- United States

- /

- Capital Markets

- /

- NYSE:OWL

Why Blue Owl Capital (OWL) Is Down 7.8% After Halting Redemptions and Forcing Fund Merger

Reviewed by Sasha Jovanovic

- Blue Owl Capital recently halted redemptions and announced the merger of its private credit fund, OBDC II, with its substantially larger publicly traded OBDC vehicle, resulting in a forced conversion for investors and an anticipated loss of approximately 20% on their holdings.

- This merger not only restricts investor access until early 2026, but also underscores heightened concerns around fund valuation practices and liquidity in the private credit industry.

- We'll examine how the redemption freeze and forced conversion highlight liquidity and valuation risks for Blue Owl Capital's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Blue Owl Capital Investment Narrative Recap

To be a shareholder in Blue Owl Capital, you need to believe in the strength of permanent capital vehicles and the structural expansion of private credit, which together underpin the company’s recurring fee-based revenue growth. However, the recent halt in redemptions and forced conversion of OBDC II investors following a merger has sharply spotlighted short-term liquidity and valuation risks, and this event casts a shadow over confidence in the key growth catalyst, access to new investment flows, while amplifying concerns about fund transparency.

Among Blue Owl’s latest announcements, the new partnership with Meta Platforms to manage a major data center campus is especially relevant. It reflects efforts to capitalize on demand in digital infrastructure and expand recurring management fees, but as recent redemptions and fund merging show, access to liquidity and the stability of private credit valuations remain immediate and highly relevant risks. Despite these initiatives, investors should be especially mindful that, in contrast to expectations for durable fee growth, the ability to realize value when liquidity is restricted can present...

Read the full narrative on Blue Owl Capital (it's free!)

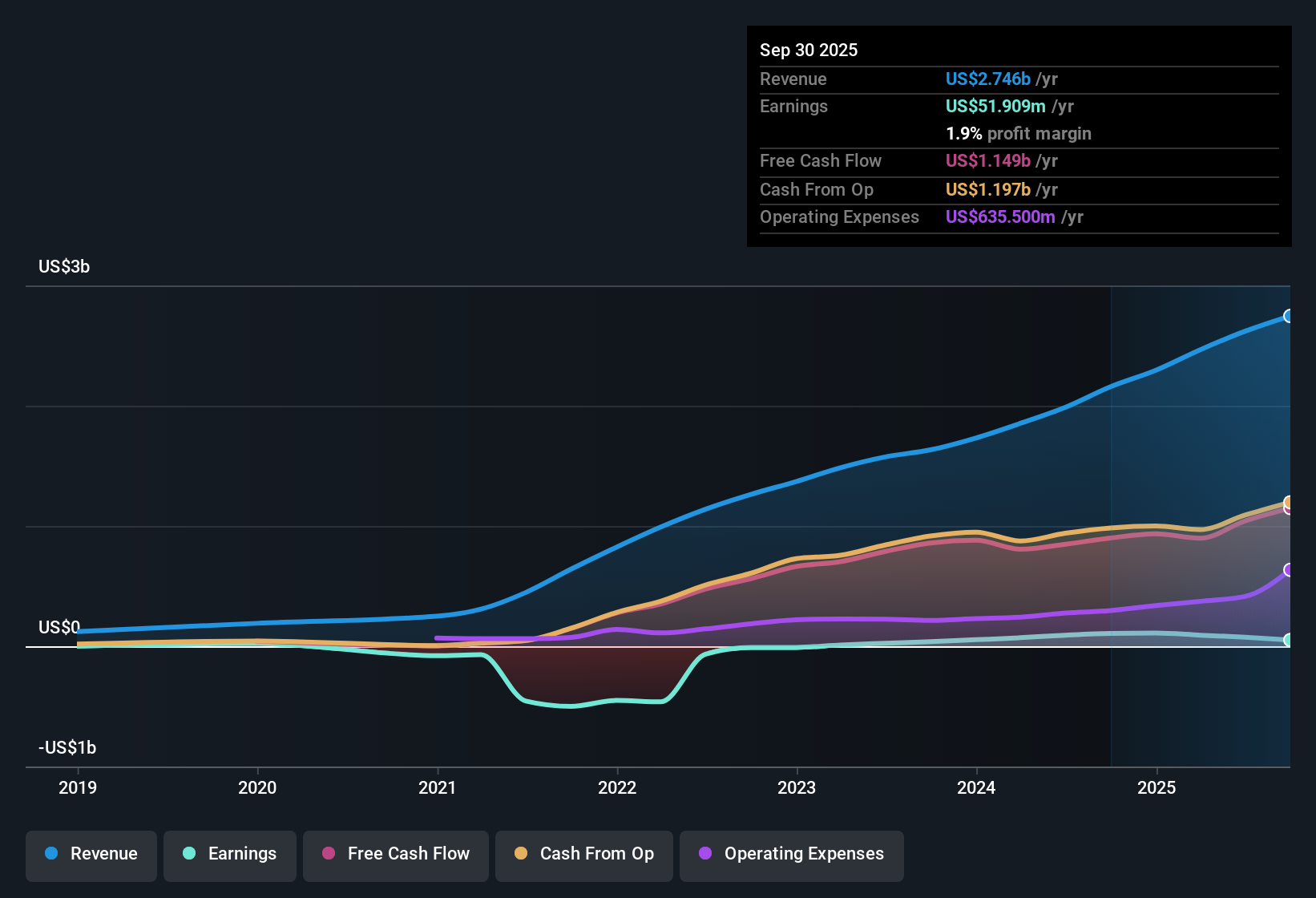

Blue Owl Capital's outlook calls for $4.2 billion in revenue and $5.1 billion in earnings by 2028. Achieving this would require 17.5% annual revenue growth and an earnings increase of about $5.02 billion from the current $75.4 million.

Uncover how Blue Owl Capital's forecasts yield a $21.30 fair value, a 53% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community have published fair value targets for Blue Owl Capital that range from US$0.54 to US$28, showing wide differences in outlook. With recent developments around fund liquidity and forced conversions, investors should compare these contrasting views carefully to understand how short-term risks could influence longer-term outcomes.

Explore 6 other fair value estimates on Blue Owl Capital - why the stock might be worth over 2x more than the current price!

Build Your Own Blue Owl Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Owl Capital research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Blue Owl Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blue Owl Capital's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Owl Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OWL

Blue Owl Capital

Operates as an alternative asset manager in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives