- United States

- /

- Capital Markets

- /

- NYSE:OWL

Blue Owl Capital (NYSE:OWL) Is Increasing Its Dividend To $0.11

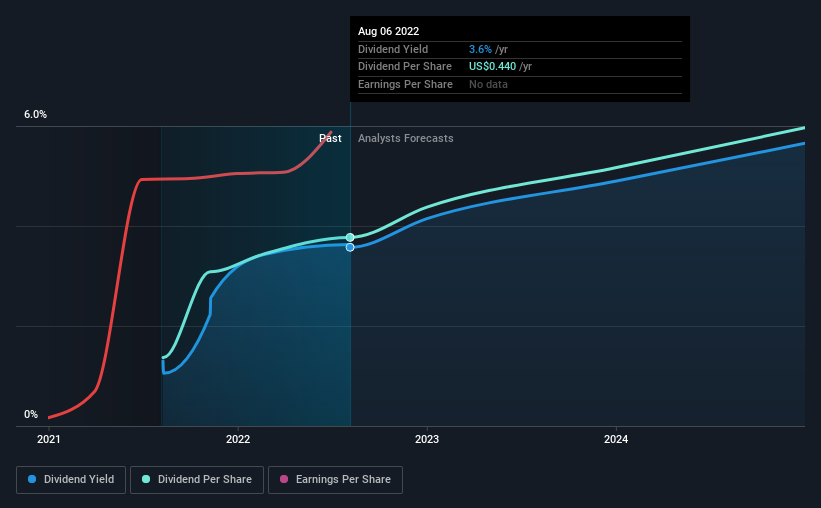

Blue Owl Capital Inc. (NYSE:OWL) will increase its dividend from last year's comparable payment on the 29th of August to $0.11. This makes the dividend yield 3.6%, which is above the industry average.

Check out our latest analysis for Blue Owl Capital

Blue Owl Capital Might Find It Hard To Continue The Dividend

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Blue Owl Capital isn't generating any profits, and it is paying out a very high proportion of the cash it is earning. This makes us feel that the dividend will be hard to maintain.

Analysts expect the EPS to grow by 50.4% over the next 12 months. This is the right direction to be moving, but it is not enough to achieve profitability. Unfortunately, for the dividend to continue at current levels the company definitely needs to get there sooner rather than later.

Blue Owl Capital Doesn't Have A Long Payment History

It is tough to make a judgement on how stable a dividend is when the company hasn't been paying one for very long. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Company Could Face Some Challenges Growing The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. The business has been going well, which we can see by the fact that EPS has risen by 88% in the last year. It's nice to see earnings per share rising, but one year is too short a period to get excited about. Were this trend to continue, we'd be interested. While the company is not yet turning a profit, it is growing at a good rate. If this trajectory continues and the company can turn a profit soon, it could bode well for the dividend going forward. However, we would never make any decisions based on only a single year of data, especially when assessing long term dividend potential.

We should note that Blue Owl Capital has issued stock equal to 12% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Blue Owl Capital's Dividend Doesn't Look Sustainable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. In general, the distributions are a little bit higher than we would like, but we can't ignore the fact the quickly growing earnings gives this stock great potential in the future. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 2 warning signs for Blue Owl Capital (of which 1 makes us a bit uncomfortable!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Blue Owl Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OWL

Exceptional growth potential with proven track record.