- United States

- /

- Diversified Financial

- /

- NYSE:PAGS

Does PagSeguro Still Offer Value After Its 10.9% Price Drop This Week?

Reviewed by Bailey Pemberton

Are you sitting on the sidelines wondering whether to make a move on PagSeguro Digital? If you have been watching this Brazilian payments player, you might have noticed the stock has swung dramatically. Just in the past week it dropped by 10.9%, but zoom out and things look very different. Year-to-date, PagSeguro boasts a 43.5% gain, with the one-year return still in solid positive territory at 17.1%. It is a rollercoaster, no doubt, but many are starting to ask if the broader market is missing the company’s real value.

Short-term dips like the recent one often reflect broader market nerves about fintechs in emerging markets. Shifting global risk sentiment and evolving digital finance trends can make stocks like PagSeguro seem volatile in the near term, even as underlying fundamentals remain sturdy. If you are scanning for signs that the price might be disconnected from value, here is a strong hint: PagSeguro scores a 5 out of 6 on our in-depth valuation checklist, suggesting the company is still undervalued on almost every metric that counts.

Curious what those valuation checks are, and which one tripped up PagSeguro’s near-perfect score? Let us walk you through the major valuation approaches investors use, and why sometimes, there is a smarter way to figure out what a company’s really worth. Stick around, because we will share that insight at the end of the article.

Approach 1: PagSeguro Digital Excess Returns Analysis

The Excess Returns model evaluates whether a company generates returns above its cost of equity. This approach focuses on how efficiently management invests in its own business rather than emphasizing only future cash flows. For PagSeguro Digital, this analysis highlights several key figures that help illustrate the company’s underlying value generation.

- Book Value: $49.97 per share

- Stable EPS: $9.32 per share (Source: Weighted future Return on Equity estimates from 10 analysts.)

- Cost of Equity: $6.43 per share

- Excess Return: $2.89 per share

- Average Return on Equity: 15.92%

- Stable Book Value: $58.54 per share (Source: Weighted future Book Value estimates from 6 analysts.)

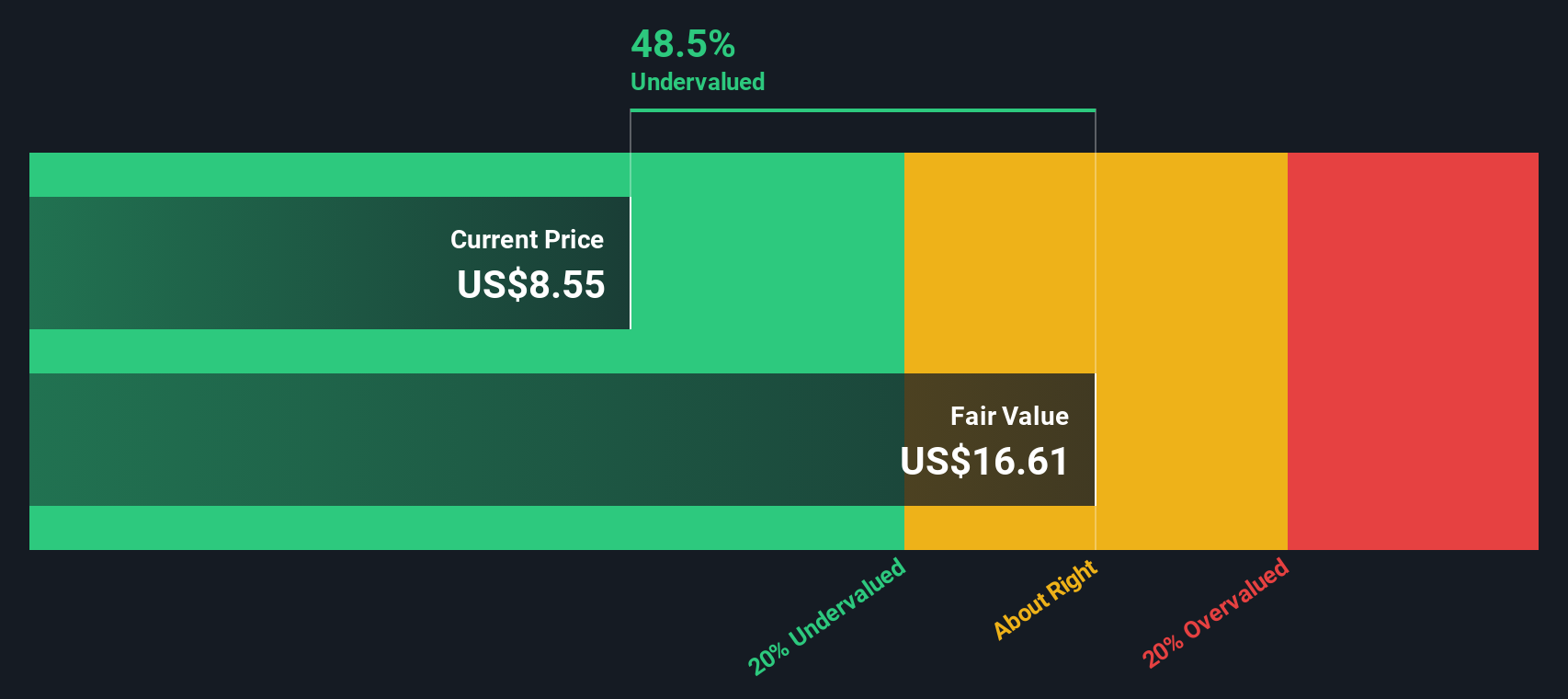

Using these numbers in the model results in an estimated intrinsic value of $17.92 per share. The current market price reflects a 48.7% discount to this fair value, indicating that PagSeguro Digital appears significantly undervalued based on the excess returns analysis.

Result: UNDERVALUED

Our Excess Returns analysis suggests PagSeguro Digital is undervalued by 48.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: PagSeguro Digital Price vs Earnings (PE)

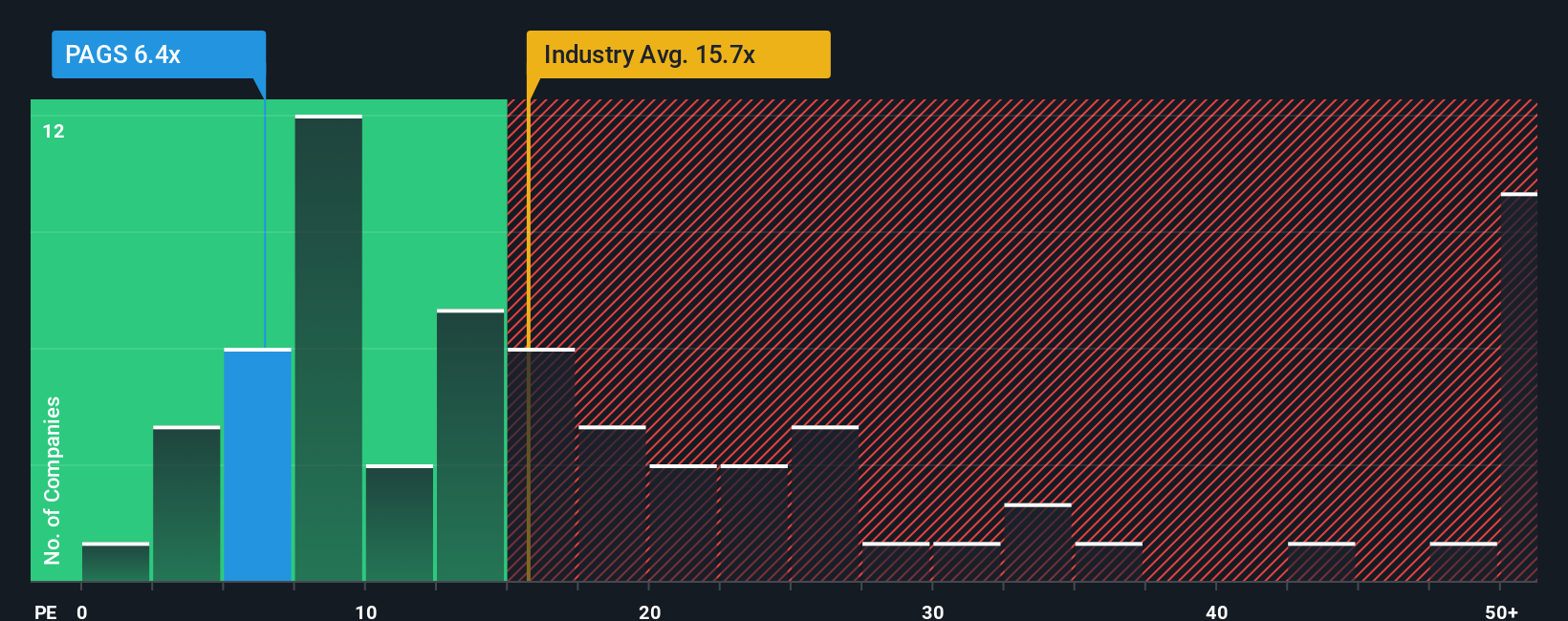

The Price-to-Earnings (PE) ratio is commonly used to value profitable companies because it directly relates what investors are willing to pay for each dollar of earnings. For businesses with consistent profits, the PE ratio provides an easy snapshot of whether a stock's price reflects the market's expectations for growth and risk.

Growth expectations and perceived risk both influence where a company's PE ratio tends to land. Higher growth companies or those with lower risk profiles usually warrant a higher PE, while companies with slower growth or bigger risks should trade at lower multiples.

Currently, PagSeguro Digital trades at a PE ratio of 6.5x. To put that in context, the average for the Diversified Financial industry is 16.1x. PagSeguro’s direct peers average about 12.8x. At first glance, PagSeguro looks significantly “cheaper” than its sector and peer group based on earnings.

A more tailored benchmark is Simply Wall St's Fair Ratio of 15.0x. Unlike generic industry or peer averages, the Fair Ratio takes into account PagSeguro's unique blend of growth prospects, profit margins, risk factors, industry trends, and market size. This provides a more accurate measure of what investors should expect given the company's specific fundamentals.

With the company's actual PE ratio well below its Fair Ratio, the analysis suggests PagSeguro Digital is notably undervalued based on earnings power alone.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PagSeguro Digital Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your own story about why PagSeguro Digital is worth what it is, where you estimate its future revenue, earnings, and margins, and tie that story to a fair value for the company. Instead of relying solely on stock metrics or analyst targets, Narratives link a company's business outlook to a financial forecast and then to an actionable fair value, helping you decide when a share price looks attractive or expensive.

On Simply Wall St's Community page, creating or exploring Narratives is easy and accessible. Millions of investors use them to position their perspectives, test assumptions, and see how their views stack up in real time. Narratives stand out because they update dynamically when news or earnings are released, ensuring your story remains current as the facts change.

For PagSeguro Digital, you might see one investor building a bullish Narrative expecting strong secured loan growth and ecosystem expansion, with a fair value of $13.98, while another remains cautious about competition and rates, arriving at just $5.17. By comparing these Narratives and tracking each fair value against the current price, you can make more confident buy or sell decisions based on your view of the story, not just the numbers.

Do you think there's more to the story for PagSeguro Digital? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAGS

PagSeguro Digital

Engages in the provision of financial and payment solutions for consumers, individual entrepreneurs, micro-merchants, and small and medium-sized companies in Brazil and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026