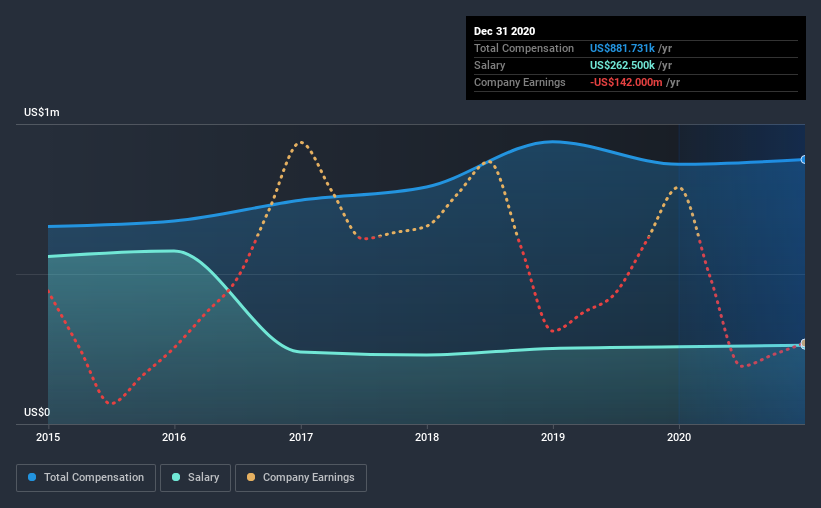

Our data indicates that Adams Natural Resources Fund, Inc. has a market capitalization of US$351m, and total annual CEO compensation was reported as US$882k for the year to December 2020. This means that the compensation hasn't changed much from last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$263k.

For comparison, other companies in the same industry with market capitalizations ranging between US$200m and US$800m had a median total CEO compensation of US$1.4m. That is to say, Mark Stoeckle is paid under the industry median. Furthermore, Mark Stoeckle directly owns US$221k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$263k | US$257k | 30% |

| Other | US$619k | US$609k | 70% |

| Total Compensation | US$882k | US$866k | 100% |

Speaking on an industry level, nearly 13% of total compensation represents salary, while the remainder of 87% is other remuneration. It's interesting to note that Adams Natural Resources Fund pays out a greater portion of remuneration through salary, compared to the industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Adams Natural Resources Fund, Inc.'s Growth

Over the last three years, Adams Natural Resources Fund, Inc. has shrunk its earnings per share by 77% per year. It saw its revenue drop 38% over the last year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Adams Natural Resources Fund, Inc. Been A Good Investment?

With a three year total loss of 7.9% for the shareholders, Adams Natural Resources Fund, Inc. would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 2 warning signs for Adams Natural Resources Fund (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Important note: Adams Natural Resources Fund is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Adams Natural Resources Fund or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:PEO

Flawless balance sheet unattractive dividend payer.

Market Insights

Community Narratives