- United States

- /

- Capital Markets

- /

- NYSE:OWL

Blue Owl Capital (NYSE:OWL) Is Increasing Its Dividend To $0.13

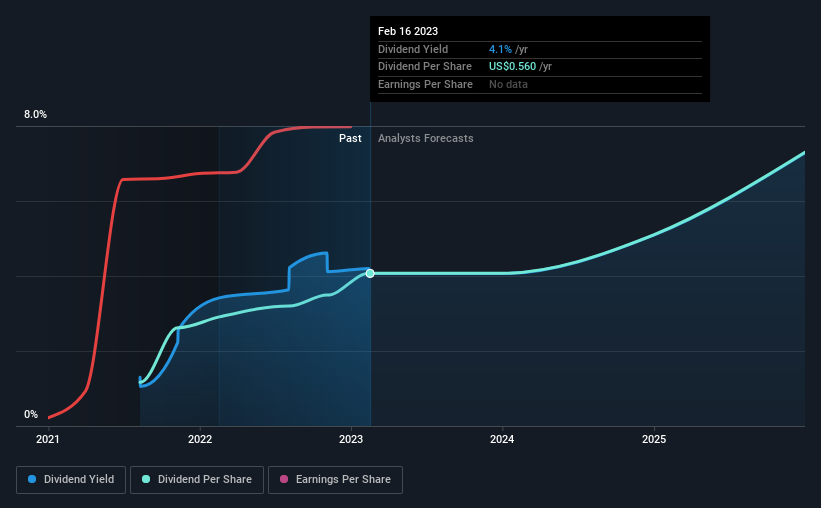

The board of Blue Owl Capital Inc. (NYSE:OWL) has announced that it will be paying its dividend of $0.13 on the 6th of March, an increased payment from last year's comparable dividend. This will take the dividend yield to an attractive 4.1%, providing a nice boost to shareholder returns.

See our latest analysis for Blue Owl Capital

Blue Owl Capital Doesn't Earn Enough To Cover Its Payments

A big dividend yield for a few years doesn't mean much if it can't be sustained. The company is paying out a large amount of its cash flows, even though it isn't generating any profit. This makes us feel that the dividend will be hard to maintain.

Over the next year, EPS is forecast to grow rapidly. If recent patterns in the dividend continues, we would start to get a bit worried, with the payout ratio possibly reaching 1,183%.

Blue Owl Capital Doesn't Have A Long Payment History

It's not possible for us to make a backward looking judgement just based on a short payment history. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Company Could Face Some Challenges Growing The Dividend

Investors could be attracted to the stock based on the quality of its payment history. Blue Owl Capital has grown its EPS by 98% over the past 12 months. It's unusual for a company to continue this long term, but we won't complain when it happens. While the company hasn't yet recorded a profit, the growth rates are healthy. If profitability can be achieved soon and growth continues apace, this stock could certainly turn into a solid dividend payer. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

Blue Owl Capital's Dividend Doesn't Look Sustainable

Overall, we always like to see the dividend being raised, but we don't think Blue Owl Capital will make a great income stock. In general, the distributions are a little bit higher than we would like, but we can't ignore the fact the quickly growing earnings gives this stock great potential in the future. We don't think Blue Owl Capital is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 1 warning sign for Blue Owl Capital that investors should know about before committing capital to this stock. Is Blue Owl Capital not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Blue Owl Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OWL

Exceptional growth potential with proven track record.